|

Sydney, Australia

Posts: 30 since Oct 2020

Thanks Given: 12

Thanks Received: 20

|

20210601 Uprofit Trader?

Previous experience with 'Prop firms'

I have previously signed up for Leeloo evaluation account a few times.

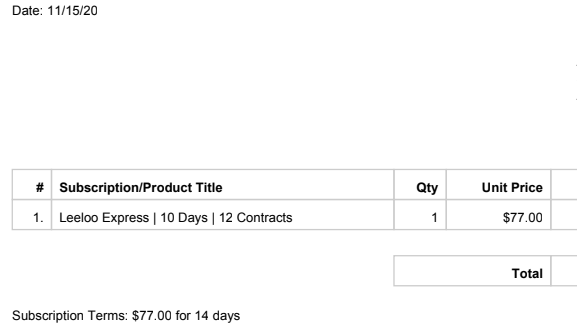

1st time, Nov 2020:

Was in profit over $2000 at one point then got tilted. '14 days to get funded' might sound sweet but I felt rushed to grow my P&L and ended up overtrading and kept trying to 'make it back' after a good amount of DD. I decided to go back to paper and practise more.

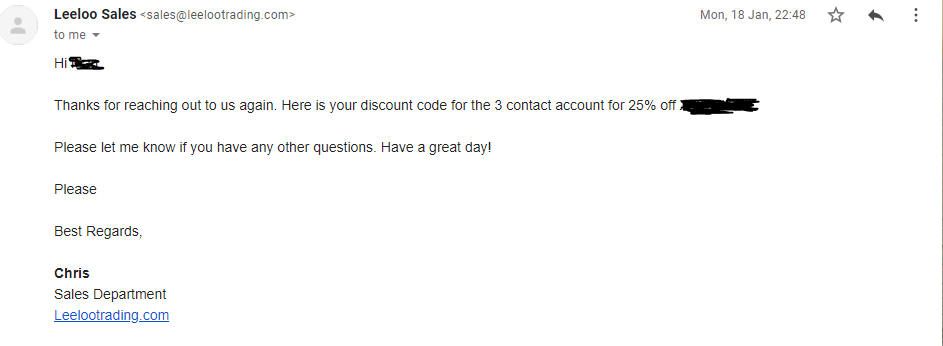

2nd time, Jan 2021:

Nicolas and Chris was very helpful and fast in responding to my emails. I told them I would return for a smaller evaluation account in 2021. I chose the 3-contract 25K account because I figured that it gives the best RR, $1500 DD for $1500 target, 1:1.

One week into the evaluation, I clicked buy instead of sell when the market is falling. My account went from positive P&L to under 25K. Not by much, but mentally I don't want to trade this account anymore. This is a mistake that should not have happened and I don't want to make back the money that I lost by mistake lol. Then, I went into sim mode and started journaling here. I figured that I just need to keep going, sim trading or not, to gain enough screen time and build a routine in trading.

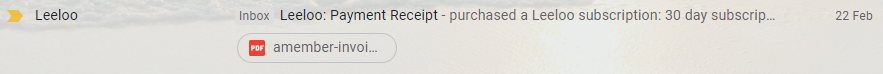

3rd time, Feb 2021:

Signed up for a new account when my 'mistake account' is about to renew. I cancelled the subscription and signed up for a new one so I don't have to pay the reset fee. Unfortunately, life happened and I had to relocate so I did not managed to trade properly. Was in slight profit at the end of the 1-month subscription period as I was trading very small with /MES. Decided to stop and looking to sign up again after I have settle in Sydney.

Uprofit Trader?

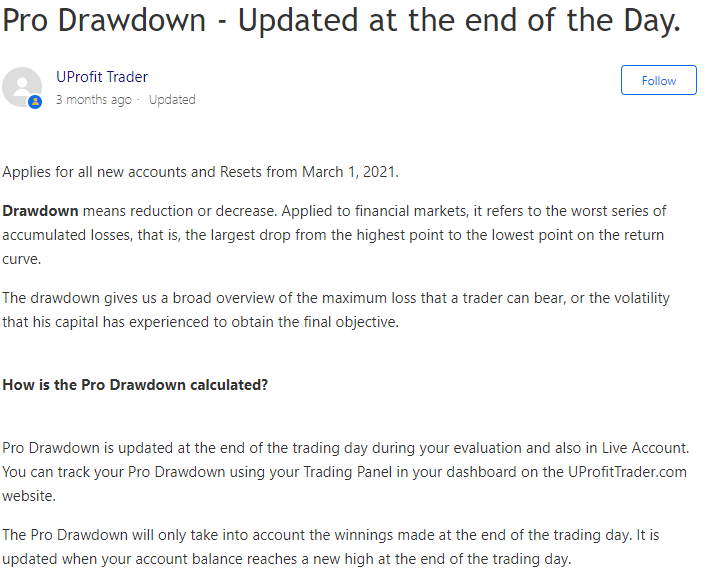

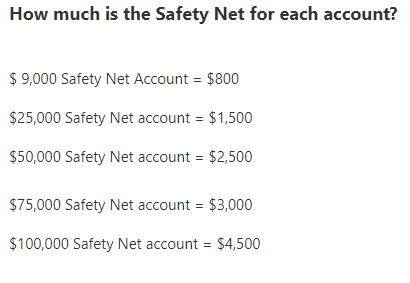

Was going to go back to Leeloo when it has a nice sale event but discovered Uprofit Trader. It does not have a trailing DD like Leeloo does but instead an EOD balance DD. With its May 50% off discount I have decided to give it a try, with the 50K account ($2000 DD, $1100 daily loss limit).

Pros(?) compare to Leeloo:

-EOD balance DD (but does it trail indefinitely even in Live account? Leeloo live account would stop trailing after starting balance + $100)

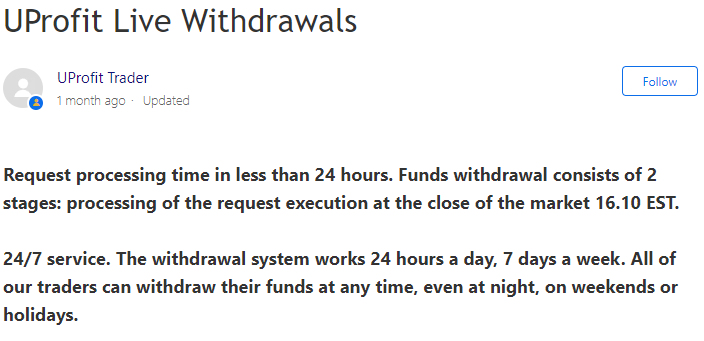

-24 hours profit withdrawal with live account (but profit split is 50/50 if account balance does not have cushion)

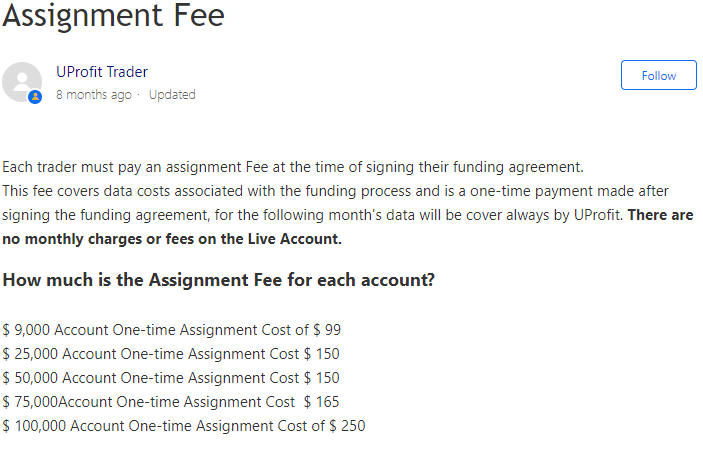

-No monthly fee but one time assignment fee

Cons(?) compare to Leeloo:

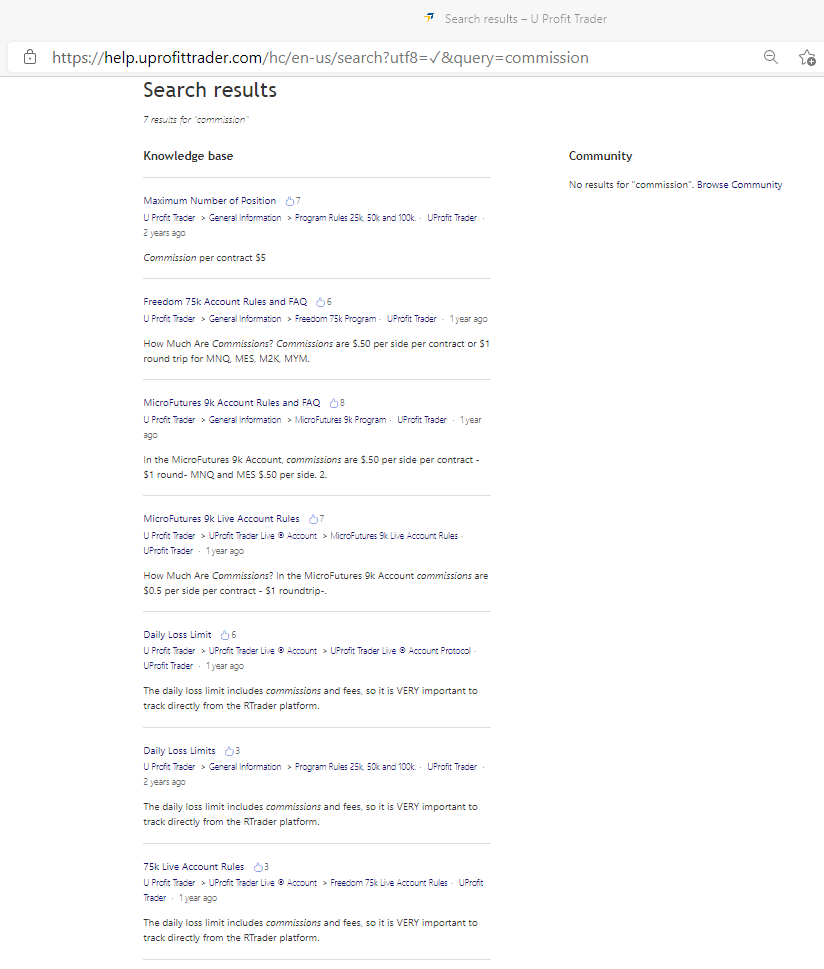

-High commission fee, and I don't know if it's round trip or not for /ES. Image below is the only result when searched for 'commission' on the site

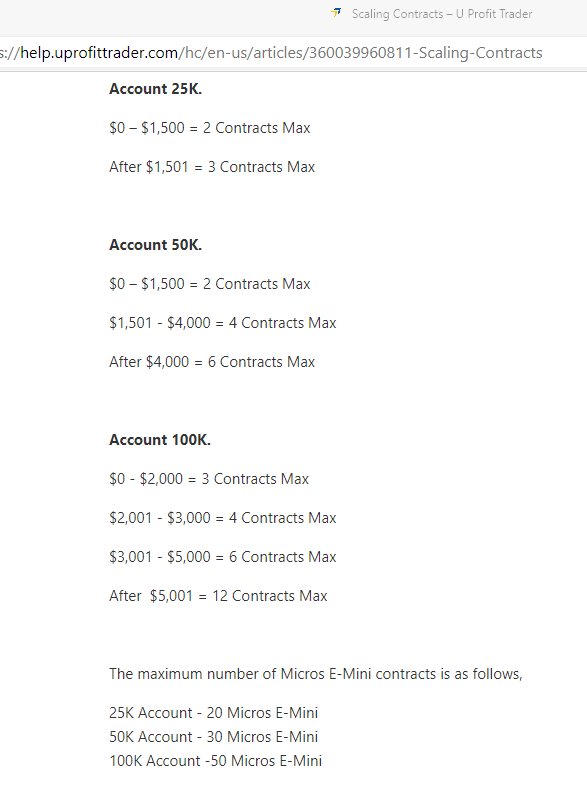

-Has scaling on live account

-Minimal information on website. I have quite a bit of questions and will send them an email and see how they respond.

Conclusion

It is time to leave my sim trading environment again and this seems to be a good opportunity to do so. I hope that the EOD DD does not trail indefinitely in Live Account. Let's see!

|