|

St. Louis Mo., USA

Posts: 75 since Jul 2012

Thanks Given: 6

Thanks Received: 79

|

Crude, 107.92 level held for roughly 24 hours but was constantly be probed. Short was in the money several times but was holding for the weekly lower level which looks doubtful at this point. Should have followed my gut with my prior post ... you could see the upward pressure building against the 107.92 level.

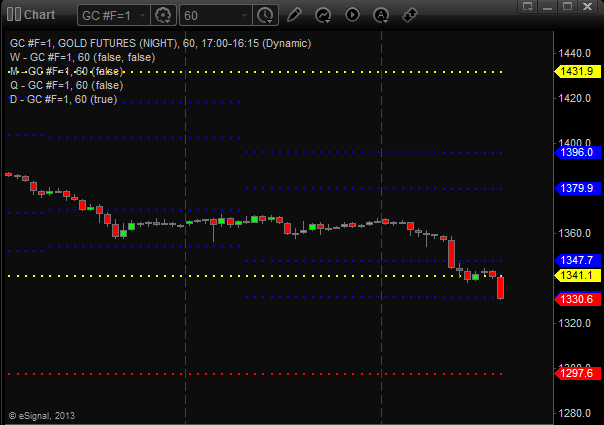

Gold is already down to the daily 2nd lower level. I am looking to nibble long here with price under this level as a stop. It is against the trend but statistically by the end of day, 96% of the time price will close at or above this level (1331.6).

|