|

Europe

Posts: 91 since Dec 2013

Thanks Given: 431

Thanks Received: 154

|

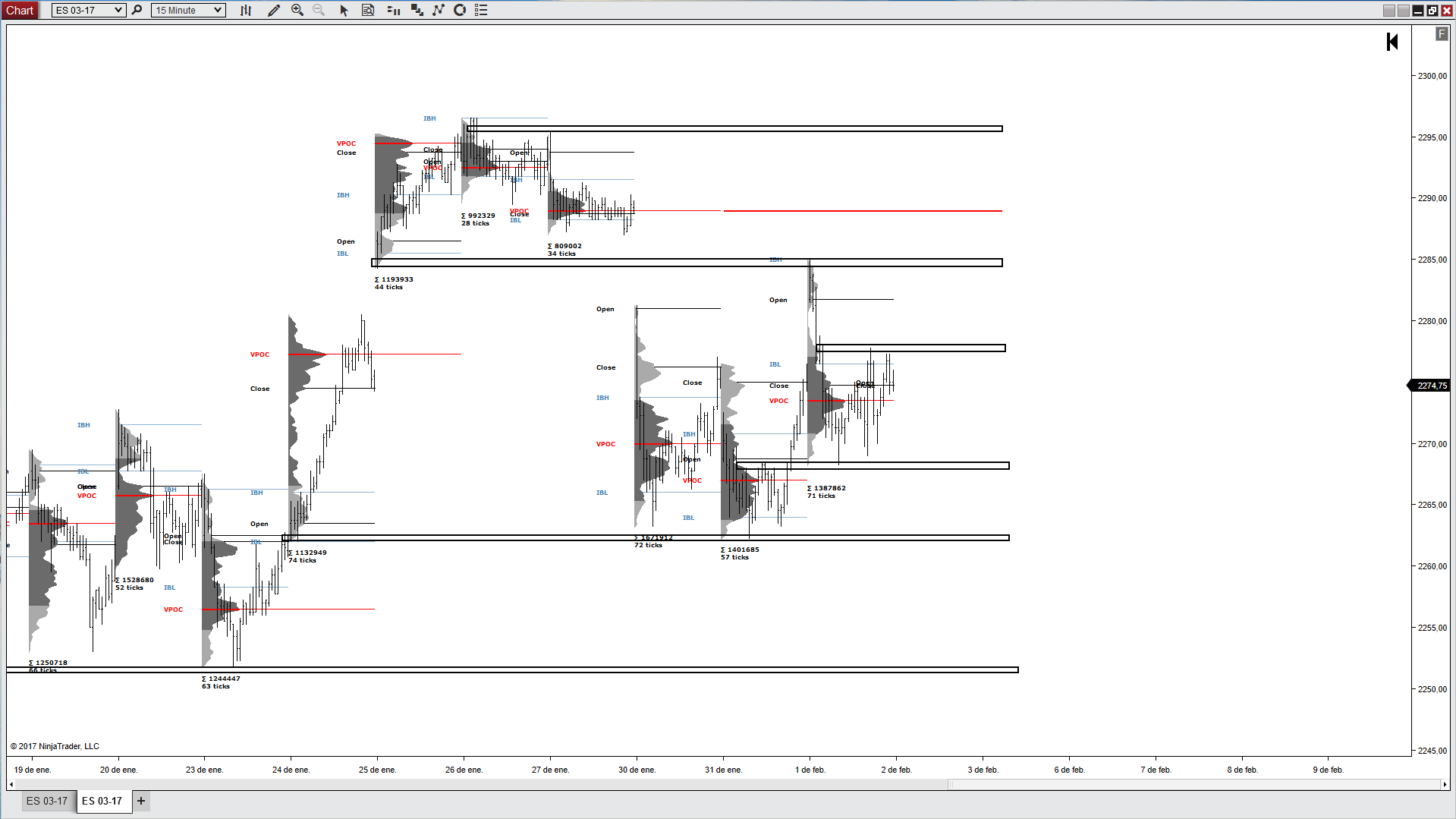

Areas to watch/context:

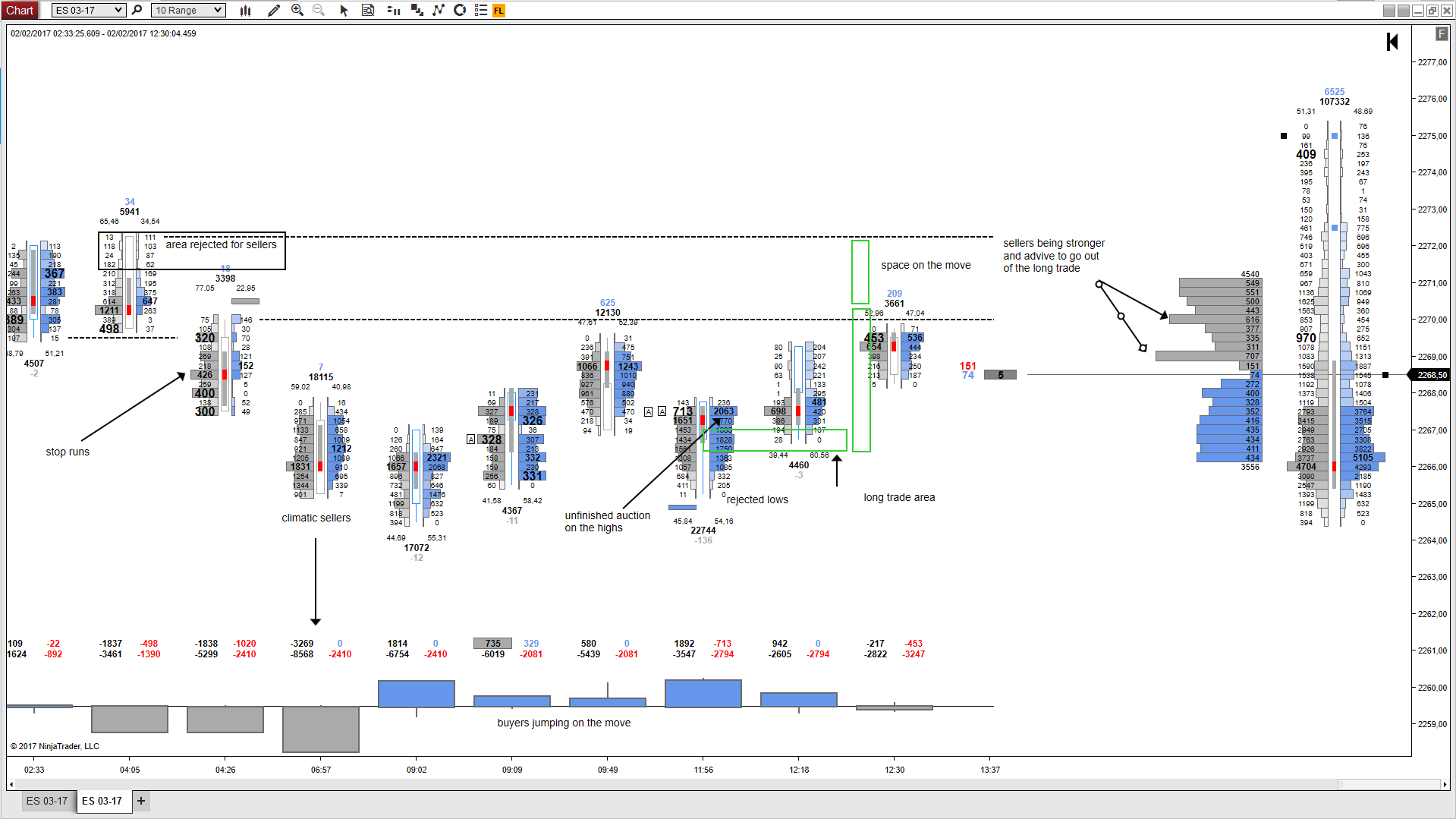

TRADE 1:

DECISION PROCESS AND ACTIVE MANAGEMENT:

I took this long trade in the buy zone created on 31 of January. Move aggressively down from sellers, but buyers jump in a buy zone. Sellers were not interested in the lows of this area because extremes were poorly traded. The initial movement at overnight was down. Looking for a continuation down, but looking at buy actions I took a long trade to work the space created between sell aggressive activity and buy actions. Looking at the level 2 and the strong side for sellers near of the rejected area, I took the decision to go out of the long. I have look at where I took the trade, how was the opposite side (sellers), found a space to trade, take the logical action.

PSICOLOGY:

I was calm, with some fear after taking the trade, because I was thinking about buyer's trap in this area, but the unfinished auction and potential space to work were giving me the confidence to take the trade. Manage the trade without fear to lose, looking how sellers were reacting at his area and manage accordingly with that. Objective actions, no hope, confidence in the decision I take.

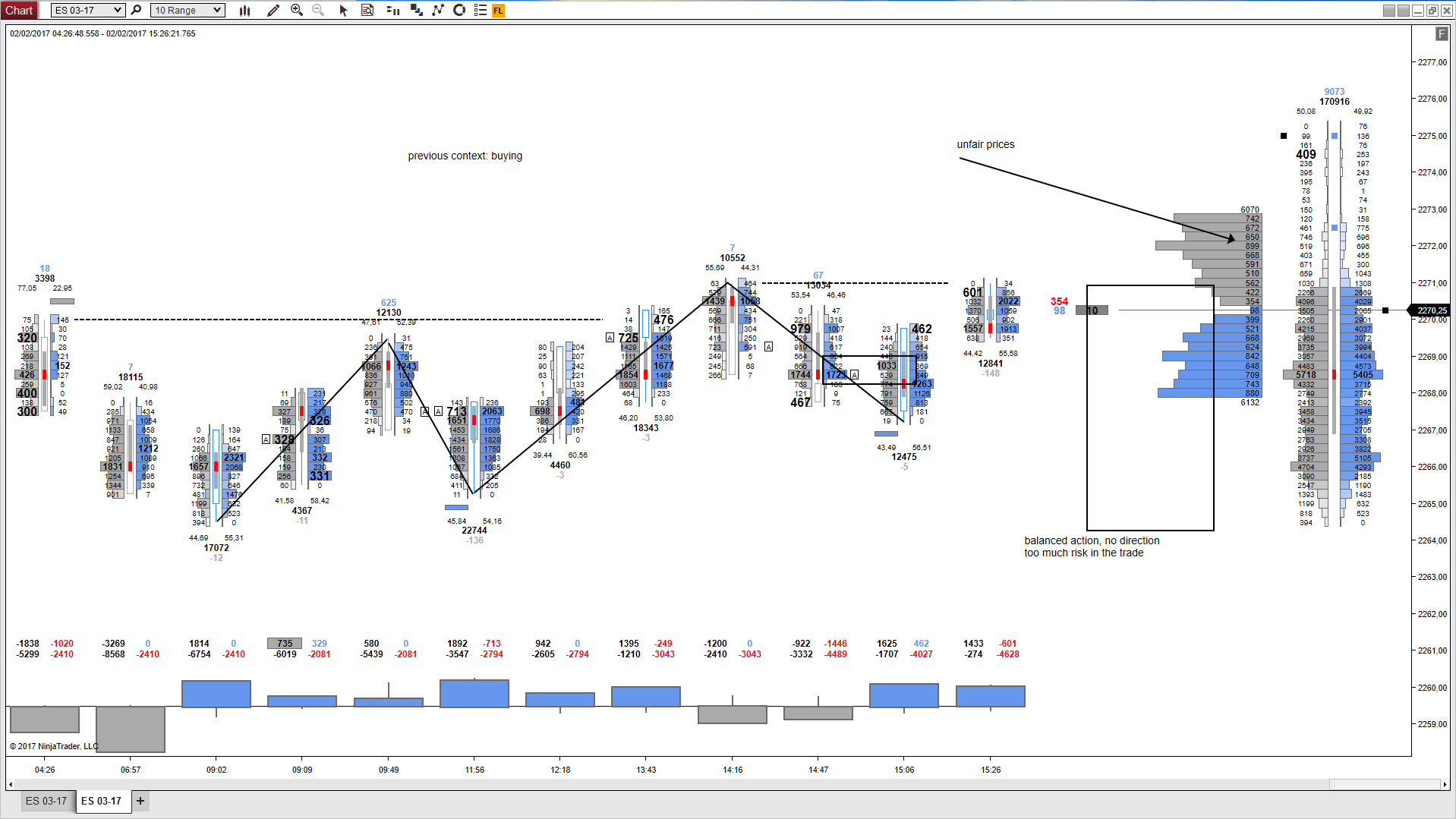

NO TRADE:

This is an action that I'm looking and want to add to my journal because is something to don't forget. The bias is long, buyers buying, but the action for all the overnight session is balanced. Following buyers, I feel the desire to buy at these balanced high. I left this trade because buying at these prices, it's buying through unfair prices.

|