|

Mianyang China

Experience: Beginner

Platform: Multicharts

Broker: broker: Oanda

Trading: HSI, DAX, ES

Posts: 84 since Aug 2017

Thanks Given: 18

Thanks Received: 10

|

I was mentored by David Weis, busy with work for years, decided to trade again.

I day trade commodities in China, which are usually tiny future contract, mostly RB(Rebar).

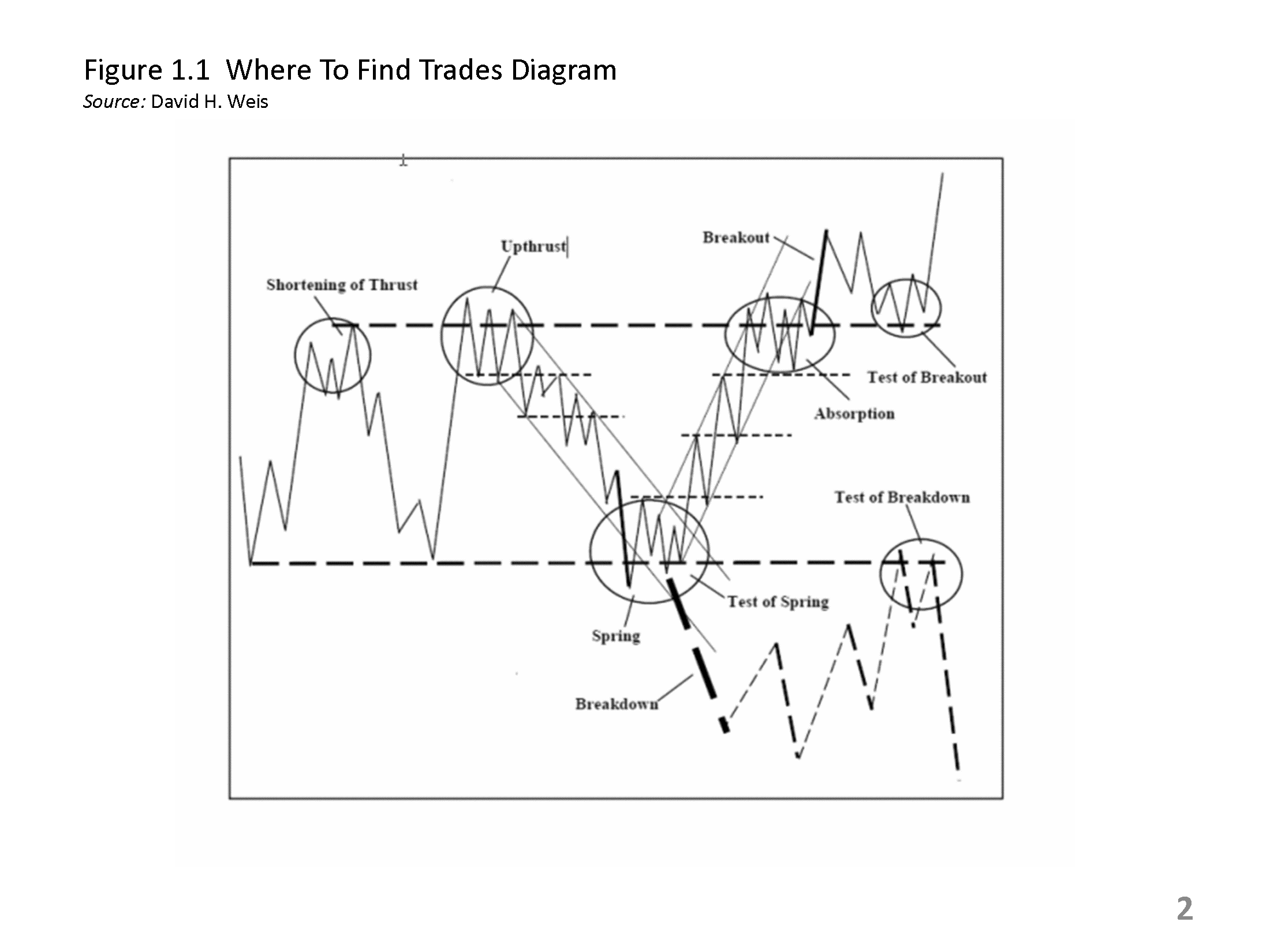

I look on charts for:

Support and Resistent

Trend lines

SOT (shorting of thrust)

The setups I decided to confine are:

1. Spring

2. Upthrust

3. Test of breaks

4. Light pull back after COB.

My problems:

1. Trade randomly

2. Trade on my imagenation

3. Force trade, Like to reenter after a trade closed.

I must bear in mind the Sequence of scan of charts:

Structure-waves-bars

Daily-hourly-15min-5min

This is Mr Weis's picture: Where to find trades.

|