|

Rockledge, FL

Experience: Advanced

Platform: Sierra Chart

Broker: Gain Capital, OANDA

Trading: GBP

Posts: 416 since Oct 2014

Thanks Given: 1,059

Thanks Received: 813

|

Ok so today I woke up to a 250 point move lower due to one of the head people resigning from their position in the UK. Pretty sure he was a key guy managing the BREXIT stuff. So this is a fundamental shift, not just some sell the news event. But 250 points is A LOT and is really not sustainable to expect that to carry through the next session with any real conviction. So we come into the day thinking higher, but cautious.

The market already had bounced almost 80 points from the lows when I was doing my pre-market prep, so now we have to account for that as well. Is the dead cat bounce over? We were initially thinking higher, but this definitely puts a damper on its ability to do that as well, and market is super volatile so what do we do?

First thing was with the realization of a dramatic change in volatility requires a change in size. Cut my size to 2/3rds, and increased stop size to help account for larger swings, otherwise you will get eaten alive.

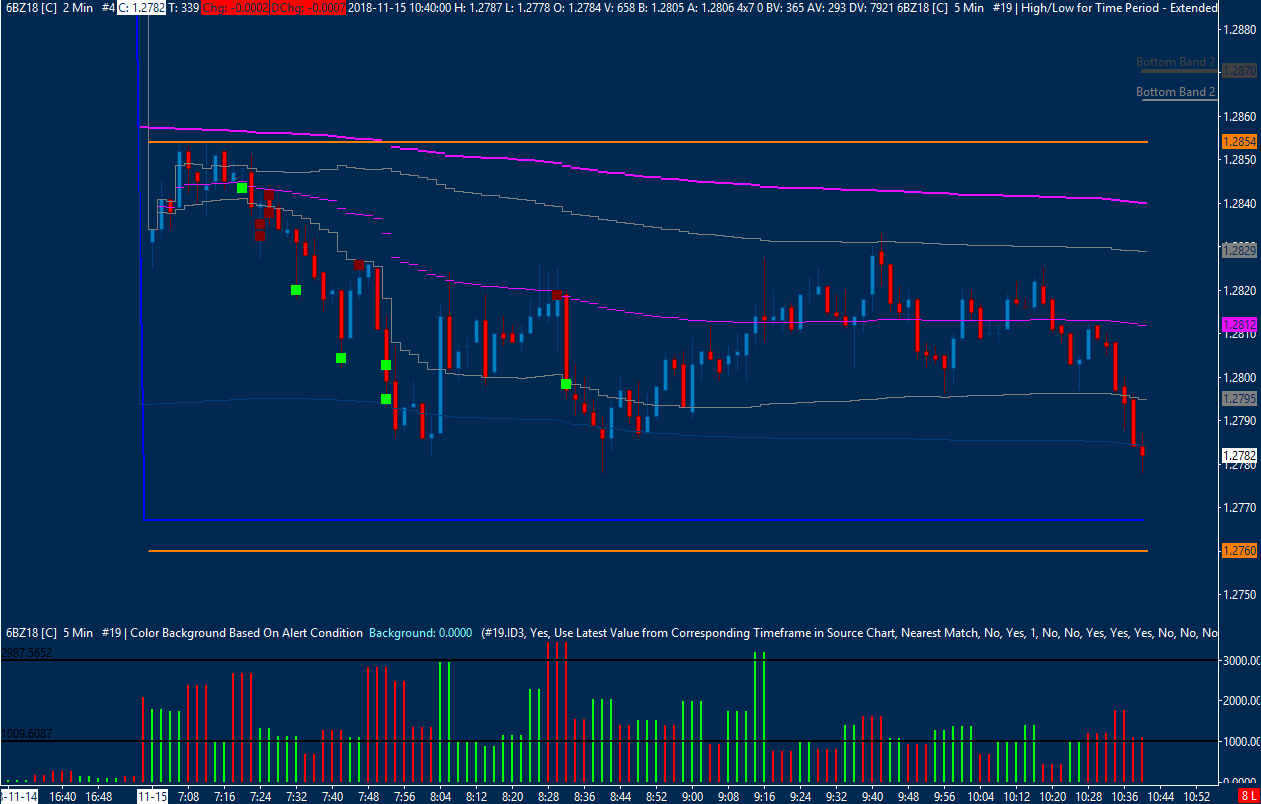

I like to use ETH VWAP as my barometer on the day as a whole, above is bullish/below bearish. So for the first 15 minutes of the session, while I am waiting for the RTH VWAP to develop, we started consolidating under ETH VWAP, and since my first initial reaction is usually wrong, I literally just tip toed in, in the opposite direction. And honestly it doesn't matter which direction you choose, as long as you are patient enough to enter at ideal risk, so if it doesn't work out it doesn't matter. Sometimes when the market is confusing, I just need to be in so I can begin to get a feel for it.

We were rotating between ETH VWAP and RTH -1SD, so once we got below RTH VWAP I took a small position, knowing that if we broke the consolidation lower I would need to quickly reverse, and that's exactly what happened. I averaged in as the market crept higher after the break, and then we got our drop.

That is honestly the hardest part about all this. Price action can get very wild and hard to gauge during direction transition, and I often find that when I am uncertain, it is also because the market(everyone else) is uncertain, and that kind of gives me peace about it. But what is the one thing we can absolutely control during uncertain times? Our risk. And it's just the art of feeling out the market as to whether you need to get all in right away, or maybe you need to tip toe in and wait, or maybe you are already all in and need to reduce exposure till everything becomes more clear. But the key is in realizing what is happening at the time you are in the middle of the tornado so that you know what to do. Unfortunately some of this is only gained by experience, but fortunately we have the RTH VWAP to help guide us.

A key rule could certainly be: Reduce exposure when uncertainty seems high, increase exposure when market begins to favor a direction. Basic and simple, but quite hard to do in real time.

I am going to read Steenbarger's Daily Trading Coach again, because I haven't in a while, but I specifically want to see how I can apply some of that process oriented goal setting to the way I am trading now. That is what is going to take me to the next level. So in the mean time I have created a little scoring system for myself so I can focus on key aspects that I know will keep my head focused on the right things, not just on PnL. They will be centered around my focus, anticipation and execution of the daily range, and overall execution based on RTH VWAP. I will tweak this going forward, but I think it will make a big impact right away. Hardest part is holding myself accountable!

Ok so some charts based on today.

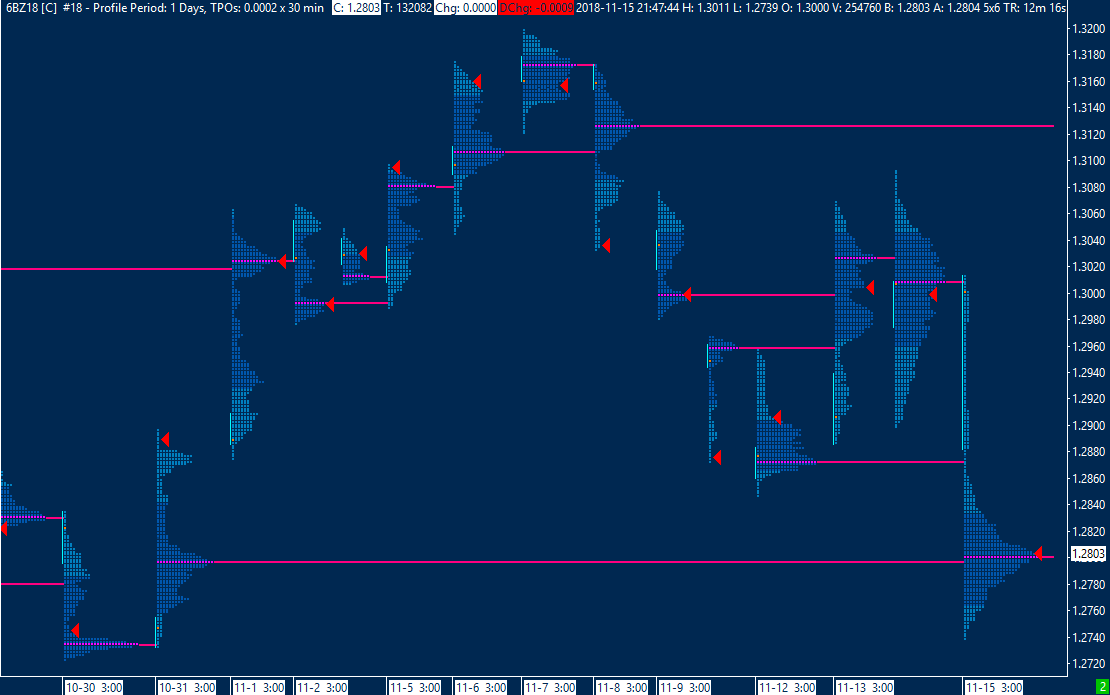

So you can see the dramatic range expansion lower here.

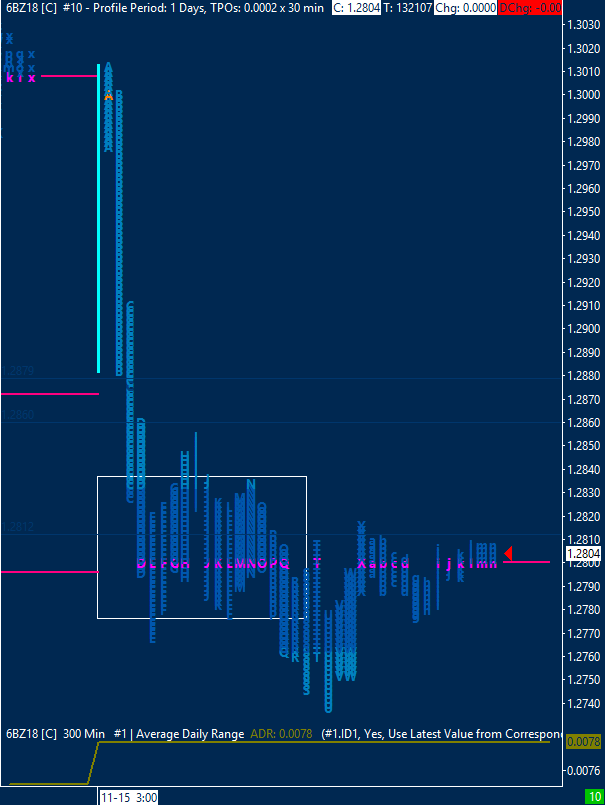

Then the initial ONL made in the E period, followed by the run to ETH VWAP in the I period. Normally this white box would be frustrating, but because of the large range we have plenty of room to run significantly between important levels.

Got really lucky with the timing this morning, had a great run up in profit within the first hour of trading. Mind you I reduced size, but my targets were extended so it all balanced out. Another note I would like to make is that after reviewing the last two months in real time, and in review, I have decided to start trading again prior to news events. Most of the time anymore the market remains active right up until the event, and so so many times it is just a complete non-event. So I will still exit prior to the news, and I will trade smaller and aggressively in profit taking. Here is the trade I mentioned before, then took my daughter to school, came home at 8:28 to see the consolidation at RTH VWAP and the news non-event. Took a small short, and market immediately dropped 20 points, out and done for the day. For the most part this was the right call.

| Rule number one in the markets is to never lose money. Well since that isn't realistic, I say if you're going to lose some money anyway then lose small, but when you win, give it all you've got and win big! |

|