|

Lubbock, Texas/USA

Posts: 46 since May 2018

Thanks Given: 1

Thanks Received: 36

|

A quick recap of last week:

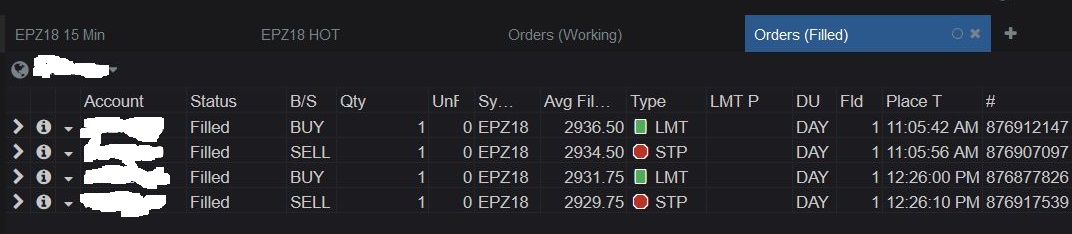

On Monday the market traded in a fairly orderly fashion to my buy level. But shortly after I entered a long position, we got a spike down that hit my stop. -2 Things quieted down for about 90 minutes and traded to another entry level. Again, BOOM, another spike down, hitting my stop for another 2pt loss.

-4 for the day.

On Tuesday, shortly after 1300, the market traded to my sell. I wasn't particularly fond of getting short at that point but I always say if you don't take the trades, you don't really have a system. It only took less than an hour to reach my target and I exited +9.5pt.

Wednesday there were so many potentially explosive market moving factors that I decided to stand aside. FED meeting, China canceling trade negotiations, Trump announcing that he was considering doubling sanctions on China, etc. etc.

Both Thursday and Friday: sustained moves without sufficient corrections to trigger trades.

+5.5pt for the week

|