|

Berlin, Europe

Market Wizard

Experience: Advanced

Platform: NinjaTrader, MultiCharts

Broker: Interactive Brokers

Trading: Keyboard

Posts: 9,888 since Mar 2010

Thanks Given: 4,242

Thanks Received: 27,103

|

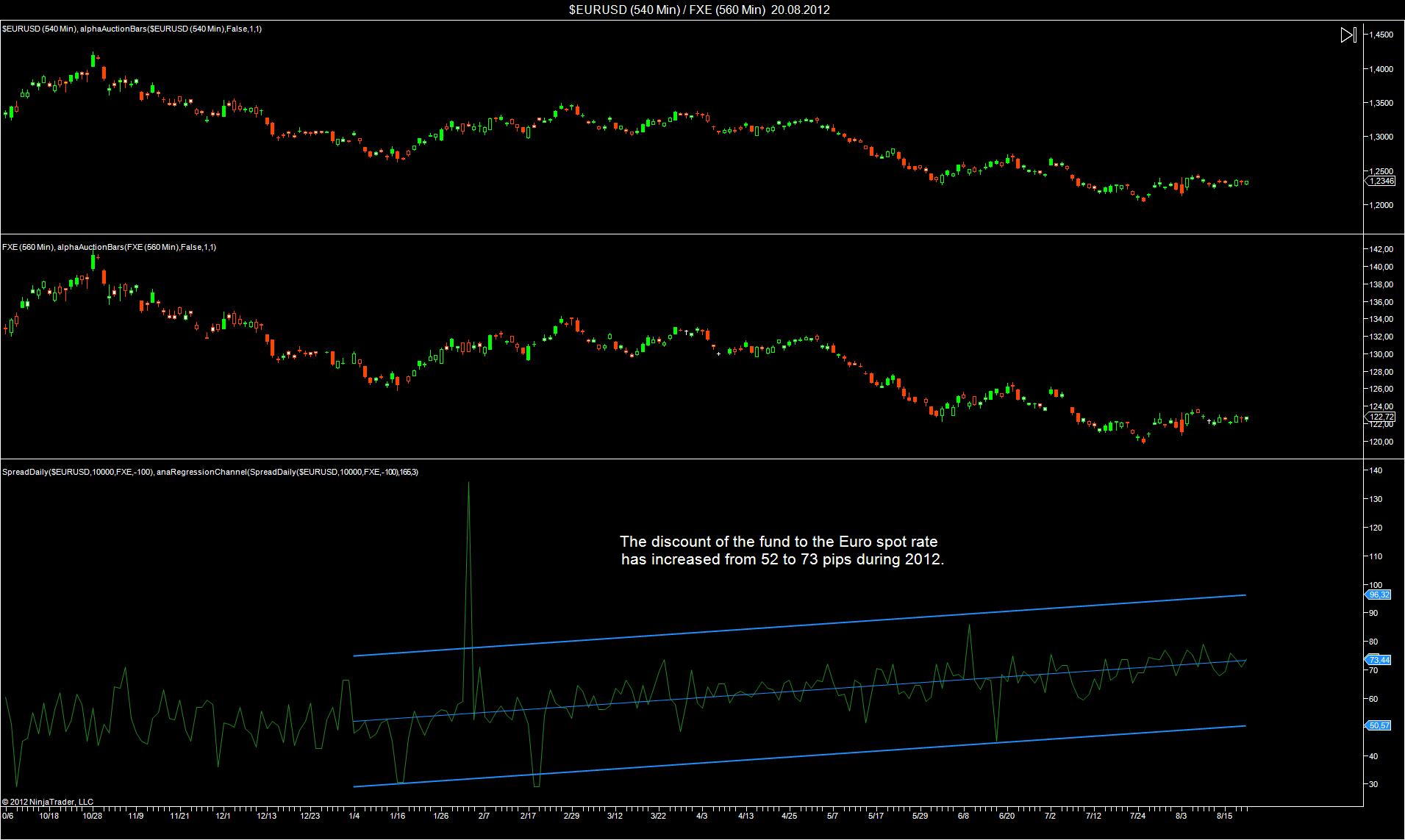

There has been a notable outflow of funds this year, as it is a long only currency fund. This will probably have a negative impact on returns.

Notable ETF Outflow Detected - FXE (ETFChannel.com, Contributor)

"Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel, one standout is the Euro Trust (AMEX: FXE) where we have detected an approximate $24.7 million dollar outflow — that’s a 8.3% decrease week over week (from 2,400,000 to 2,200,000).

The chart below shows the one year price performance of FXE, versus its 200 day moving average:

Looking at the chart above, FXE’s low point in its 52 week range is $119.73 per share, with $144.93 as the 52 week high point — that compares with a last trade of $122.73. Comparing the most recent share price to the 200 day moving average can also be a useful technical analysis technique — learn more about the 200 day moving average".

Also in an emergency case, it will probably not be easy to exit the fund as fast as the Euro. Therefore the discount to the Euro is growing. Not really a good investment. There is the risk that the fund will be dissolved, if it cannot attract enough investors. In that case arbitrage is not a good idea.

|