|

United Kingdom

Elite_Member

Experience: Beginner

Platform: Bookmap

Broker: Stage 5, Rithmic

Trading: US Equity Index Futures

Posts: 1,250 since Sep 2013

Thanks Given: 3,500

Thanks Received: 2,532

|

@vluskr

You're right that level2 data wouldn't make a difference but that is because Level2 is the orderbook depth of orders you see on the DOM.

The current price is Level1 and that should be the same for everyone due to the centralised exchange.

Also aggregated data is transacted volume, not Level2 data, and it gets bundled up in to chunks instead of being sent as it is transacted as it reduces the amount of data being sent. For most people it makes no difference but if orderflow trading off a DOM for instance the data "flows" better if it isn't aggregated.

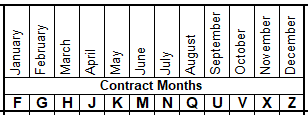

You solved the September/October contract month issue so I guess you know the letters:

From your introduction post you mention MES and MNQ also. Be aware if you aren't already that the equity indexes rollover at three months intervals but Crude rolls every month. The Tradovate platform will though give you a pop up warning if you open the platform and a chart, quoteboard, DOM is using a contract that has rolled over in volume.

ps. You can delete a post from its Edit menu. You can edit a post up to for up to 24hrs after writing it.

| You do not win as a trader, you just get to play again the next day. If that game doesn’t appeal to you then you should not trade. Gary Norden |

|