Information Risk and Price Risk. The phrases and distinction between the two terms comes from Justin Mamis' book, The Nature of Risk: Stock Market Survival and the Meaning of Life.

Amazon.com: The Nature of Risk (Fraser Publishing Library) (Contrary Opinion Library) (9780870341328): Justin Mamis: Books.

This concept has been

covered by

F.io member

FuturesTrader71 in his F.io webinar here:

https://nexusfi.com/webinars/mar22_2012/futurestrader71_risk_trading_probabilities/

Price Risk: when you decide to risk getting a better price for the benefit of getting more confirmation.

Information Risk: when you are willing to take what you think is a better price even though you may not have confirmation or more information about the setup.

Source: definitions from the webinar.

Another way to describe the difference between price risk and information risk is in terms of where you think you have the biggest advantage or edge. If you are more confident that your information gives you an advantage, then you can absorb more information risk in your execution (i.e., get in sooner at a better price, before you have confirmation of the market moving in your direction). If you are not as confident in your information (homework and analysis) then you cannot absorb as much information risk with your execution and need to take on less information risk by exchanging it for more price risk (i.e., get in later at a worse price after the market has begun to give you confirmation that your hypothesis is correct).

Source:

See also this thread specifically focused on information vs price risk:

The basic concept is that either you enter early and get a good price but with little information (information risk). Or you get in later at a worse price but with more information (price risk).

Source (with edits):

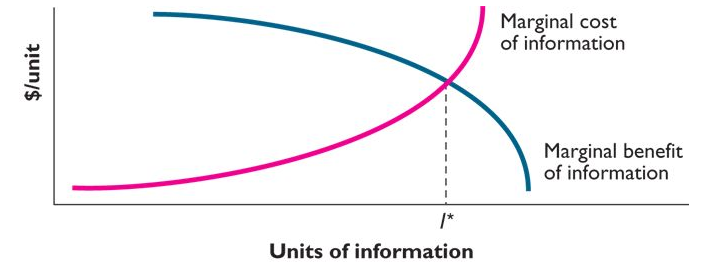

As demonstrated in the graph, there is an optimal level of information; a market equilibrium of sorts (the point at which the the marginal cost of an additional unit of information outweighs the marginal value of that unit, presented graphically as the intersection of the MB and MC plots).

The graphical representation of this concept, as simple as it may be, reveals the costliness of waiting for "perfect" information (often referred to as confirmation). Assuming you have a system with a positive

expectancy that provided you with a valid entry signal, the longer you wait to take that signal, the potential benefits of that position are greatly lessened (not to mention the increased risk due to the larger stop that is often required). In other words, it does not pay to wait for perfect information. Of course, everyone will have a different "market equilibrium" (a different optimal information level that will vary depending on your trading methodology, personal convictions, appetite for risk, etc...), but the premise of the idea remains valid. Take the trade when your risk is minimal and your profit potential is greatest.

Source:

See also: