|

UTRECHT/The Netherlands

Posts: 644 since Dec 2016

Thanks Given: 8

Thanks Received: 274

|

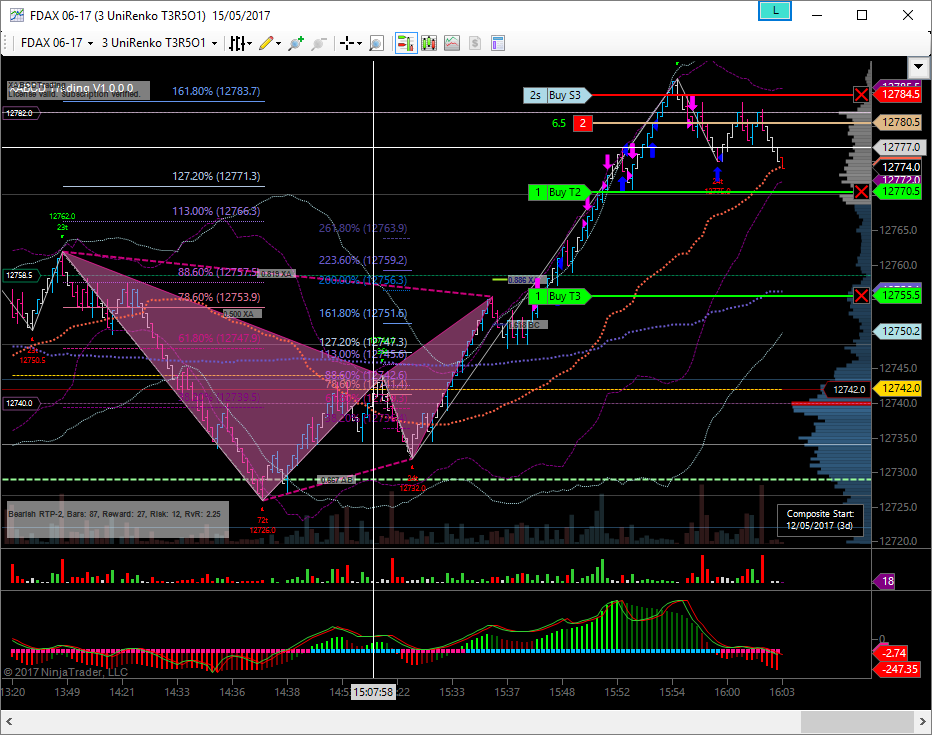

FDAX is as difficult to trade as in every other NY session.

Price has lifted substantially in just a few minutes and finally find reaction from 161.8 extension.

The operator has upthrusted the initial top after the sellers moved in at 127.2. The upthrust has hence formed a divergence in the volume strength meter.

When trading against such a strong move, the only reliable strategy is to trade the divergence in the strength of the pushing volume. I am not able to consistently pick the final reversal by reading either the volume profile or footprint chart.

|