|

Phoenix, AZ

Posts: 67 since Feb 2016

Thanks Given: 3

Thanks Received: 38

|

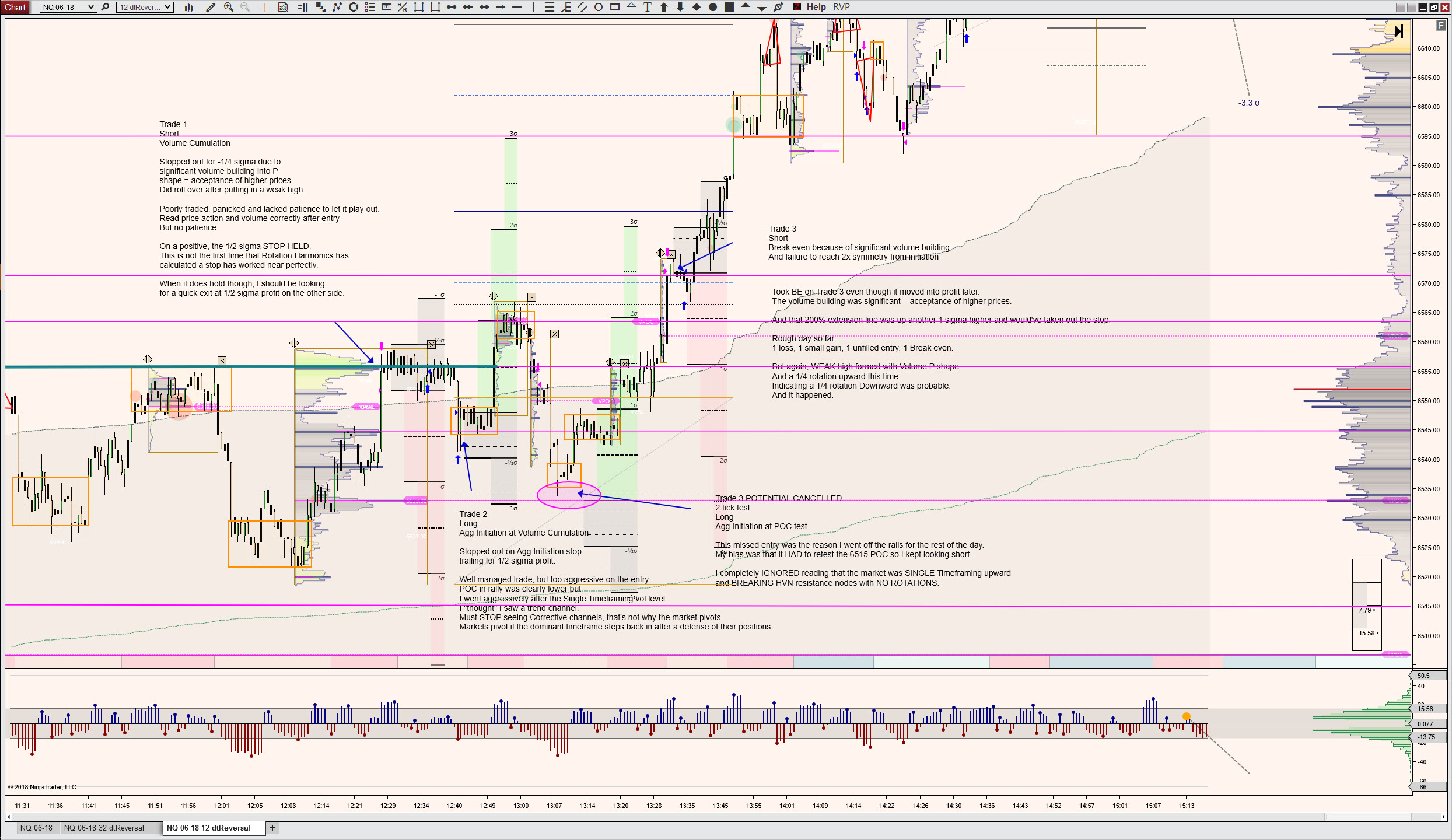

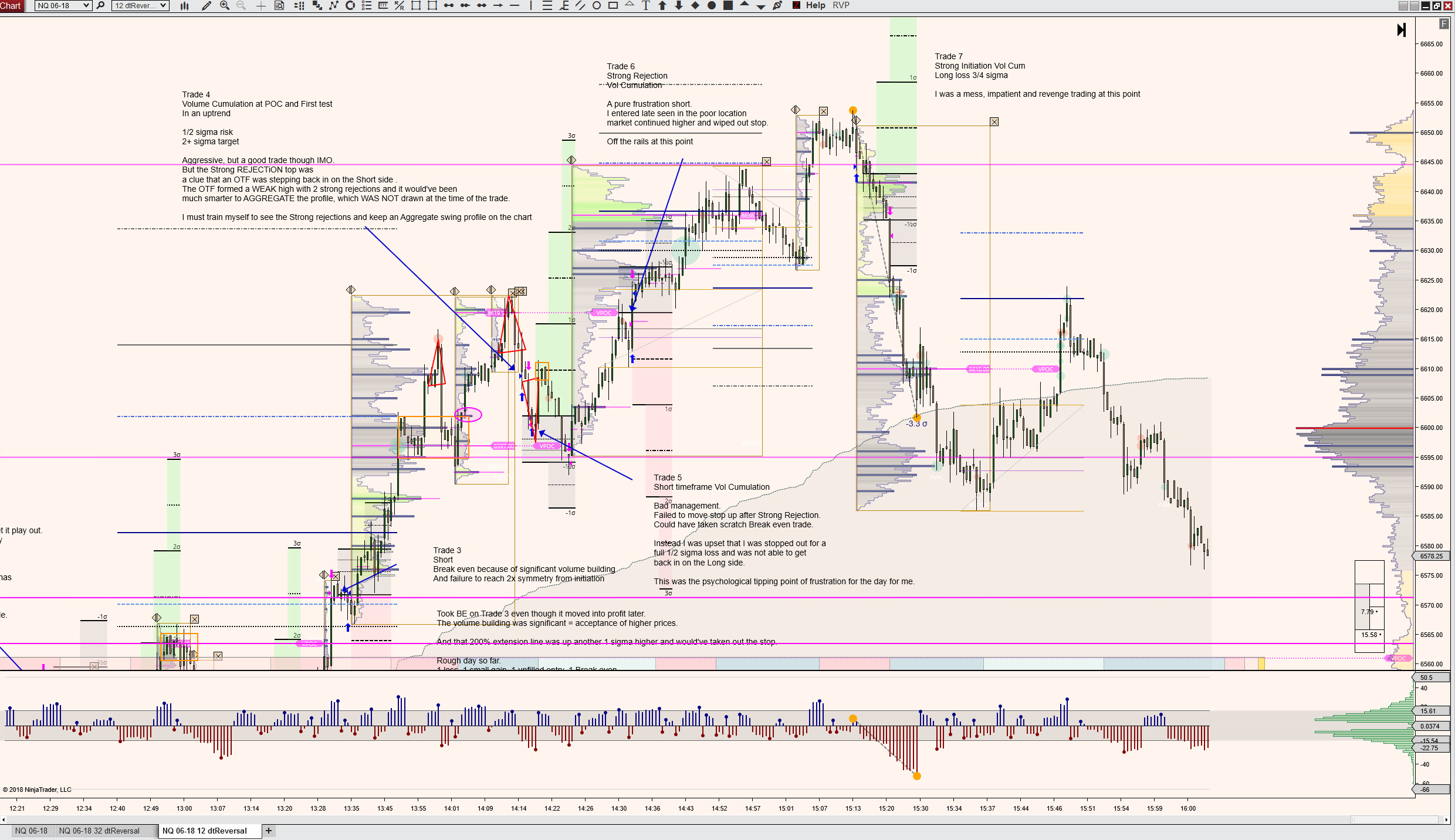

I failed to just sit and watch the Day timeframe singletimeframe the move and take an intermediate timeframe view.

I let anxiety and FOMO get me and I was jumping aggressively at small HVNs.

I can't do that. Even though it's a 12 range chart, it's still like a 1-3 minute chart speed.

Patience to let the market run without me, and just keep reading the breaks, rotations, weak highs/lows and strong rejections. Then take a longer profile, see the developments and only trade the Virgin retests.

|