|

Europe

Posts: 91 since Dec 2013

Thanks Given: 431

Thanks Received: 154

|

Hi,

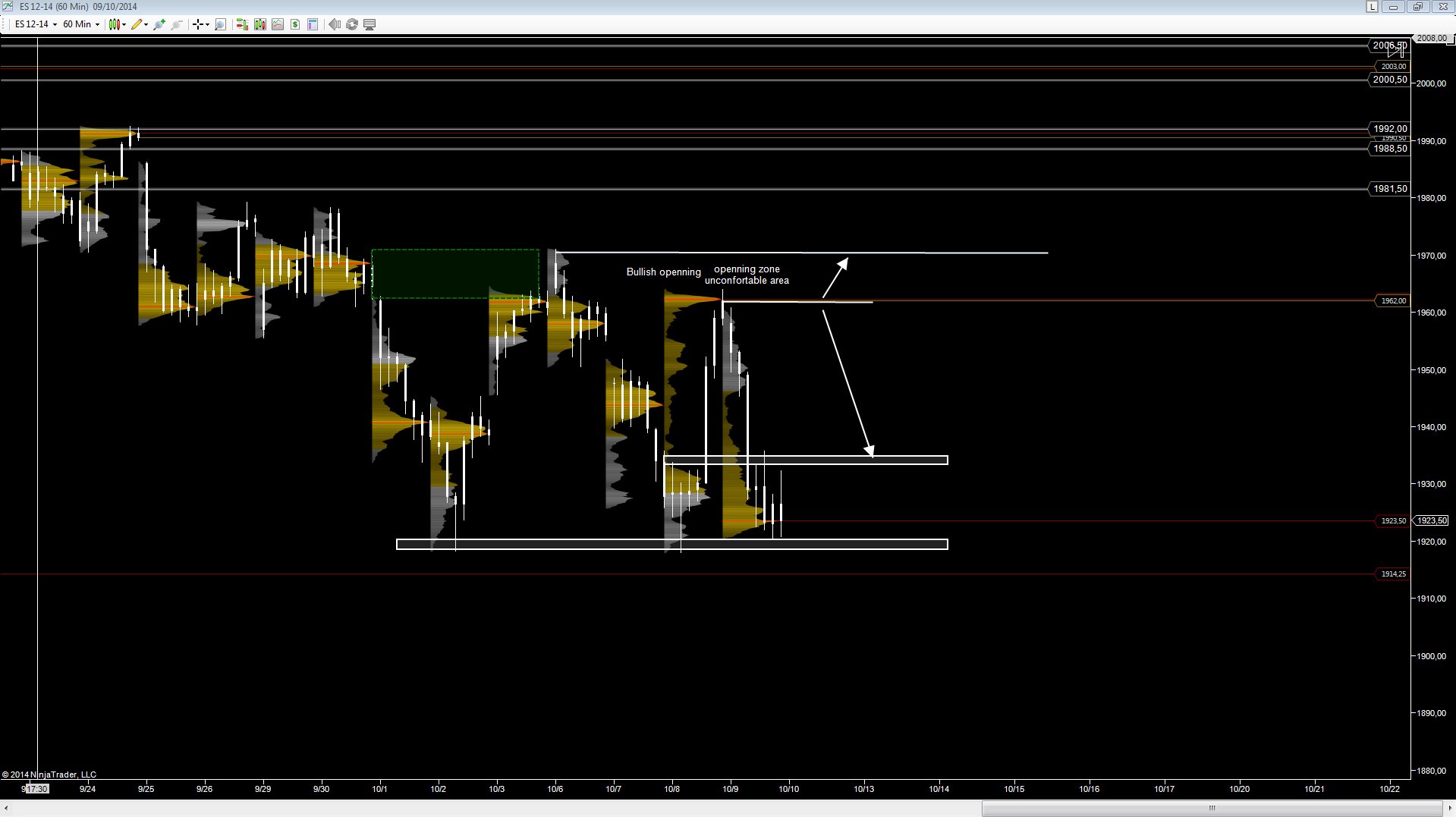

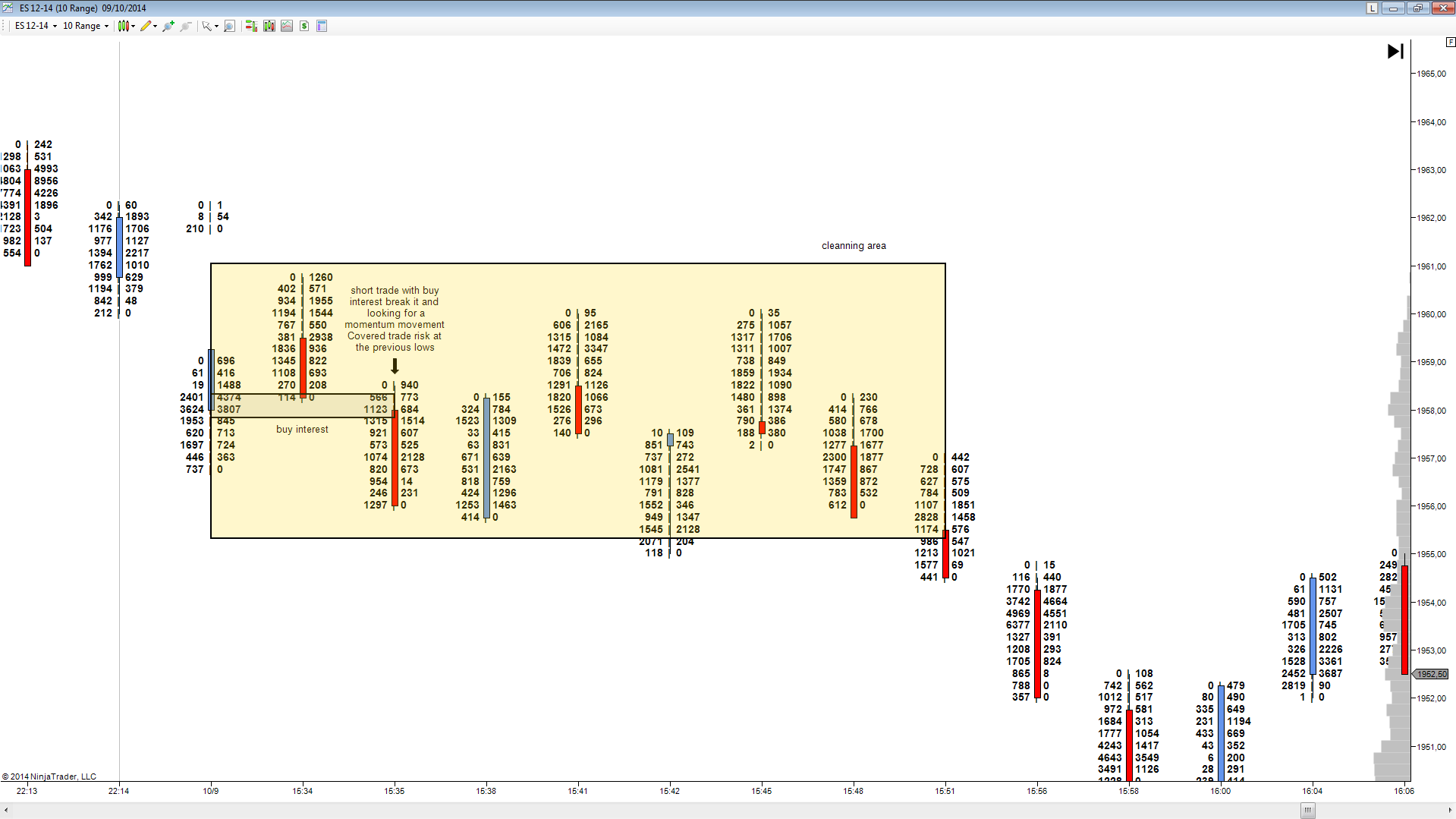

Yesterday i started again my new combine. The open was bullish, looking at the big movement made it in the previous day. News were driving price up, and in the open i was ready for to look at buyers in control. Far to that, buyers were acting with very poor actions. The open was really choppy, but was understable because the markets was trading in an unconfortable area. This type of movement gave me nervous and i take only one trade in the open.

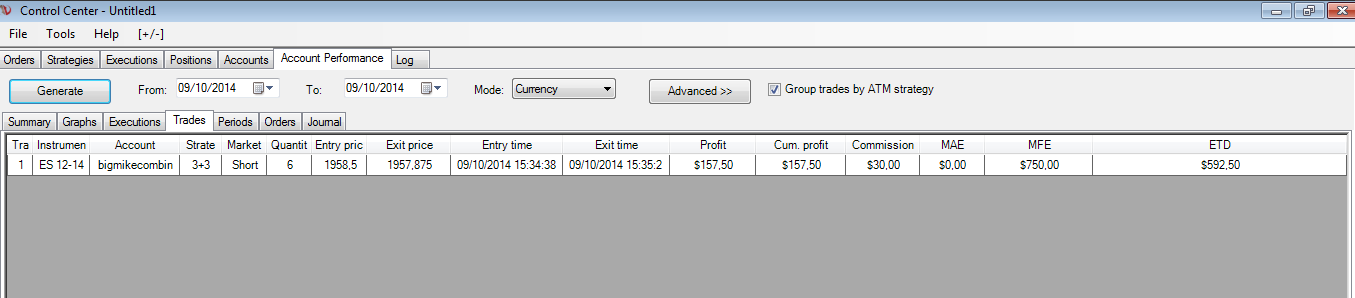

The first trade was take looking at a potential momentum action. I saw a little interest to buy in the first bar and looking that no buyers were stepping up, i take the short down this buy interest, covering in the previous lows (first bar) and expecting the continuation. The market was trading choppy in this area and the expected movement was made it later in the day.

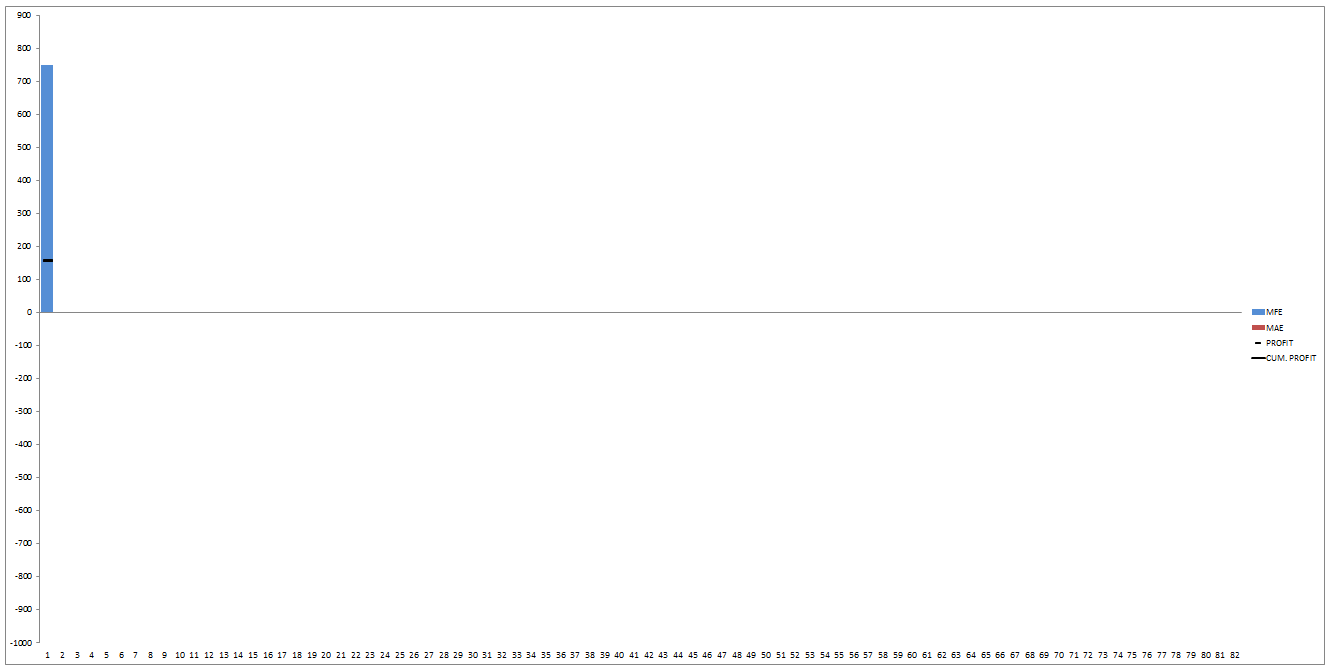

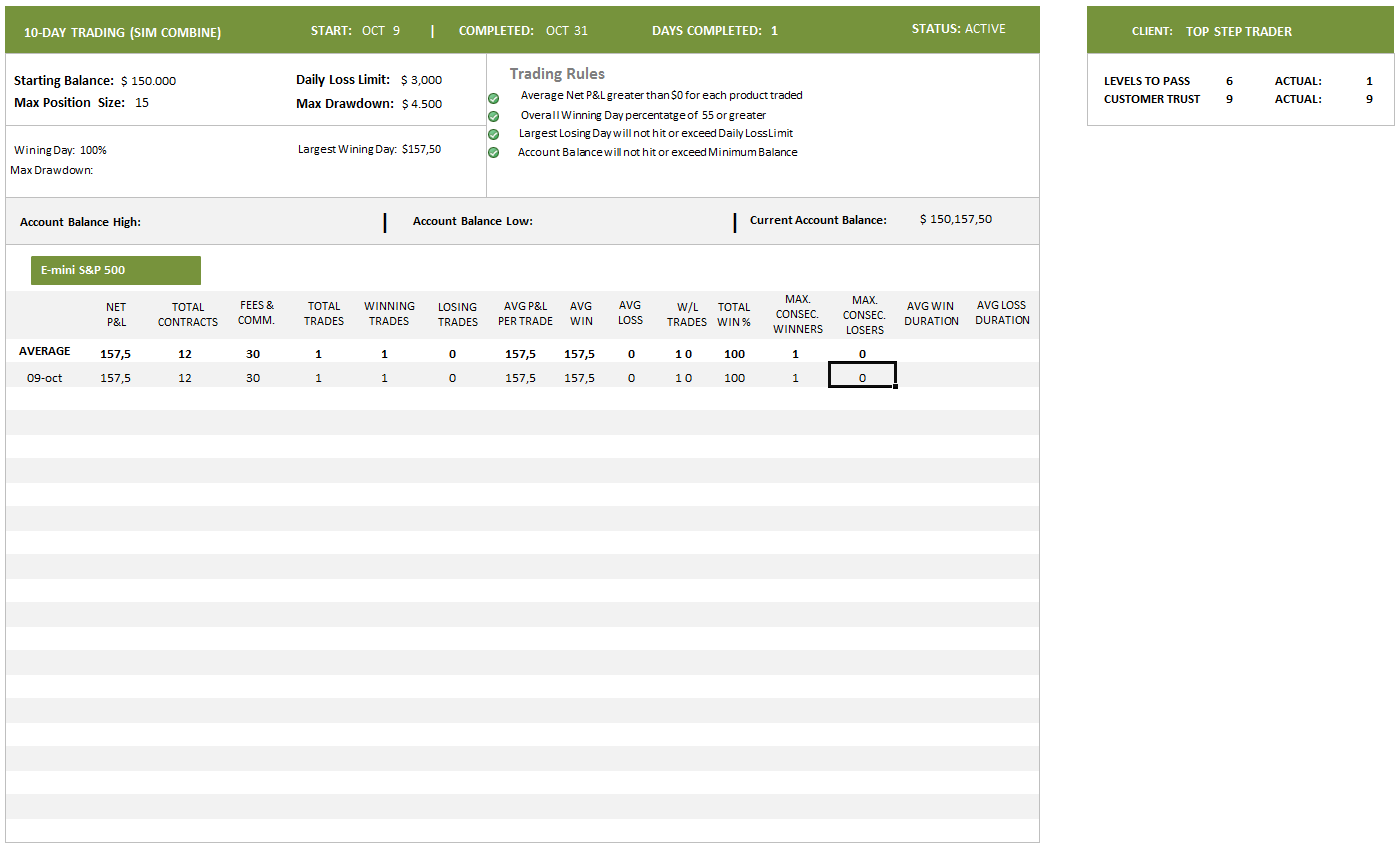

Results for today:

Areas of trading:

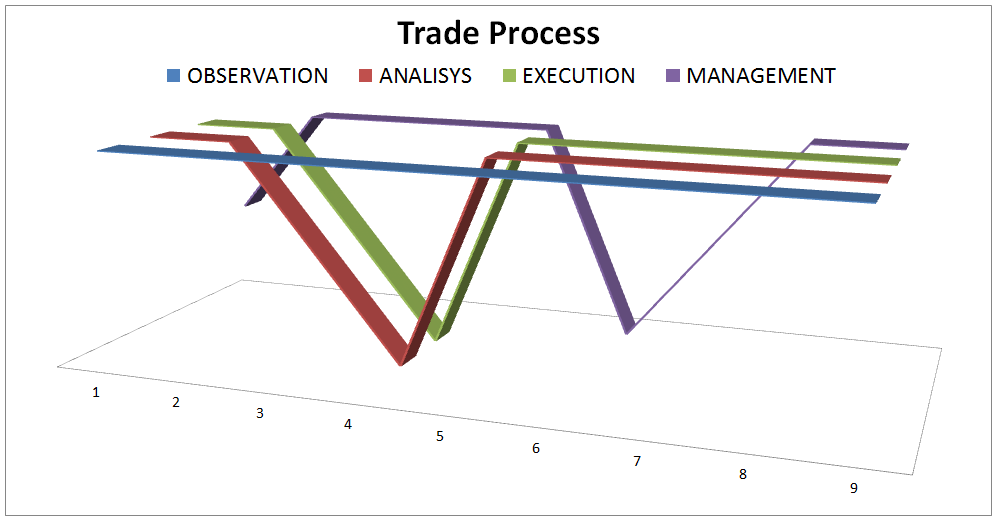

Observation: 10

Analysis: 10

Execution: 10

Management: 10

Today was my first day trading again the simulated combine. I was nervous and really feeling fear to begin this combine loosing. This is why looking at unlogical movements in the open i decided not trading more in the day. Fear is what was driving me to take this and i know that i need to control that.

Work for tomorrow:

Control fear and trade what i see. I need to remain trading objectively.

If you like this journal and find it valuable to you, please click here and hit the thanks button. Unfortunately you can only thank me once in the voting thread but you can thank me all you like here .

|