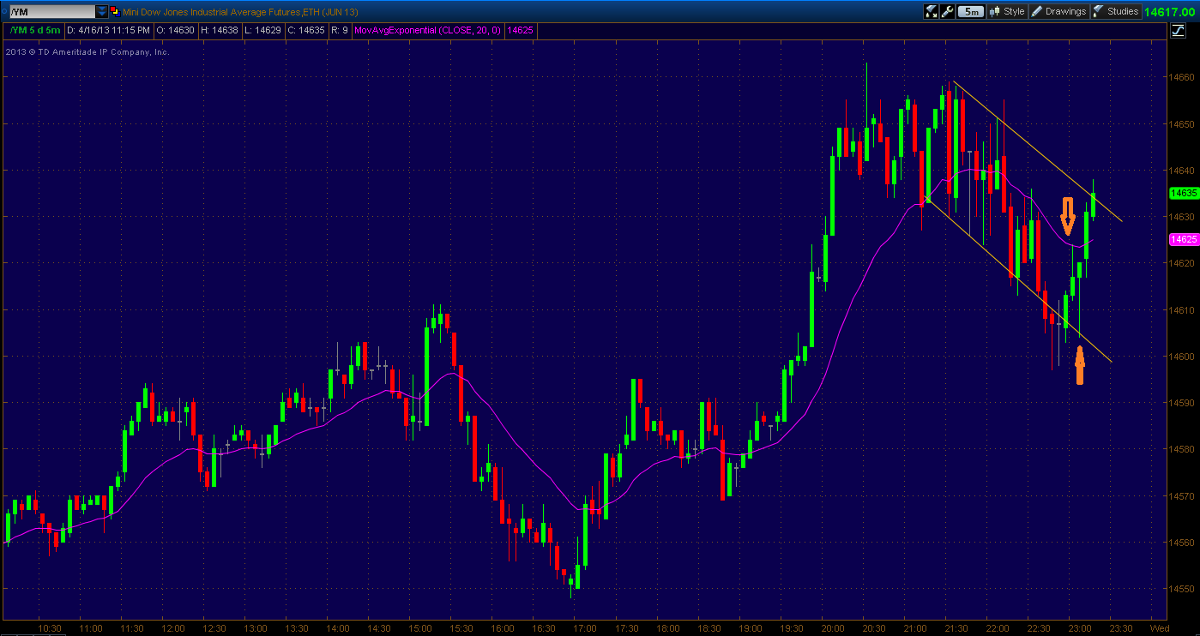

The trade is a

range fade setup

PA and Risk analysis

There are many overlapping bars with noticable tails and the bars are grinding downwards gradually. A bear channel can be drawn. As price is moving both ways within the weak bear channel, I look for opportunities to enter at both the high and low of the channel. I noticed a 3 bar reversal at the channel low and decided to enter based on 3 reasons:

1) Bear channel overshoot

2) 2 failed attempts to push price down.

Bulls pushed price back up, forming lower tails

3) Price at lower channel line

The risk was within limits also.

Risk: 12 ticks Target: 11 ticks

Entry

I entered on an

OCO stop buy order.

Emotions

I experienced a roller coaster of emotions during the trade. Initially, price went up and I felt good. Price came to just 1 tick off the target and it stalled. It fell off a bit and went up again to 1 tick off the target. This repeated a few times. By this time, I was feeling anxious and was debating if I should drag the target limit lower.

I remembered my exit rules and left it alone. Price then fell back and reached the entry price. It fell again and went to the opposite situation, just 1 tick off the protective stop level. By this time, I was very frustrated and regretted not shifting the target

limit down a bit. I went off the computer to get a drink.

Price then went back up again to the entry price. By this time, I just wanted to get out of the trade after going from feeling good to anxiety to frustration and regret and hope again.

Trade Management

I did not shift the target limit downwards as price came to within 1 tick of the limit. However, after seeing price come so close to both the target and the stop, I exited at market as price went back up to around break even. My emotions took control and I wanted to get out of a stressful situation without much rational thought.

Exit

I exited at the market around the entry price

Result:

4 ticks

On Review, pre-entry, price and risk analysis is good. I followed my rules. There was a good setup and more than 2 reasons to support the entry. The risk amount was also within limits. The entry was ok as well.

Emotion and trade management is no good and needs improvement. This is the 2nd time in a row where I exited prematurely only to see price hit the target. I have to stay firmer in following my exit rules.