|

Boston, MA

Posts: 166 since Dec 2014

Thanks Given: 61

Thanks Received: 126

|

At the end of every week and before the Sunday open, I will post my analysis of the 7 pairs I am trading (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, NZD/USD, USD/CAD).

I posted this in my journal at brookspriceaction.com, and forgot to post it here.

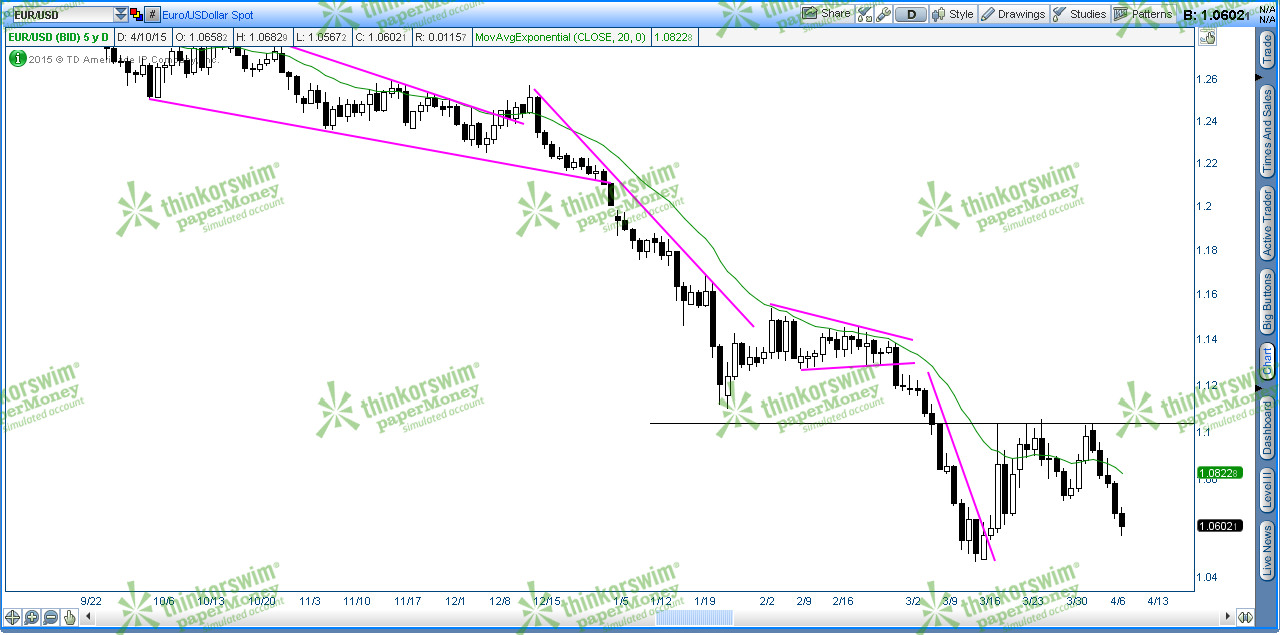

EUR/USD:

04/06/2015 Failure of bull breakout. Also a possible L2, and an end to the deep 2 legged pullback beginning on 3/16. Also a failure of the LH MTR setup. Also a double top with bar 3/26.

04/07/2015 L2 entry bar. Early bulls likely to exit their long positions.

04/08/2015 Bear bar with good size tail on top. Bulls try to keep market from falling, but fail. Measuring gap.

04/09/2015 Strong bear bar as bulls exit their longs at a loss.

04/10/2015 Bear bar with lower tail.

GBP/USD:

04/06/15 Failed bull breakout. Barb wire. Stay flat.

04/07/15 Bear bar with tail on top. Bulls still trying to keep market from falling.

04/08/15 Strong bull pressure early on, but bulls failed to close above. Failed bull breakout. Two failed bull breakouts is bad news for bulls.

04/09/15 Big bear bar as bulls exit their longs.

04/10/15

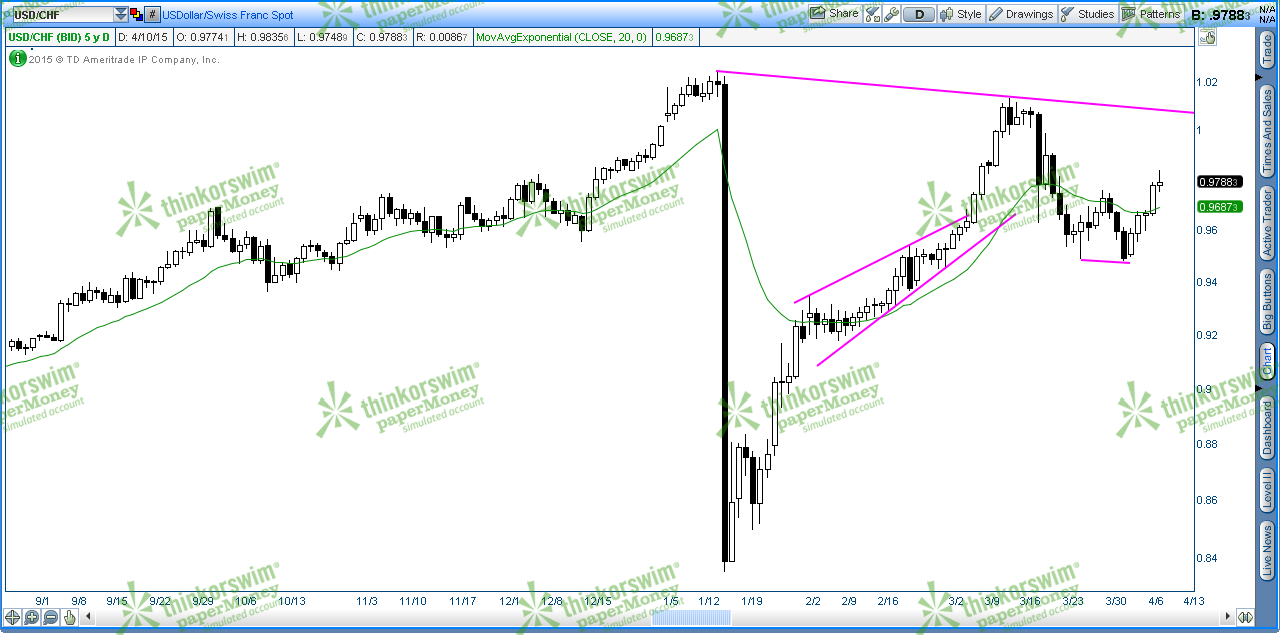

USD/CHF:

04/06/15 Bars 4/5 and 4/6 formed a 2 bar bull reversal. Double bottom with bar 3/26.

04/07/15 Good follow-through after reversal.

04/08/15 Doji. Some bears probably scaling in shorts. Bears want to see a lower high.

04/09/15 Strong bull bar as bears exit their shorts at a loss.

04/10/15

USD/JPY:

04/06/15 Higher lowers, but lots of two-sided trading.

04/07/15

04/08/15 Tight trading range, lots of bars overlapping.

04/09/15

04/10/15

AUD/USD:

04/06/15 H2 setup bar, but looks like tight range. Limit order market.

04/07/15 4/6 was an H2 signal bar, but weak follow through today.

04/08/15 Trading range. Looks fairly tight, however. Difficult to trade with stops. Limit order market.

04/09/15 Doji bar with bull body. Lots of two sided trading in past few days. Lots of tails on tops of recent bars, indicating many bull breakout failures. Bears are still strong. Expanding triangle forming since bar 2/3.

04/10/15

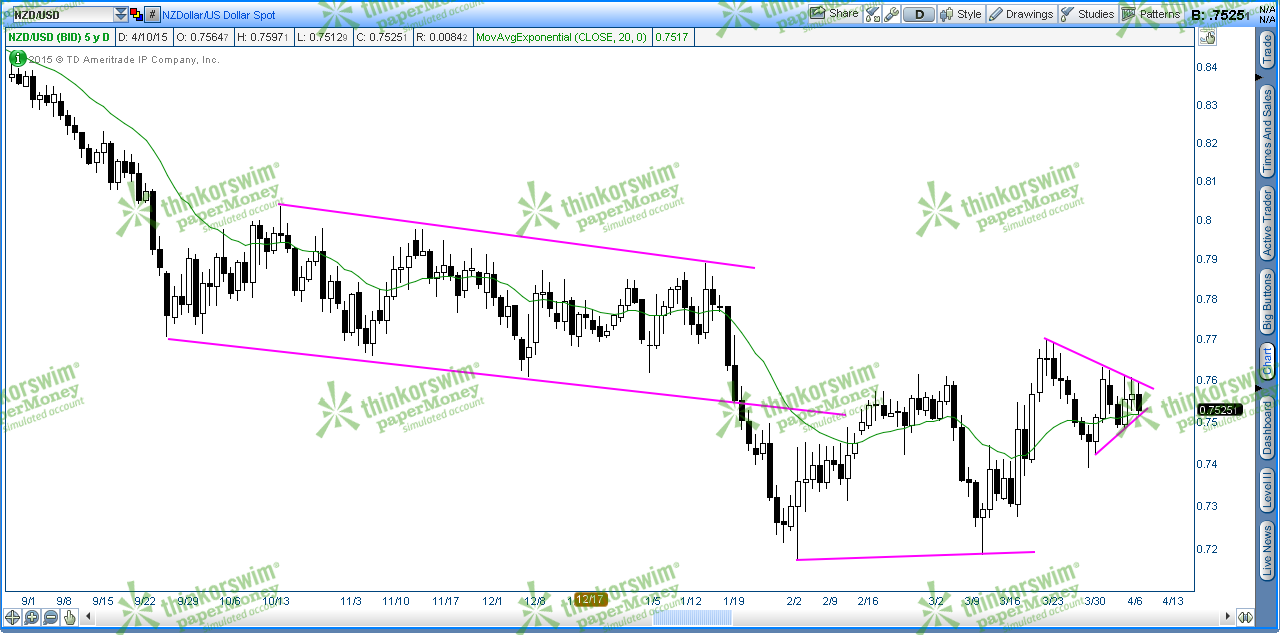

NZD/USD

04/06/15

04/07/15

04/08/15

04/09/15

04/10/15 Lots of two-sided trading, but likely more sellers than buyers due to the tails on the tops of many bars.

USD/CAD

04/06/15 H1 at bottom or trading range.

04/07/15 Trading range fairly tight. Bars would have to be fairly small to enter on stops. More of a limit order market.

04/08/15

04/09/15

04/10/15 Strong bear reversal bar. Maybe going to touch down again to the bottom of trading range.

|