|

Columbus, OH

Experience: Advanced

Platform: NT8

Trading: ES, CL, GC, NQ, YM, RTY/TF/EMD, 6A/B/C/E/S

Posts: 57 since Jan 2017

Thanks Given: 0

Thanks Received: 22

|

Daily Review for 08/28/17:

13 orders, 12 trades, P/L: +0.2R

Although I finished up on the day, everything came together today to finally break down the discipline I've had over the past 2 weeks. I was down intra-day over 7R and on multiple occasions I traded with fully margined positions in some instances without stops in place. After seeing gold breakout as expected and not having a position, after seeing my level in oil hold the market for a 150+ tick move for the 4th time, after missing 4 morning scalps in the NQ, after completely missing out on the morning equity dump I anticipated last night, and after losing 1R on the first trade I finally took, I should have recognized that these circumstances of massive missed opportunity only to immediately take a loss have consistently led to trouble in the past. Instead I overtraded, took emotional trades, and mismanaged good entries. No daily plan for tomorrow as I'll be taking the day off.

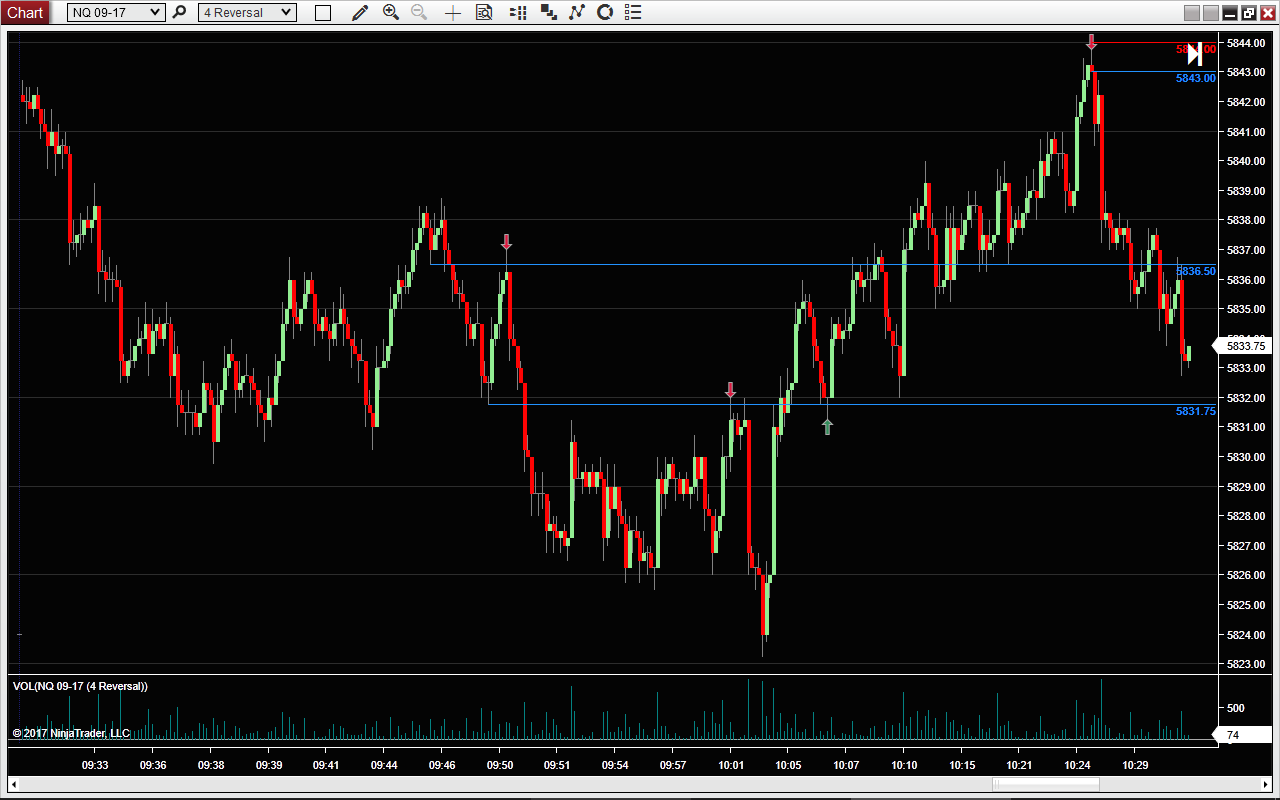

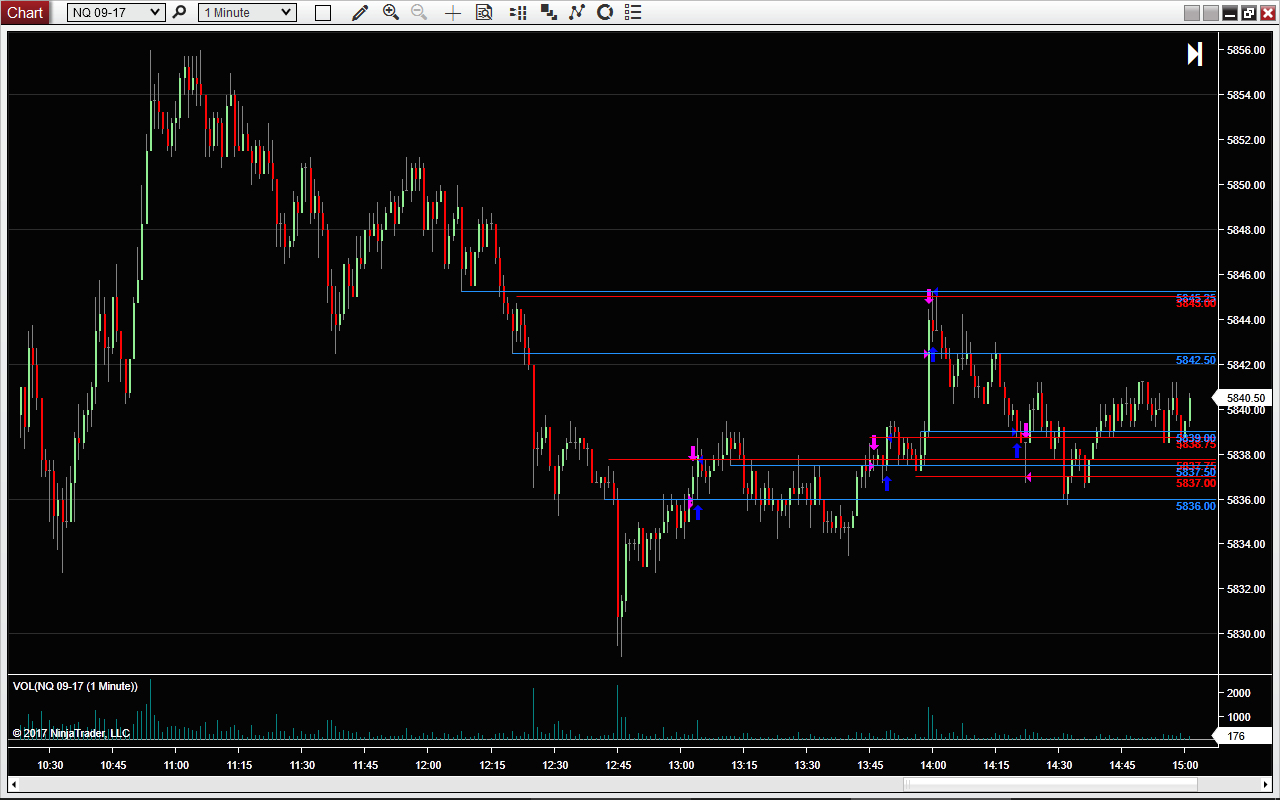

NQ - the first 4 scalp setups in the morning worked so well you'd think I had gone back and cherry picked them. In reality, I had my finger on the trigger for each of these setups but just never pulled it, probably because each of these setups had a stop of 4-5 ticks. Although none of the stops were ever hit, I was afraid the whole time they would be. Later in the day, I finally took one of these setups and it went straight to stop. The day went downhill from here. I took another scalp that was marginal at best, and was quickly stopped out again. The next setup I made the massive mistake of stopping out into another area of resistance that I would actually be happy selling at. My stop out here held as the high tick. Final setup was a re-test long but I ignored the fact price had already bottomed ahead of my level, the same level had broke in the other indexes, and the return was very soon and sharp. 3 things that should have kept me out of this trade yet I still took it and was stopped out yet again.

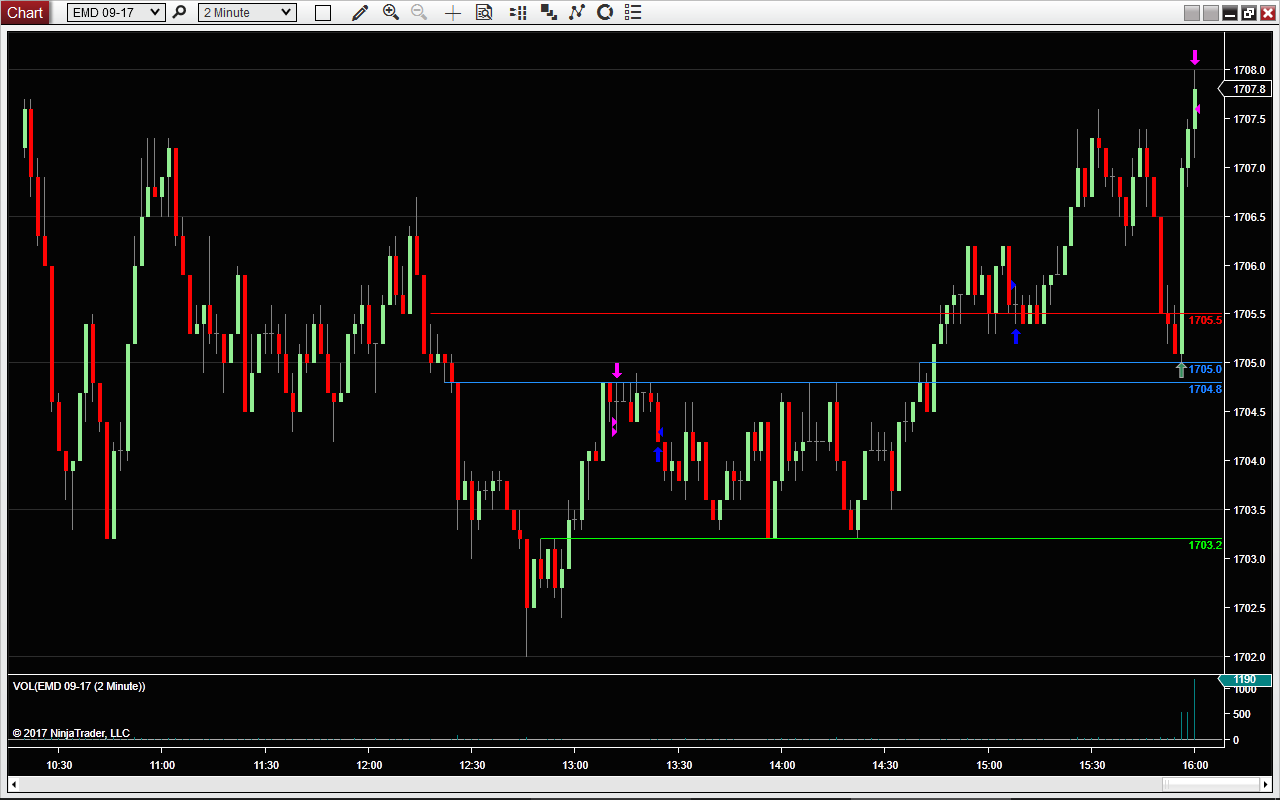

EMD - both of these trades were at full position size and without stops. The idea behind the first setup was actually sound, but I panicked out as I realized I shouldn't be in such a large position. This setup actually ended up working ok. The second setup was a chase and if you look closely, the entry I wanted actually traded as the low tick just before the rally into the close.

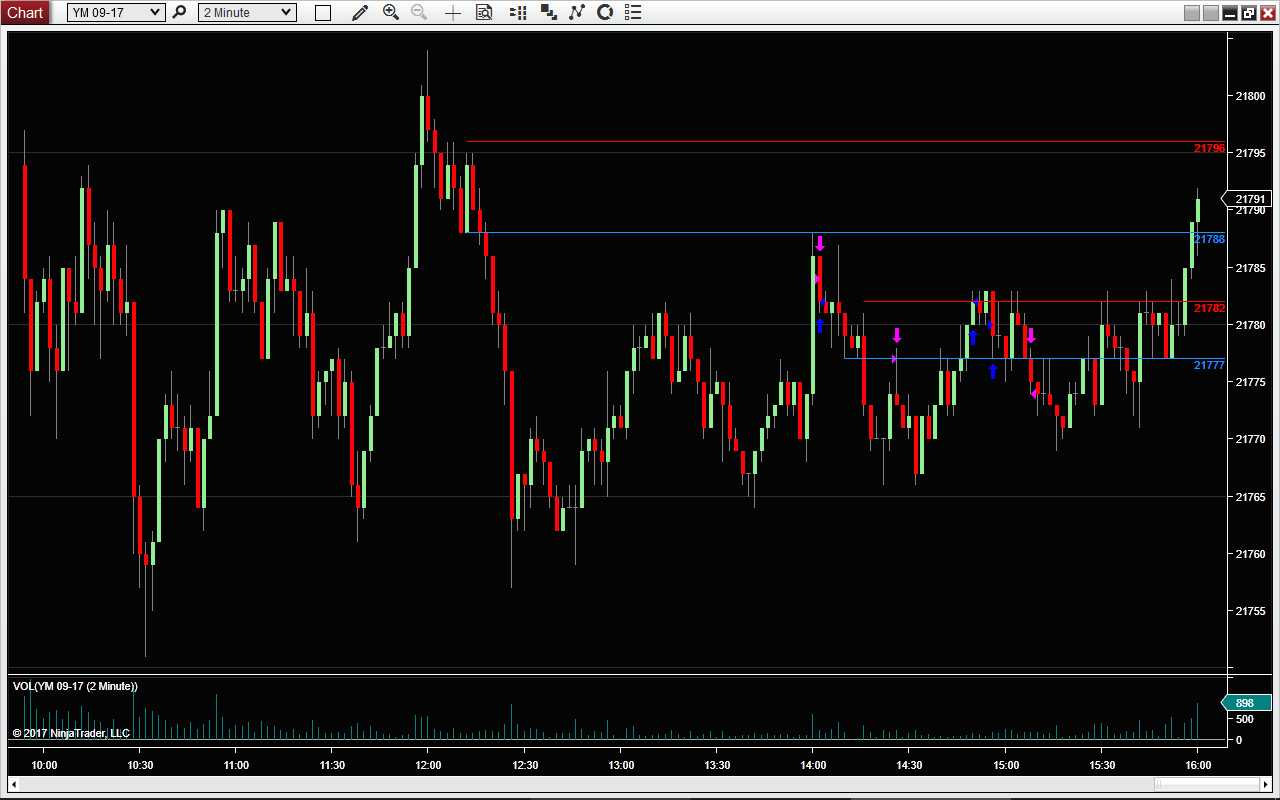

YM - first trade here was also a sound idea but I chased the market down because I didn't trust my original entry level, even though it ended up holding to the tick. Took a massive position here too so I cut it as soon as I snapped out of the emotion. This setup ended up working though. Second setup I wanted to run to the daily lows so although the entry was perfect, I took a loss because the market never broke. Third setup was a trade purely out of emotion that I would never take under any other circumstances.

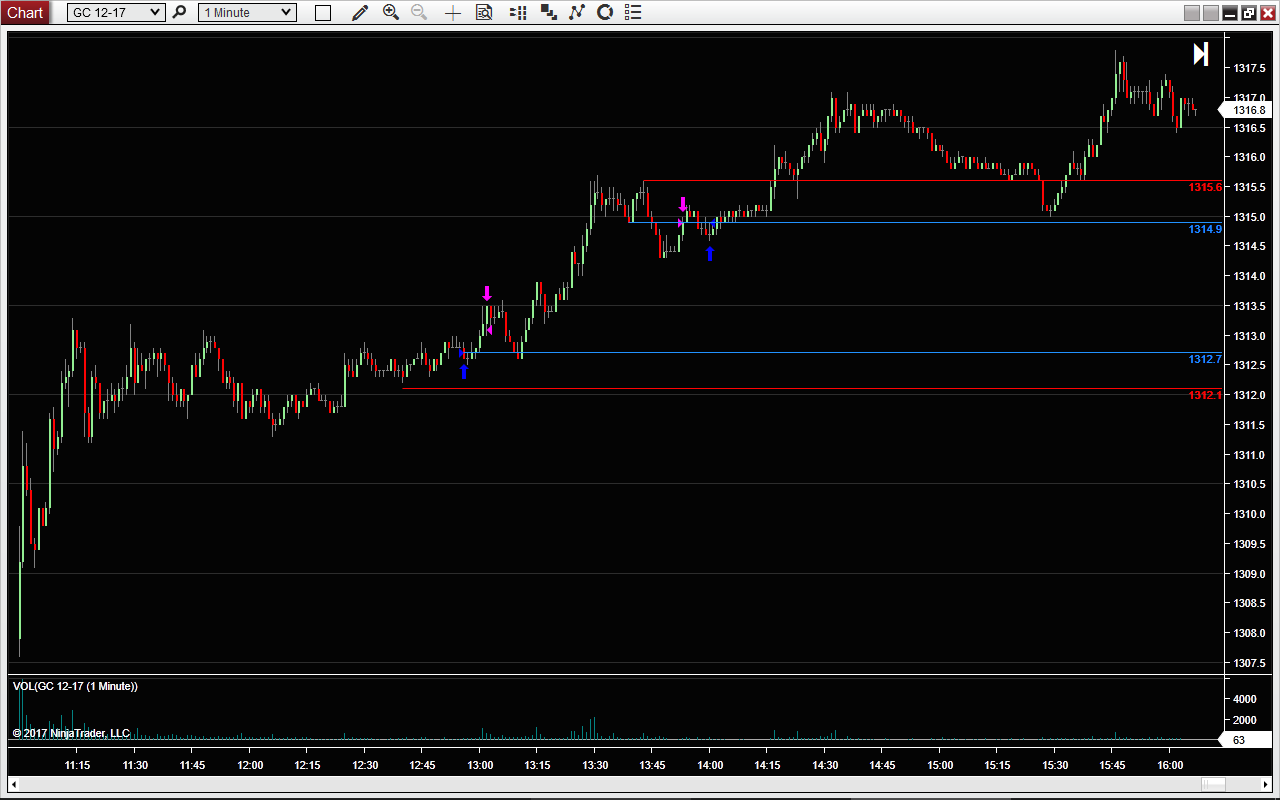

GC - I'm tired of calling 100+ tick moves only to not participate so midday today I took a long position only to hold it for 4 ticks profit. The market failed at it's high, which I didn't like so I exited. The market then continued 47 ticks higher. Second trade was a short based only on the M1 timeframe, which is against my rules.

CL - Another 100+ tick move I missed after calling the high. Wanted to short 46.70 but was put off by the failure at the lows shortly before. The market then sold off 50 more ticks. The only trade I did take was out of desperation that the move lower I had missed out on would continue. I stopped myself out of this trade early once the market started holding into the pit close.

|