|

London, England

Experience: Intermediate

Platform: Stockcharts, NinjaTrader, ProTA

Trading: Silver, Gold, ES

Posts: 179 since Sep 2011

Thanks Given: 68

Thanks Received: 209

|

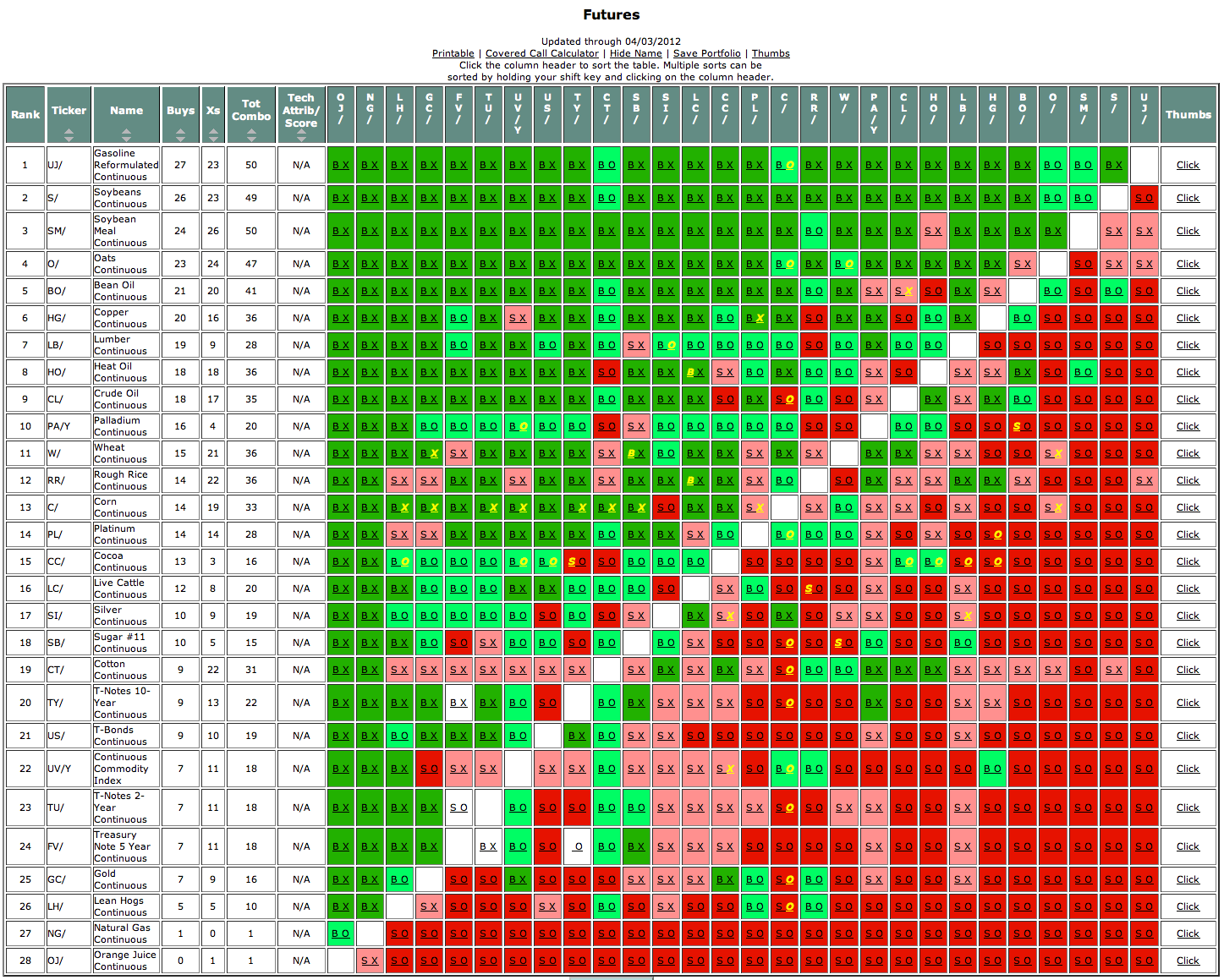

Since I closed out my medium term positions in stocks on 12th March I've moved to a more short term trading phase focusing on commodities trading both long and shorts. I've put on 16 new positions since then of which four are now closed with 3 winners in Silver, GBP/USD and KLR.L and one loss in Corn. So I've now got 12 open positions which have mostly been opened in the last week or so, and for the commodities picks I've been trialling Dorsey's matrix service and have created a custom futures matrix which shows the peer relative strength in a large table of point and figure signals which I've attached. This is a supplementary tool to my normal method as peer to peer relative strength is very important to that.

It's early days for the picks, so there hasn't been much movement yet, but below is the table of the open trades.

| Current Trades | | Entry Date | Ticker | Description | Sector | Long/Short | Entry Price | Current Price | Entry Stage | Current Stage | ATR(200) % | Grade | | 3/14/12 | GC_F | Gold | - | S | 1650.21 | 1645.51 | 3 | 3B | 0.13% | C- | | 3/22/12 | GC_F | Gold | - | S | 1634.18 | 1645.51 | 3 | 3B | -0.31% | D | | 3/14/12 | GBP/USD | Pound / US Dollar | - | L | 1.57045 | 1.5888 | 1 | 2A | 1.76% | A- | | 3/19/12 | GBP/USD | Pound / US Dollar | - | L | 1.58831 | 1.5888 | 1B | 2A | 0.05% | C- | | 3/30/12 | GBP/USD | Pound / US Dollar | - | L | 1.60211 | 1.5888 | 2A | 2A | -1.28% | F | | 3/19/12 | HG_F | Copper | - | L | 3.9004 | 3.8825 | 1 | 1B | -0.16% | D | | 3/26/12 | HG_F | Copper | - | L | 3.9004 | 3.8697 | 1 | 1B | 0.11% | C- | | 3/28/12 | SB_F | Sugar | - | S | 0.24687 | 0.24677 | 1A- | 1A- | 0.01% | C- | | 3/29/12 | O_F | Oats | - | L | 3.4797 | 3.4017 | 1B | 1B | -1.26% | F | | 3/29/12 | CT_F | Cotton | - | L | 0.93553 | 0.92077 | 4B- | 4B- | -0.49% | D | | 4/2/12 | W_F | Wheat | - | L | 6.4965 | 6.5521 | 4B- | 4B- | 0.32% | C- | | 4/3/12 | C_F | Corn | - | L | 6.5578 | 6.5758 | 1A | 1A | 0.10% | C- |

| "Fate does not always let you fix the tuition fee. She delivers the educational wallop and presents her own bill" – Reminiscences of a Stock Operator. |

|