|

rome italy

Posts: 17 since Feb 2021

Thanks Given: 18

Thanks Received: 47

|

Good evening to all traders and the futures.io community.

I too have finally decided to start my trading journal and share it with you.

I hope that my operations and my approach to the markets can be of help to someone, and can also help me in the process of learning and improving my strategy, because in this world you never stop learning.

Strategy

I state that my strategy is based on multiple factors but I will try to explain it as best as possible.

The strategy includes not too many market entries (around 10), with the aim of going into gains of max 20/25 points per trade.

Analysis tools

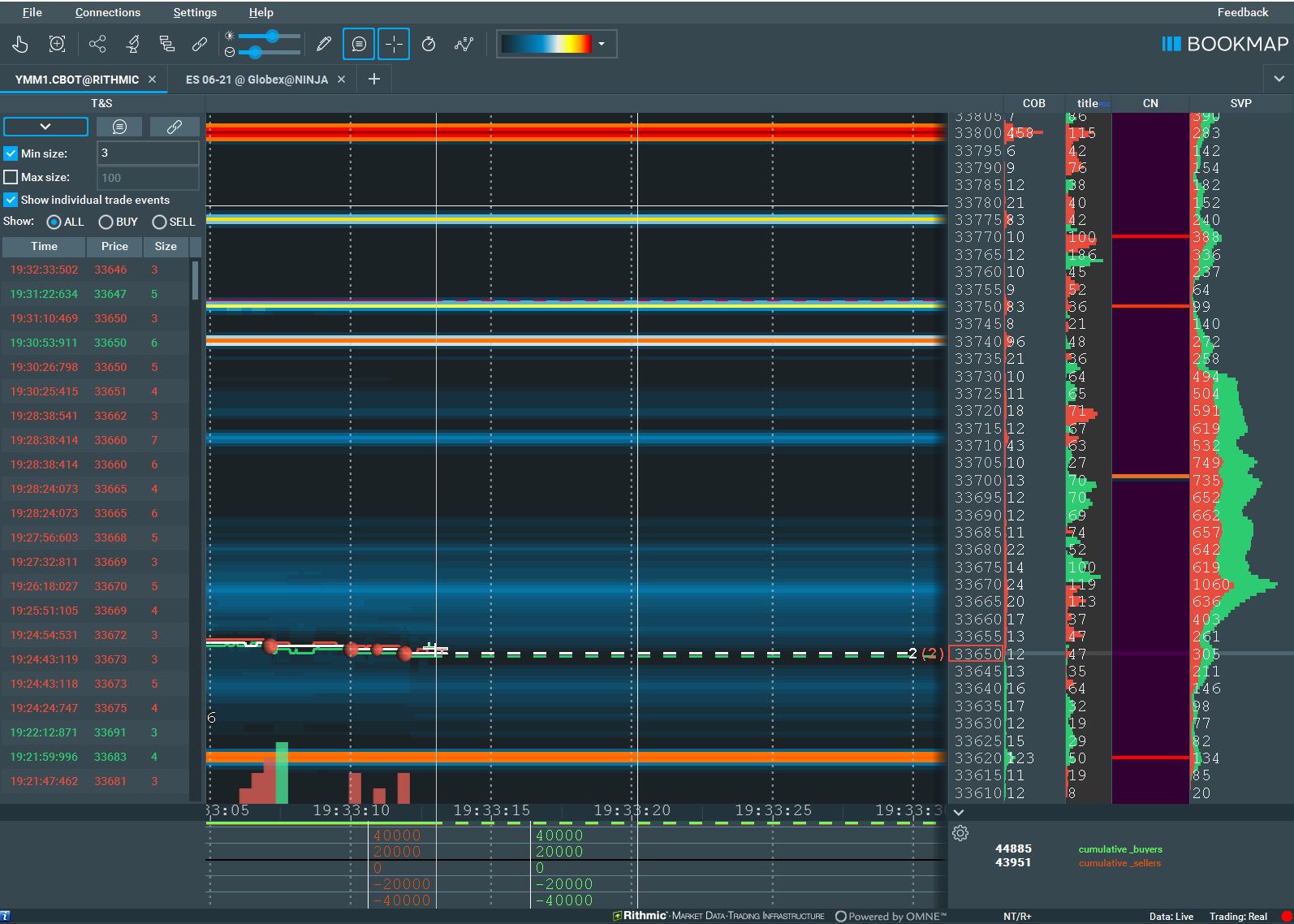

Bookmaps = watching the orderflow constantly helps me understand how the price is moving, its speed and if there are large sudden pending order entries

Footprint = this tool is essential to make me understand if the auction and if there are imbalances in the market situation. (I look at it almost simultaneously on the bookmap).

Candlestick chart = this instrument set to tick, I use it for analysis before the opening of the markets and thanks to the delta volume and other tools it gives me support and confirmation of a possible signal that I see on the footprint and on the bookmap.

Volume Profile and Tpo = these tools are essential to understand in what market condition we could be and to evaluate possible key levels useful to enter and to avoid making big evaluation errors to enter at a given moment.

Good will: this is the fundamental attribute that I am applying to improve every day more and to try to make this work my life.

Fingers crossed

patience: even if I feel like a novice in this community, I believe that waiting and patience are another really important aspect to work on.Like an eagle from above awaits the moment to launch itself on its prey, we small retail traders must arm ourselves with patience and wait for the right moment.

Traded instruments: I am one of those who think that trading a couple of instruments is more than enough. I believe that specializing given the difficulty and player we find on the market today, is important to try to gain another small edge.

For this reason I observe and translate only ym and mym and es and mes. Every now and then some Nq but not always looking at it I don't feel safe enough, because I don't know their behavior.

This is what I am trying to do every day and let's say that now I think I have started to follow the right path. or at least I hope.

I think I'm just at the beginning of this path, but every day the passion pushes me to do better. And I believe it is crucial for a trader.

Having said all this, now I tell you how my day went.

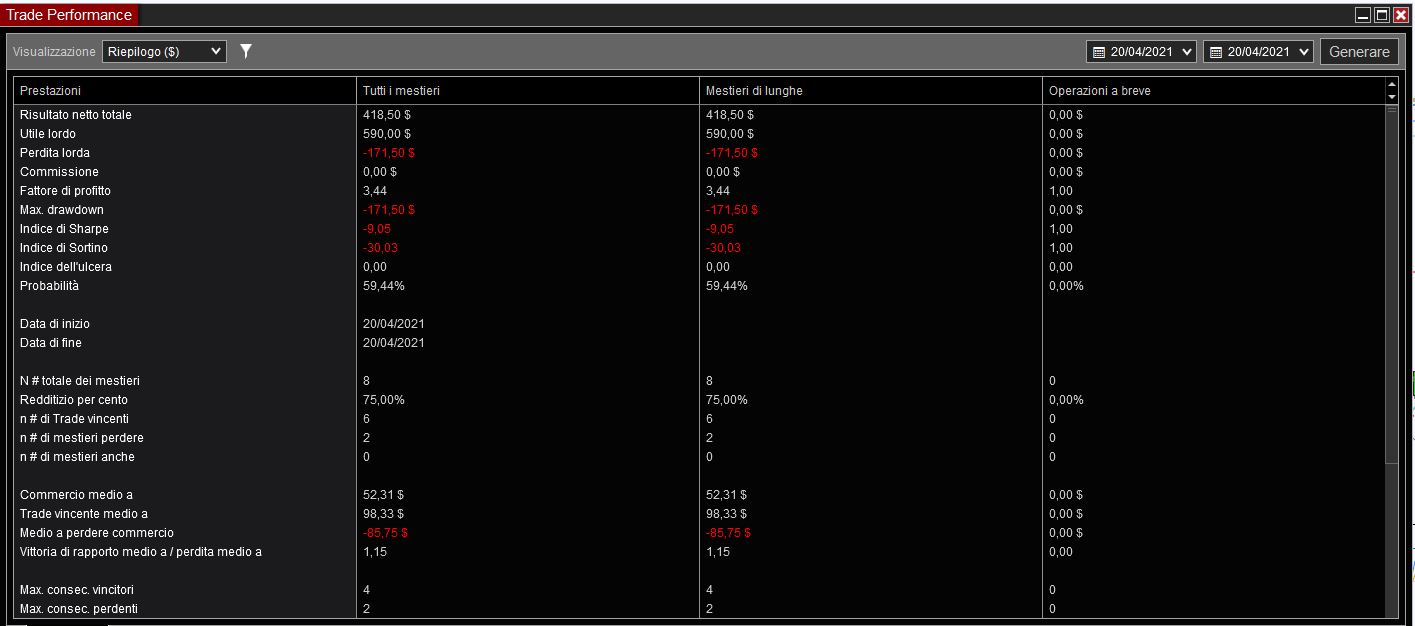

Day 1 of my trading journal 04/20/2021

At first I had a hard time understanding where the market wanted to move, but despite this I scored a couple of good trades and left one open but with a small size.

But then I came back ready to catch a quick retracement but I missed the entrance.

I entered them a bit in pain but I was ready to stop as the market was becoming very directional.

At that point, despite the two positions in loss as soon as I saw a signal to catch a retracement and I entered again but on es.

With that I was able to ride almost the entire movement and in the end I stopped both others with a controlled loss.

Result a nice green day.

Below I show you the ninja report for this day.

I am satisfied with the result but even more with the emotional management of the position.

See you tomorrow and let's see what happens.:hehehe

|