|

Chicago

Experience: Intermediate

Platform: NinjaTrader

Broker: NinjaTrader Brokerage

Trading: FDAX, NQ, HG, SI, CL

Posts: 68 since Oct 2015

Thanks Given: 42

Thanks Received: 22

|

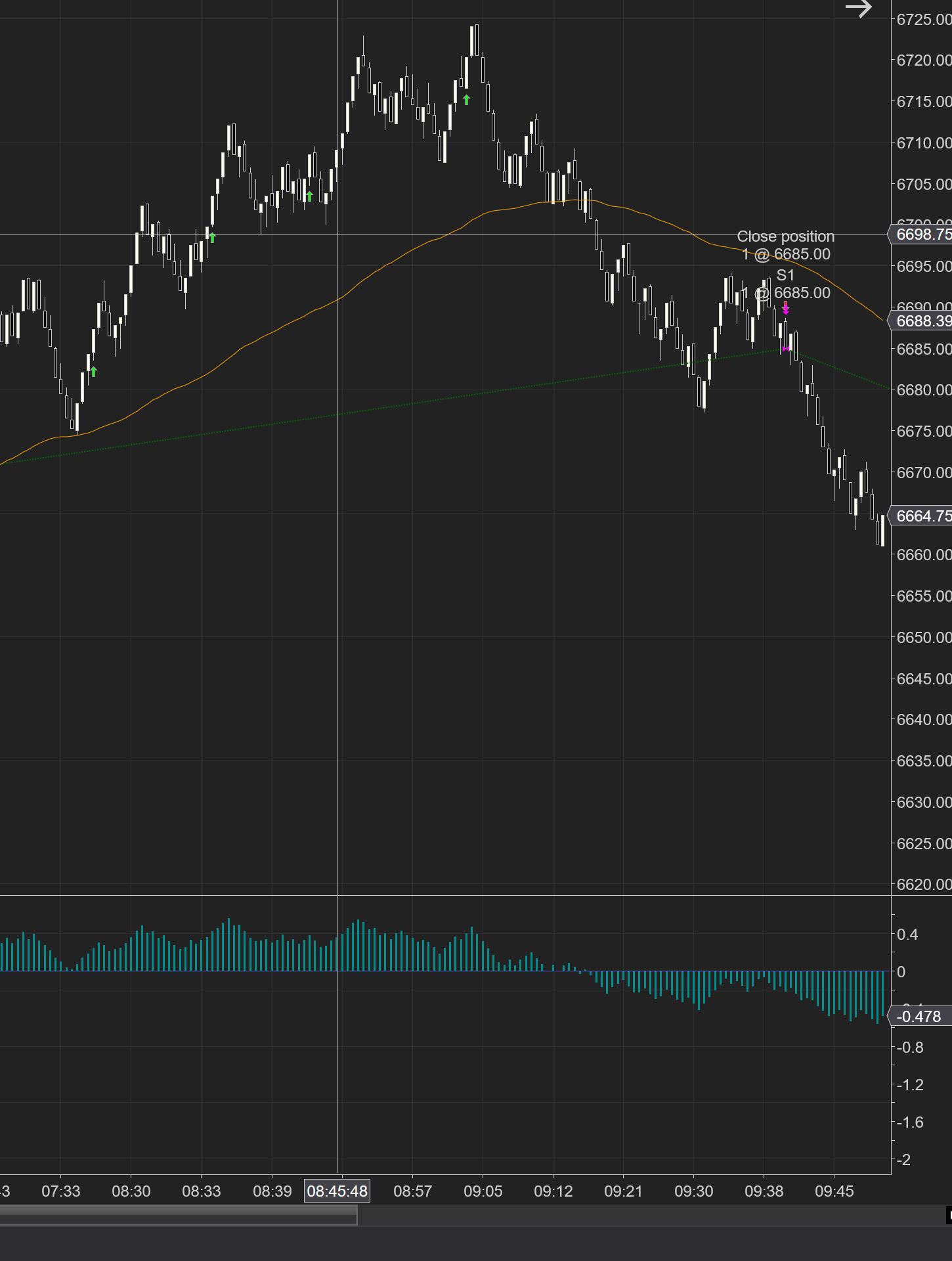

I have been testing out some momentum indicators that use other indicators as the input rather than price (see the aqua colored bar histogram below), and I was wondering if there is a way to achieve the same scale or equalize it regardless of the symbol used? In other words, a scale from 1-100 or 0-1 . Not sure the actual scale range matters much, but I would like the SAME scale to work from symbol to symbol without having to customize the thresholds I'm using as filters each time I apply the indicator to a new symbol. As you can see below, the relevant reading on each scale are quite different as far as decimal places are concerned; so if a threshold of .2 and -.2 work as a filter on the NQ, they will not work on the CL or work differently as a filter; I have to customize the threshold levels for every market. Not sure if this can be done or not, but hoping someone can point me in the right direction.

Cheers

Bullywig

|