Posts: 135 since Dec 2013

|

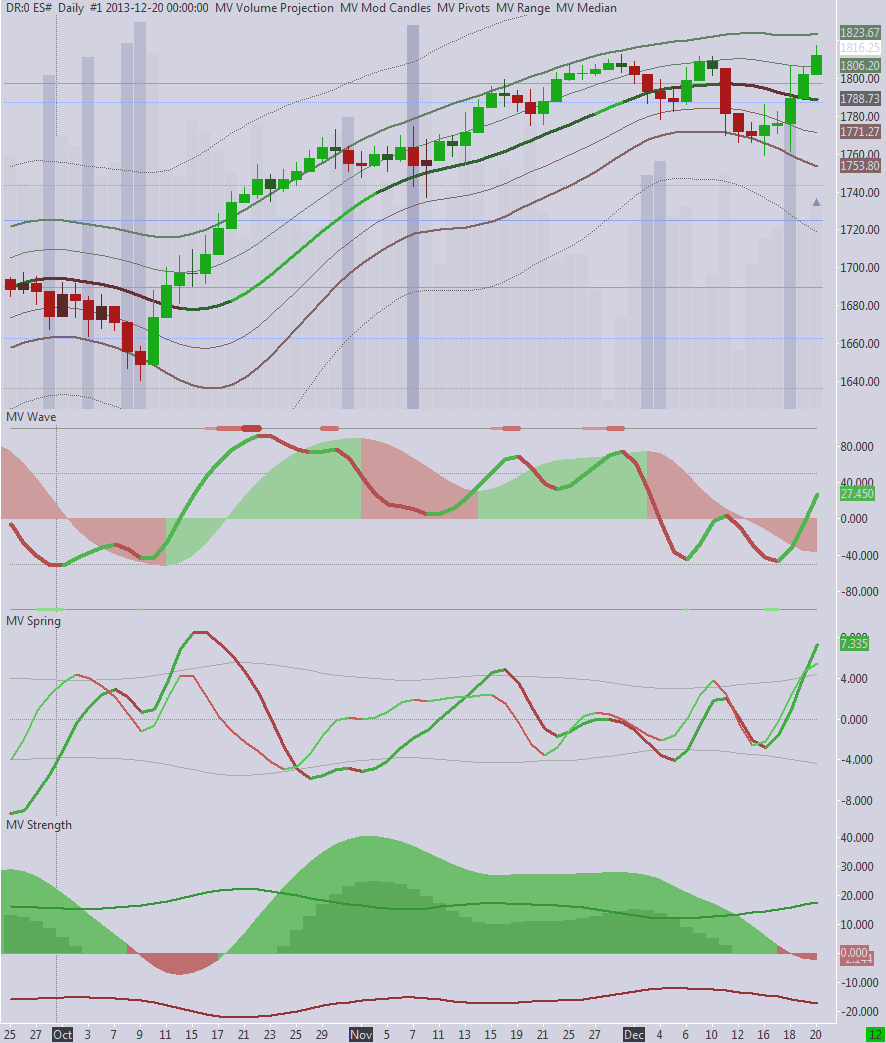

Hmmm... The momentum on the fed reaction was much much stronger than expected. The strong break above median eliminated the potential for a short setup.

I have been thinking over the event and am kind of puzzled why the reaction was so big. I have come up with two different theories to explain it. One... There is a LOT of old money in the market with memories of the old days when the fed would tighten hard and wouldn't care about the markets. They had a lot of fear before the news and were holding back. Second... A lot of funds and hedge funds were hedging and taking risk off before the announcement. More cost effective to hedge stock positions with futures than options.

Next pullback cycle will be a buy provided it doesn't retrace this cycle beyond 50%.

Tip: A few of my trading rules... I don't hold positions through big news events, or hedge, and I don't daytrade within 5 minutes either side of big market moving news releases. Ecb/Fed/Jobs report, etc... Stuff like consumer sentiment cpi, etc... They are fine.

|