|

san diego

Posts: 5 since Feb 2017

Thanks Given: 1

Thanks Received: 4

|

Hi everyone.

Long time lurker and passive trader looking to share my trades, ideas, and hopefully wins as I navigate through this trading journey. Working from home on the west coast, I'm finding I have spare time to monitor the markets and through this last week I have been able to actually get my feet wet with micro emini futures. Before this, I practiced through simulation through TOS and Sierra Chart.

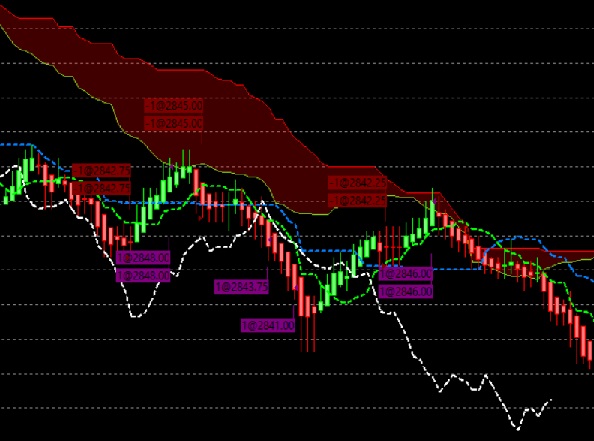

I've mostly been focusing on Heikin-Ashi charts timed at 256 ticks with an Ichimoku Kinko Hyo overlay. Supplemented with a $NYSE tick chart, and a separate Volume Profile chart (still learning how to utilize this fully).

What I've found is that if I am very patient and strict with my entries, I can easily come away with 1-2 points. The last couple of days I have been up 4-5 points going into 12PM and I get eager to anticipate changes and find myself throwing the rules out the window and end up going negative for the day. I definitely need to hone in on my discipline and need to shut down and walk away for the day when I am up by an acceptable amount.

Here are a couple of my trades for the day

Looking back, if I would have been more patient at least with my second contract, I could have let the initial trade run up to 2867. I like the Ichimoku but I'm finding that it misses out on a lot of big swings. Which led to my next screenshot.

After the bearish crossover above the cloud, I was anticipating a downtrend and entered once the price moved below the cloud. I took a very small profit and got lucky because it ended up bouncing back past my entry.

Here is my last trade of the day where I was trying to be smart but the markets proved how impatient and dumb I can be. Should have walked away for the day. No real explanation here just trying to trade off my gut and anticipating swings towards the end of the day. Maybe only 1 of these trades actually make sense based on the Ichimoku rules.

Thanks for reading. I hope to continuously improve and post to hold myself accountable.

|