|

Singapore

Experience: Beginner

Platform: MT4

Trading: Forex

Posts: 143 since May 2012

Thanks Given: 262

Thanks Received: 468

|

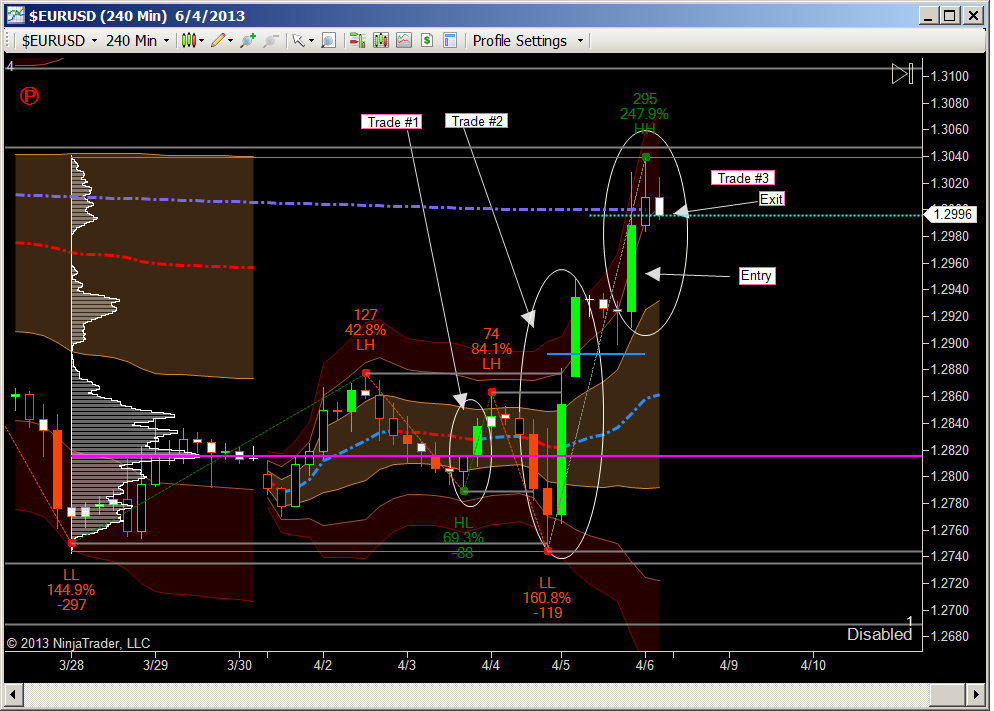

Trade #1:

3rd April

Saw a bullish reversal bar, enter at bar close. Exit with 25 points.

But immediately the next 4hr bar becomes very bearish in the 2hr mark, so I took a short.

Of course this 2nd bar become fully bullish at the 4hr close, taking out my 25 points stop in the process.

Result: 0

Lesson: if my strategy is to wait for bar close, then I must wait for the 4hr bar close to make a trading decision.

Trade #2:

4th April

Price makes a 100 pips drop, then moves back up.

During the down and up move, I try to trade it and makes 4 trades but the net result is break even.

I should avoid violent moves like this: I will be either entering too late or not sure when the direction is going to change.

Result: 0

Better to stay away.

However price fully recover the 100 pips drop and continues higher.

When price breaks the previous bar high, I enter on small size and get 15 pips profit, afraid to hold longer.

But of course price continues to move higher.

Result: +15

Moves like this are taking out many stops in the market. Next time if I have the patient to sit out the original 100 pips move down, and then the subsequent big 100 pips move up happens: I can consider to enter full size at price break and hold longer.

Trade #3:

5th April

A daily bullish engulfing bar pattern is forming just before NFP news. I took the risk and place a buy stop at the top of the engulfing bar (1.2950). The risk pay off and I exit at 1.2995.

Result: +45

|