|

Houston TX

Legendary Market Wizard

Experience: Advanced

Platform: TT and Stellar

Broker: Advantage Futures

Trading: Primarily Energy but also a little Equities, Fixed Income, Metals and Crypto.

Frequency: Many times daily

Duration: Never

Posts: 5,049 since Dec 2013

Thanks Given: 4,388

Thanks Received: 10,207

|

I know many trading systems look at volume as an important indicator.

How do you analyze volume on futures contracts when the volumes are so 'roll' dependent?

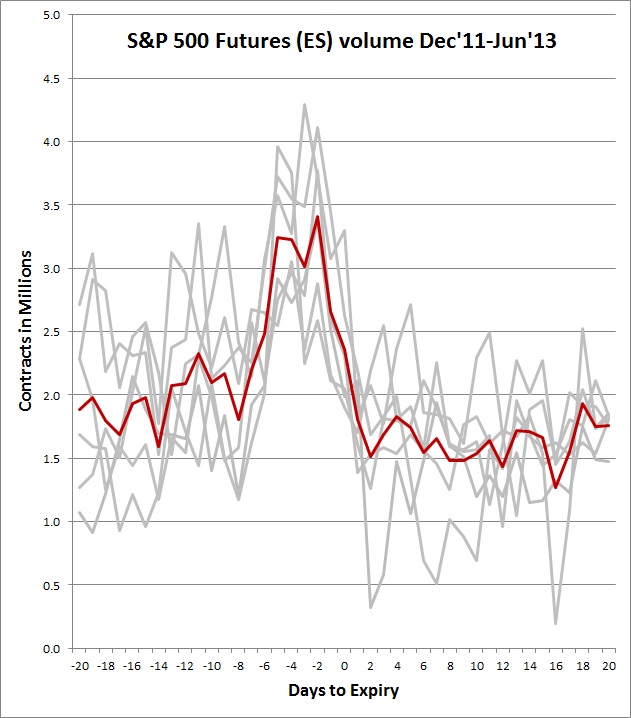

For example the chart below shows the trading volume of the prompt two ES contracts for the Dec'11 thru Jun'13 contracts centered around their expiration day.

As you can see volume spikes approximately 50% in the 4-6 days around expiry. So how do you tell what volume is important due to price, and what is volume due to the roll.

|