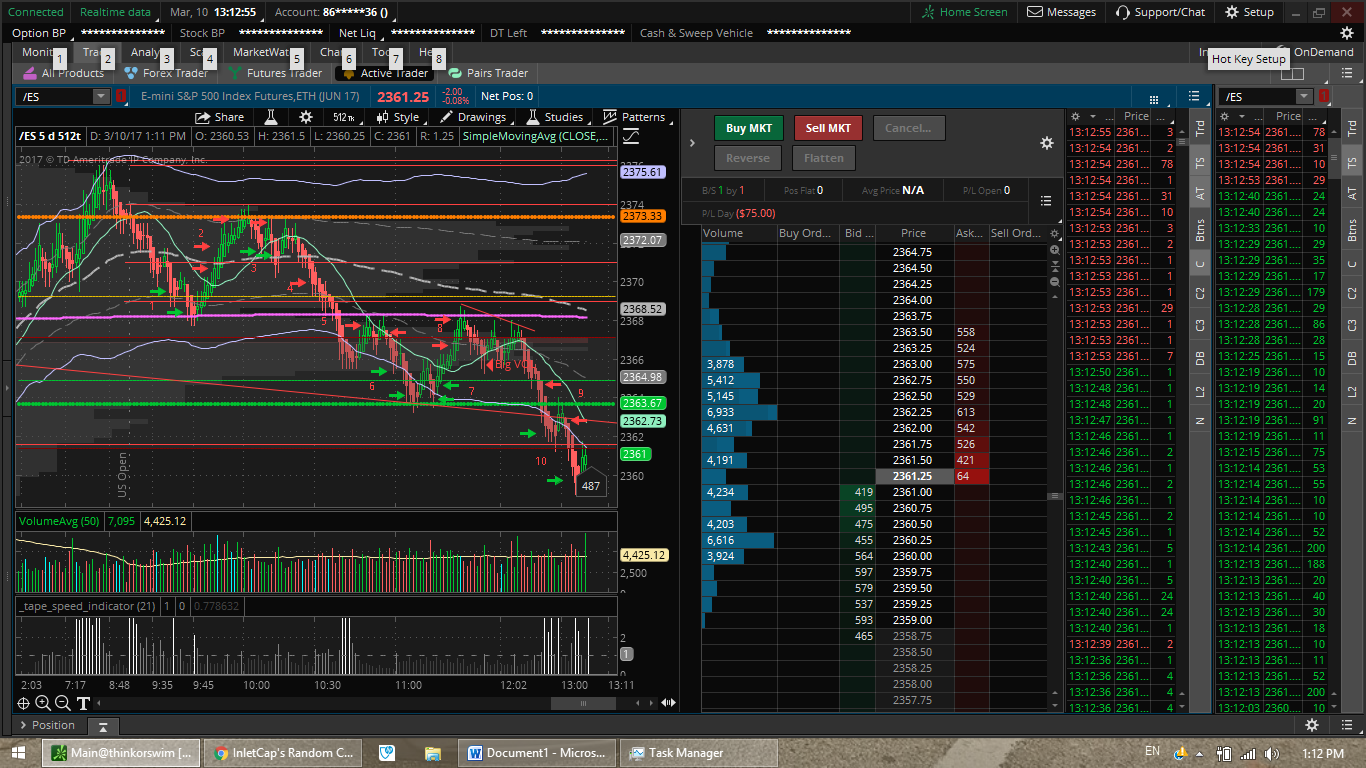

Friday- Going to type out trades here that I would do with a different style like Intelcap. I will still trade my system live

Broke a channel

overnight, so have a long

bias.

Open selling off, would look to go long @ sd1 at 2369

Weekly

vwap and weekly pp confluence

Opening

gap of about 7

points. Some of it getting filled.

Attempt to get through yesterdays high/

a_down

Add at weekly vwap/pp @68.25

Don't know how to go about setting targets yet, but I assume I would've taken profit off at this point somewhere, up 4 and 5 points respectively.

Failed a_down

Acceleration through vwap, add on

pullback to

ORL

Signal 1 (real): Long at vwap 72.50, risk 1.5, target 2.75 towards

ONH. Stopped -1.5

After looking through IC's journal again, I saw a day that looked exactly like today so far. And its starting to play out like that as I type this. Except inverted.

And it plays out just like this day! Failed A_Down, back into OR, Top at top of OR while tick is

diverging, bounce off vwap with lower highs, lower tick, acceleration through vwap, sd1, weekly vwap/pp, now gettting a pullback to weekly pp/vwap and sd1, short here. Only thing is that his played out a lot slower and throughout the whole day while today has been quick and price came down to a key trendline that was broken out of last night, so might rather be long biased.

Ok we came further down to touch that trendline and daily pp,

ONL, also yesterday

POC. Slight tick

divergence coming in, but not too significant. Long @63.75. Add at 64.75

Tick is correct and getting a good reversal, accel through sd1 up to week vwap/pp

Side note: Came across that

futurestrader71 stat that price will hit either the ONH/L during

RTH 97% of the time. Thought this was pretty interesting.

Ranging

___________________________________________

Done for the day. Going to do my write up now. Below is all sim trading. Focusing more on entries rather than exits.

1. Had a long bias going into the day, so was looking to get long off the open. Had a huge

gap up from the previous days close, so some of it got filled. Got long at yesterdays high, and again at weekly vwap/pp.

2. Took profit below vwap for a couple points to pay for my stop, above vwap then a

runner to R1. Saw

bearish tick divergence so lowered my target to below R1 All hit. Looking to get back in at vwap.

3. Long at vwap, took profit to pay for stop, added to position at vwap again. GOes against me. This is where I discover the play from intelcap above.

4. Exit 3 for a loss. Looking short for the day as

range was broken and a_down is in play.

5. Short on pullback just below weekly vwap/pp. Add to the position on confirmation.

6. Take profit to pay for stop, then place target at daily pp and long term trendline, which come together. Target hit.

7. Pretty good

bullish tick divergence identified, signaling a reversal. Long on retrace to daily PP, add on confirmation at yesterday POC.

8. Again take profit to pay for stop, then again at key

resistance of weekly pp/vwap. Would've had runner that would be

reversed at 9.

9. Price breaks out of the range and continues lower, as intelcaps play on this type of day would say. Stop out long runner at POC, then short on pullback to trendline/daily pp. Take some profit at next key level of 60.

1. Getting a bearish divergence with tick printing lower highs while price coming up to the same levels. Can't break through. Price reverses and is bearish for rest of day from here.

2. Confirms the above point. Lower lows while price remains high.

3. Decent confirmation of a bottom being made. Not divergence but a higher low being made on both.

4. More confirmation on the bottom. TIck making new highs while price is down. Price then does

reverse for about 3 points into a range.

5: Price is staying high within 2 ticks but tick prints lower highs and lower lows.

6: Higher highs on tick, lower highs on price. Bottom end of tick confirms reversal

7: Higher highs on ES, Lower highs on Tick. Expecting bearish reversal. Ended up only getting a small pullback as price churned up into the close. False signal I'd say

Have a good weekend guys.