|

Corpus Christi, TX / Westcliffe, CO

Experience: Advanced

Platform: NinjaTrader

Broker: DDT / Rithmic / Kinetick / IQ

Trading: 6E, ES

Posts: 420 since Oct 2010

Thanks Given: 24

Thanks Received: 1,022

|

>>Is there a scenario where the total volume is preferred?<<

What do you expect to learn from Delta or total volume that will benefit your trading? It's possible that neither gives you everything you need/want and that using both may get you closer to where you want to be. A large part of the answer to your question depends on the time frames you are considering. On a 1 min chart, an up close will invariably show positive Delta...down close will show neg Delta. Move higher in time to a 5 min bar and you will start to see mixed messages. When price hits a level you expect to see a reversal you may find that a divergence between Delta and Close is announcing the reversal is being attempted.

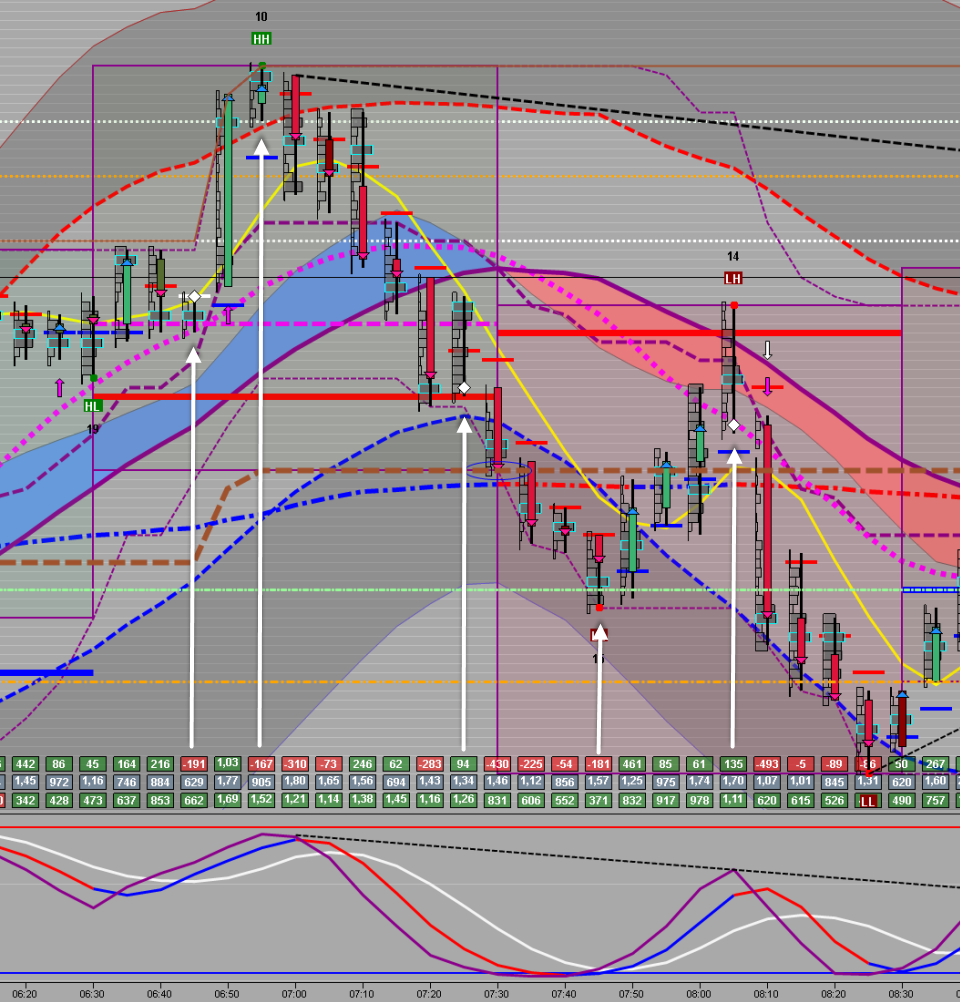

On the 5 Min 6E chart below white arrows point to moments it would have been nice if the Delta or Total Volume where saying something useful and maybe it is or maybe it isn't depending on how you interpret what you are seeing. The top row is Delta, middle row Volume, bottom row Cumulative Delta. Plotted on the bars is the Metro Volume Ladder and the Cyan boxes are the high volume nodes ( POC ) of each volume profile. Notice how the bar's Close relative to its POC gives a reasonably more accurate message than the bar's Delta about the underlying dynamic.

|