So its end of this competition. And its end of my month doing this journal.

Its started just as part of competition and I really wanted to win jigsaw tools with its educational stuff ... but

I guess this journal was much better education then anything else. At least for now

So thanks

FIO for this opportunity and thanks all for nice and encouraging comments and replies

I didnt trade today. Dunno if I will be able tomorrow. Not much time these days. But I spent some time reviewing my trades. Also reading my journal. For past few days I also spent some time learning

volume profile and how it can provide

support and resistance.

And I would like to make some summarization.

I dont know who was and will read this. Maybe it was and will, because I really want to continue with this, helpful for traders that just started. And maybe it was funny to read for someone who is profitable and I made that person smile with my tries

and maybe somebody will help me with finding my way. Because what I have learned is that one just cannot copy somebody else and has to find his own way.

And that comes what I found so far. I still dont have any playbook trades. I really want to find something. But thing is, that nothing is holy grail. I think that I have to find most probable setups. But its not easy. It takes time.

For example ... lets say there is setup that is 70% probable. But it happens just once per day. Which is good! Trade that every day and statistically I shoul be profitable 21 times per month. Great! But .... I dont know if what I have so far is THAT setup. What if I missed that already? What if I tried it 3 times in a row and it didnít work out. I would have been like well ... this wont work. And what if, even worse, I found sth that worked 4 times in a row but it was just luck and I thought thats the setup! But well ... it isnt.

So I guess ... it takes time.

But I got sth already. But still cant find anything like X happens do this and if Y happens do this. Is there sth like that? Maybe it isnt and maybe you just have to do it everytime and just manage your trade.

It will make sense in a sec when I get into real setups and trades. But managing trades is a own huge topic. And maybe that is holy grail.

So so far I like ranges. You can fade them or ride breakout. If there is no breakout, there is fade. Yey! Simple! Hah ... but how do you know?

There is even head fake ... well ... I desperately tried to find an edge. Was looking at retest. Also

price action. Absorbing. Volume profile.

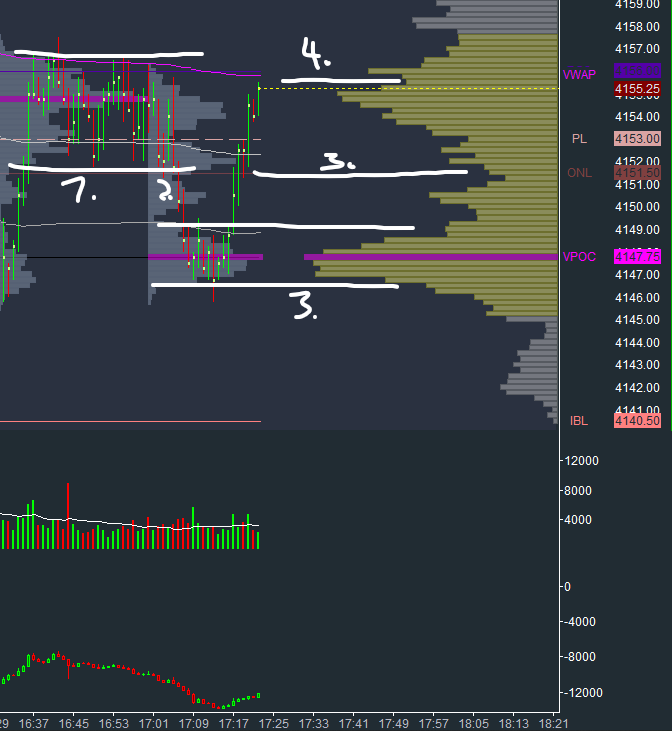

Lets look at some pictures

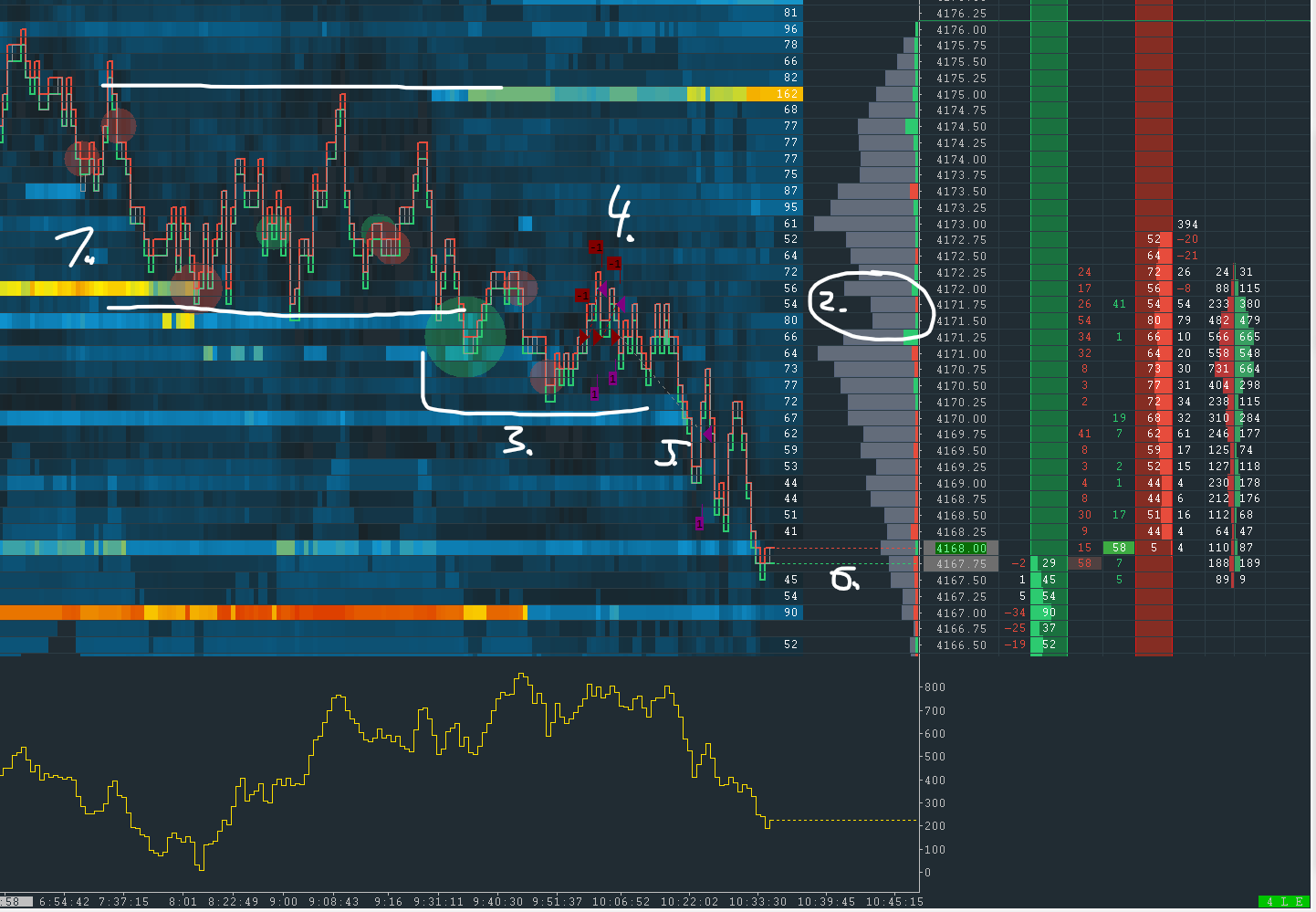

This is so beautiful! See how those ranges aligned with volume profile?

- Range with support at overnigh low

- Breakout with nice momentum

- Range around HVN with VPOC

- Test of previous range and we traded through

- All the way up into range resistance

This is so nice and simple! But ... was this a breakout? Was this a head fake? Because we traded back and even through. Maybe it doesnt matter. Breakout or headfake ... It was nice setup.

With breakout I was always looking for test of range we are breaking. I would wait and trade that with SL in a range and with manual target. I would be stopped here. And here is a question. Should I do that all the time? Or should I look for other confirmation like

absorption or sth else? Or if it wont do what I hope for I just change

bias and go different direction, because now if int not going to trade there is high possibolity it will go to other side of range ... like in this scenario.

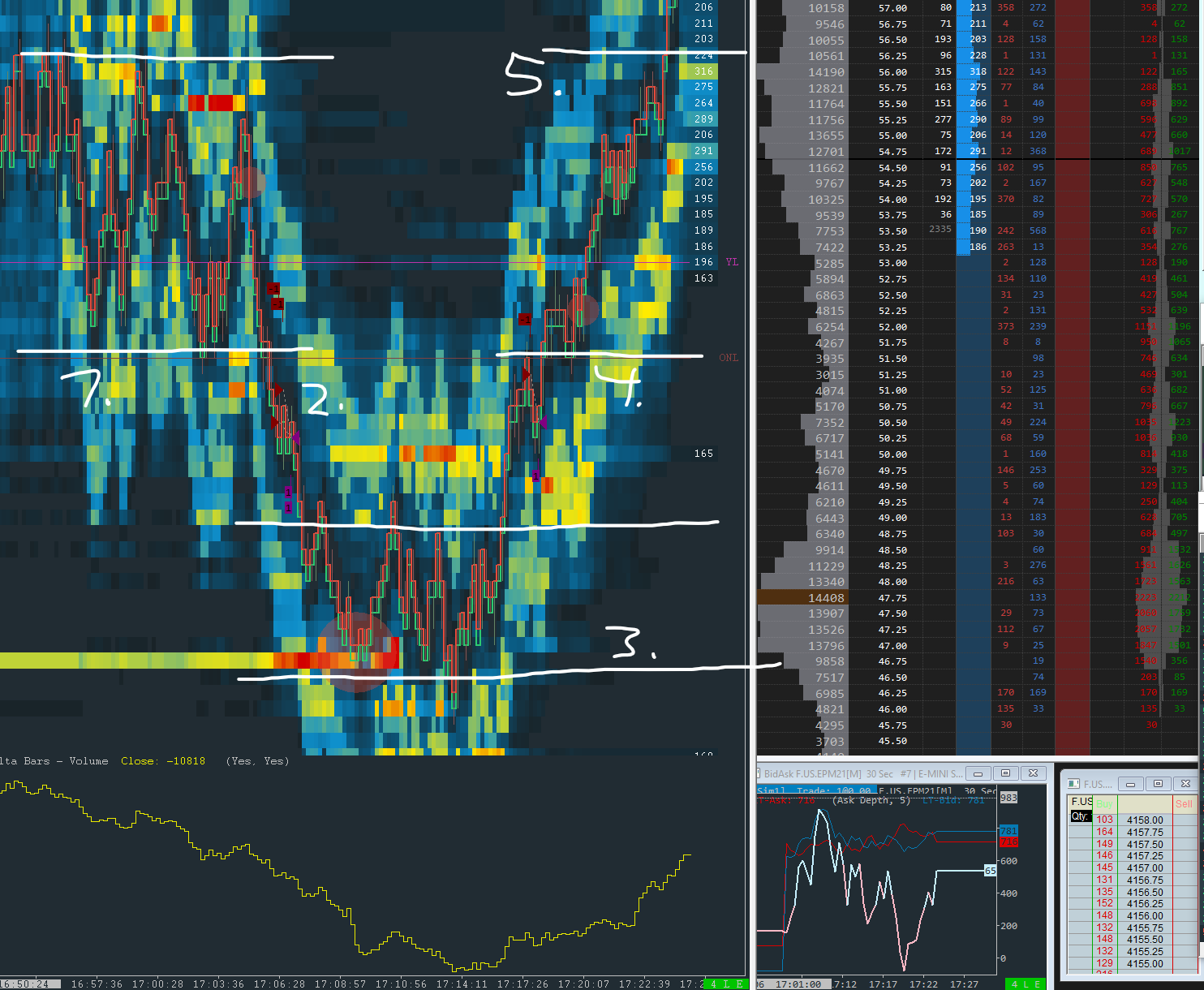

Lets have a look at another similar setup:

- Range

- Breakout with lots of volume here

- Retest of range

And we didnt bounce back and didnt go higher. We went back to range all the way back to low of that range

So was this a headfake? If this will happen everytime ... like if this wont break after retest there is high probability it will go to other side of range ... cool! that sounds like a setup. Now its a matter of managing this kind of trades.

How it looks like when it works?

- So we broke a range into this HVN

- retest of range

- retest of HVN high

- retest of HVN low

Or another one:

- Range

- HVN

- Retest of range

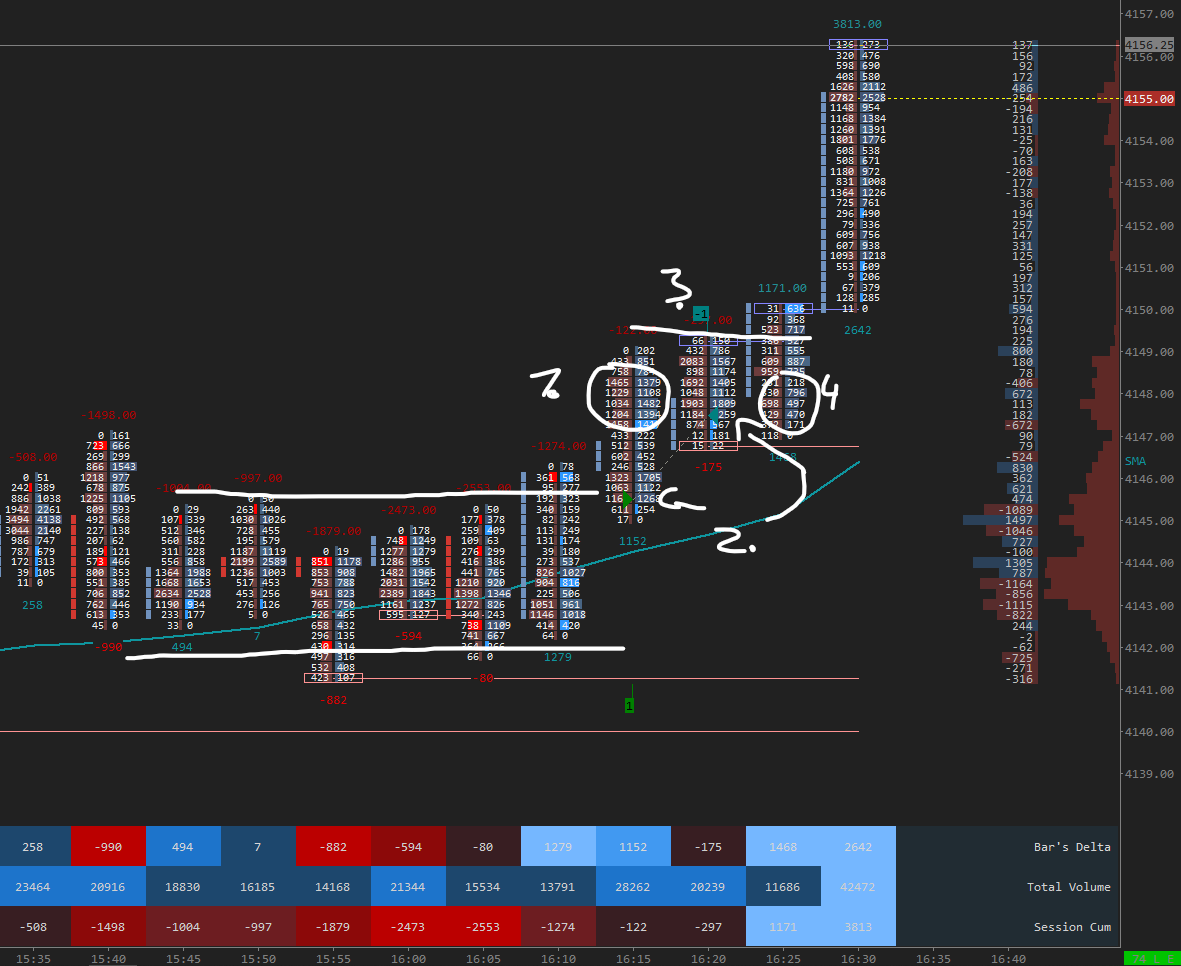

So far ... we got ranges. We can fade them for few

scalps, we can break from them or we can fake break out from them. Now its about managing trades. Managing stops and target. How much breathing room should I give my trades? Is there some real strategy, or is that a feeling? Feeling like there is too much of selling/buying, absorbing, or order pulling/

stacking ... or its about momentum?

For past few days I tried to learn volume profile. Well ... it didnt go good. I somehow forgot about everything else and was just looking at profile and nothing else. I wanted to trade everything. But what usually happened I got stoped out precisely on tick ... either by

hard stop or manual stop. And then it went to my direction.

I will repeat that:

But what usually happened I got stoped out precisely on tick ... either by hard stop or manual stop. And then it went to my direction.

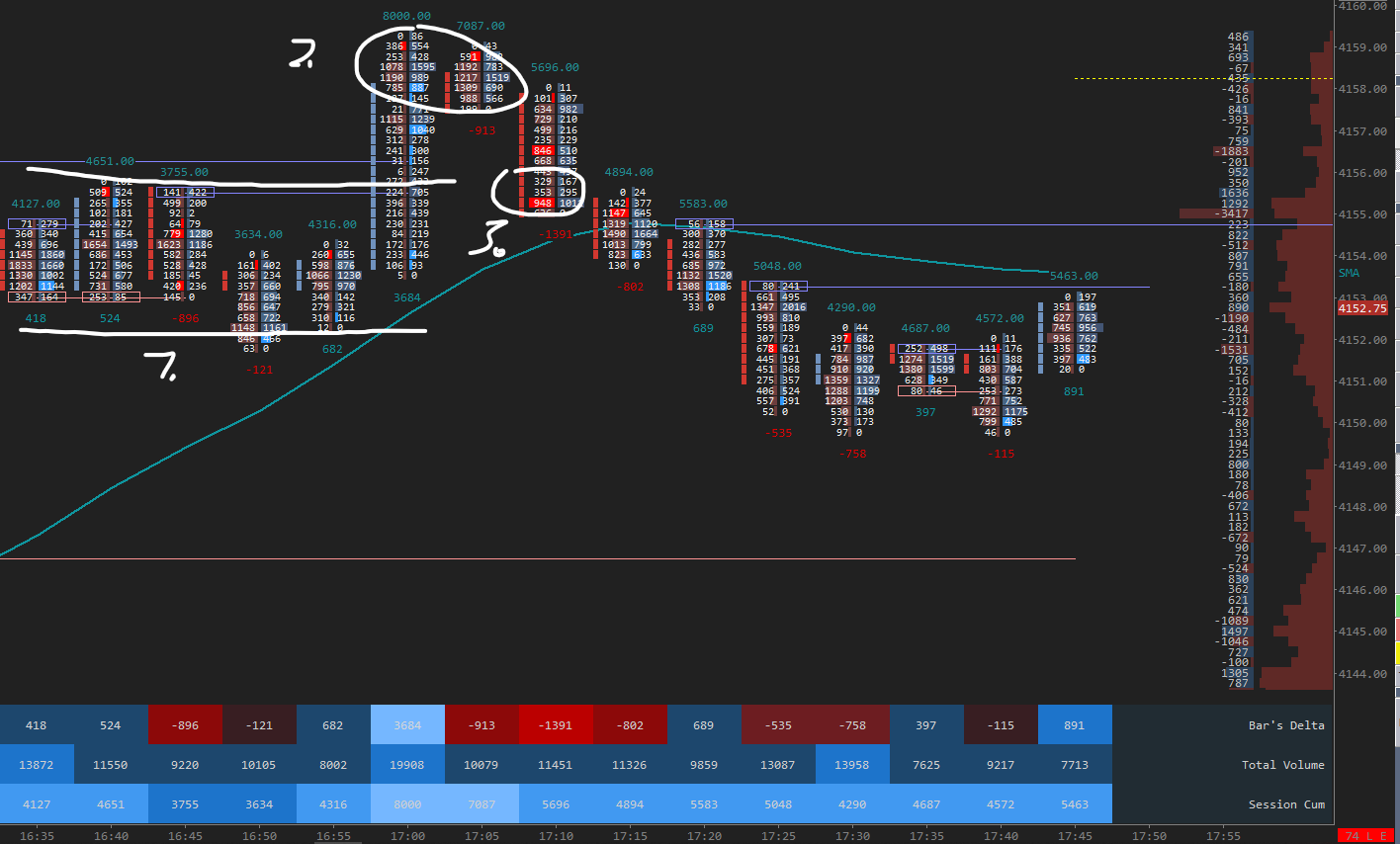

What does this mean? Was I correct with my bias? Well ... yes and no. I actually was, but my entry was really bad!!! Unfortunately I dont have any screens with trades, but got sth similar

Those

points I marked in pictures are from previous post. But what is important here is n2. Its

LVN.

in point 3 we traded through and we retest that. I would go short. But where would my stop go? Where I really know that im wrong. 71.50? 72.00? Or even 73?

As you can see I tried few trades in point 4. I stoped out from first one because it went to 72.25. Tick perfect

it bounced

Second one stopped out at 71.75. Tick perfect

bounced ...

Third I hold and I had nice trade. Should have hold even more ... but

And that is the question. I dont want to exit from trade because of some magic number ... like 6 ... 6 ticks agains me and Im out ... why?

So I was looking at VP ... but which one to choose? LVN? Edge of node? HVN? It will always bounce from sth ... but one time its LVN and other time its HVN

So .... what to do?

Should I look into momentum? Buying/selling?

Delta? What can confirm Im wrong?

Until I finish this sum ... there is one more thing

Sim vs Live

I traded sim for 2-3 months ... In the beginning of this journal I tried live trades for the first time. I just cant tell you how much different it is. Its somthiing completely different. That fear! Fear of holding ... fear of even going into trade. And then ... blowing up almost 30% of my account in one day, because I had few bad trades and no rule can stop me to gain in back ... Yeah ... I lost even more. I was soooo pissed. I had to change my rules. And after that ... I was mainly sim trading.

But still I have to encourage everybody that didnt start live trading. DO IT!!! Just for one day and then come back to sim. Just to have this feeling. Then you will manage sim differently. Trust me!

After one month of doing this journal ... what have I learned?

I got this feeling, that I have learned nothing. And maybe ... maybe I have learned a lot!

I know there are zones worth trading. We got support and resistance. These zones are happening around volume profile. They can create ranges. We got some possibilities with ranges. We can fade them or we can play for

breakouts. There are important zones like VPOC and even yesterday VPOC. Or yesterday high and low. Also composite profile from several weeks, months and years can be helpful for finding zones of interests.

So I have learned, there are these zones. These zones are worth trading. But ... how? What is that edge? I guess ... i just have to observe more. I would appreciate if somebody will tell me what to do. But even tho, I would need to observe it and try it on my own. Get this feeling.

For example ... lets say we are in a range and we traded into support. We even had a momentum and volume. But there is huge absorption. Bids are eating selling and there is huge selling, but its going nowhere. Should we go long? Should we wait and see how it develops and then go long? What if we miss it? And what if that selling will continue and it will dominate so much it will eat through bids and there will be huge sell off. What is here a more probable trade?

Maybe

context? Maybe thiis ... feeling? Experience? Or maybe managing that trade.

Go long. If there is huge absorption, it should just rip too highs. Huge momentum. Its not happening?

Bail out! Or a tight stop? Or both? Or not going long and go short and try the same but from short perspective? But that we can say its 50/50 ... well ... then maybe its not the right setup.

So what have I really learned?

Observing

And I guess ... I have to observe more.

Thanks all for going with me on this incredible journey. Specially thanks to @

Anagami and @

Sandpaddict for their kind and encouraging replies. I wont stop. I didnt have much time trading last few days and for next days it wont be much better. But I will try to observe. There just have to be some kind of edge. Price action?