|

Toronto, Ontario/Canada

Experience: Intermediate

Platform: TOS

Trading: stocks

Posts: 38 since Dec 2014

Thanks Given: 10

Thanks Received: 3

|

Hello!

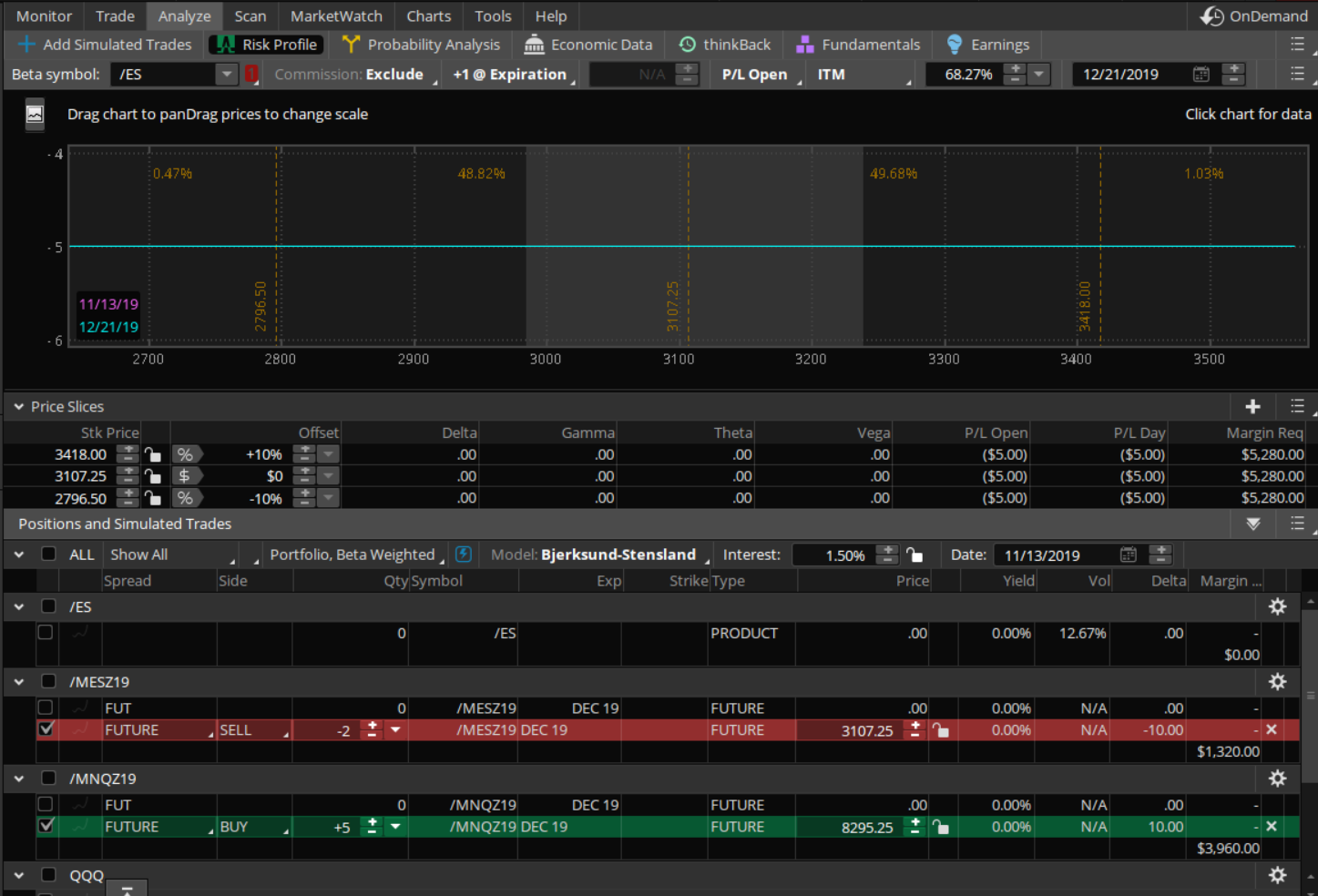

I'm trying to compare Micro NQ vs Micro ES in TOS.

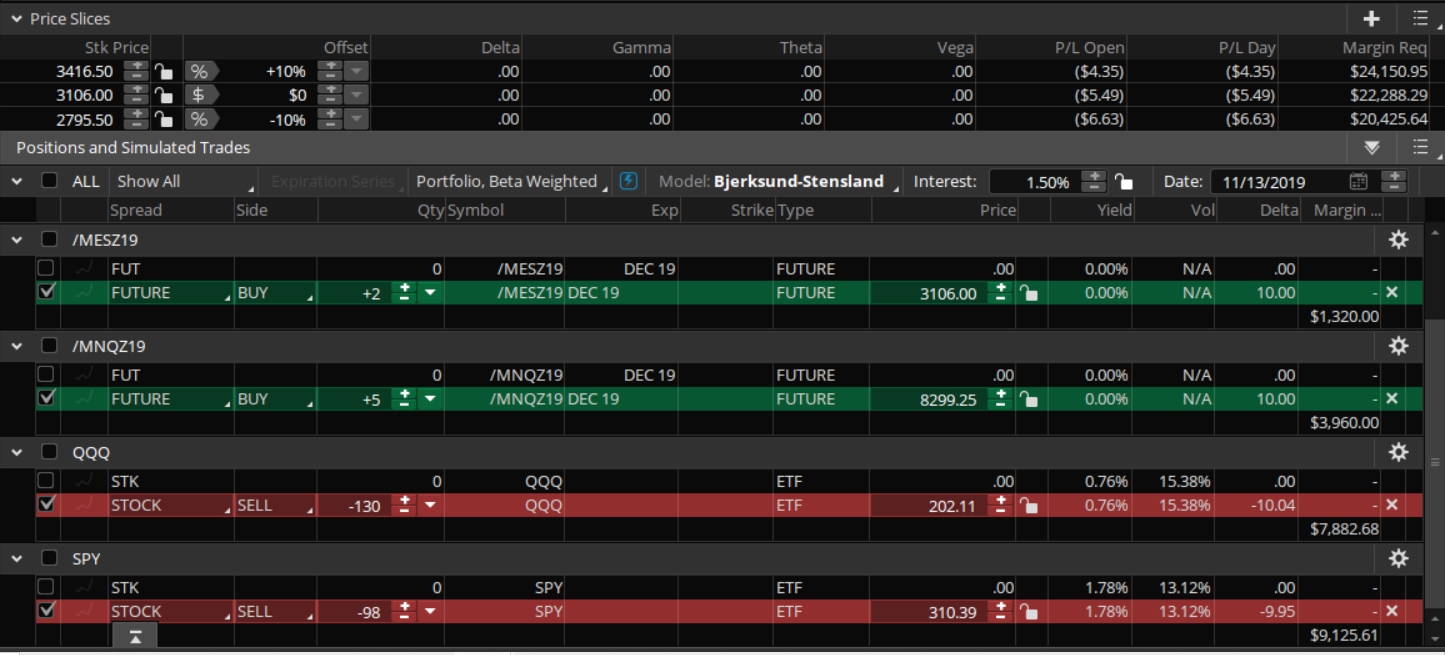

Fast-Beta weighted in TOS, it's showing me 5 contracts of /MNQ vs 2 contracts of /MES is completely delta neutral. I'm not sure this ratio entirely makes sense to me - can anyone confirm? For ETFs, it's 100 QQQ vs 76 SPY - quite different.

If we go by notional equivalency - 100 shares of QQQ to 65 SPY gives me the same 6,065 margin requirement, but not quite fully delta neutral. 100 QQQ and 76 SPY however, gives me delta neutral, but slightly different margin - but wouldn't that make sense since QQQ has a slightly higher IV than SPY?

Keeping the above in mind - 1.315 ratio of QQQ:SPY (the way TOS betaweighting likes it), and using 2 /MES and 5 /MNQ - betaweighted against SPY and QQQ - it's showing me delta neutral! Why? Same with individual QQQ vs /MES, QQQ vs /MNQ, SPY vs /MES and SPY vs /MNQ. Isn't Fast Betaweighting taking into account volatility and correlation for the past year?

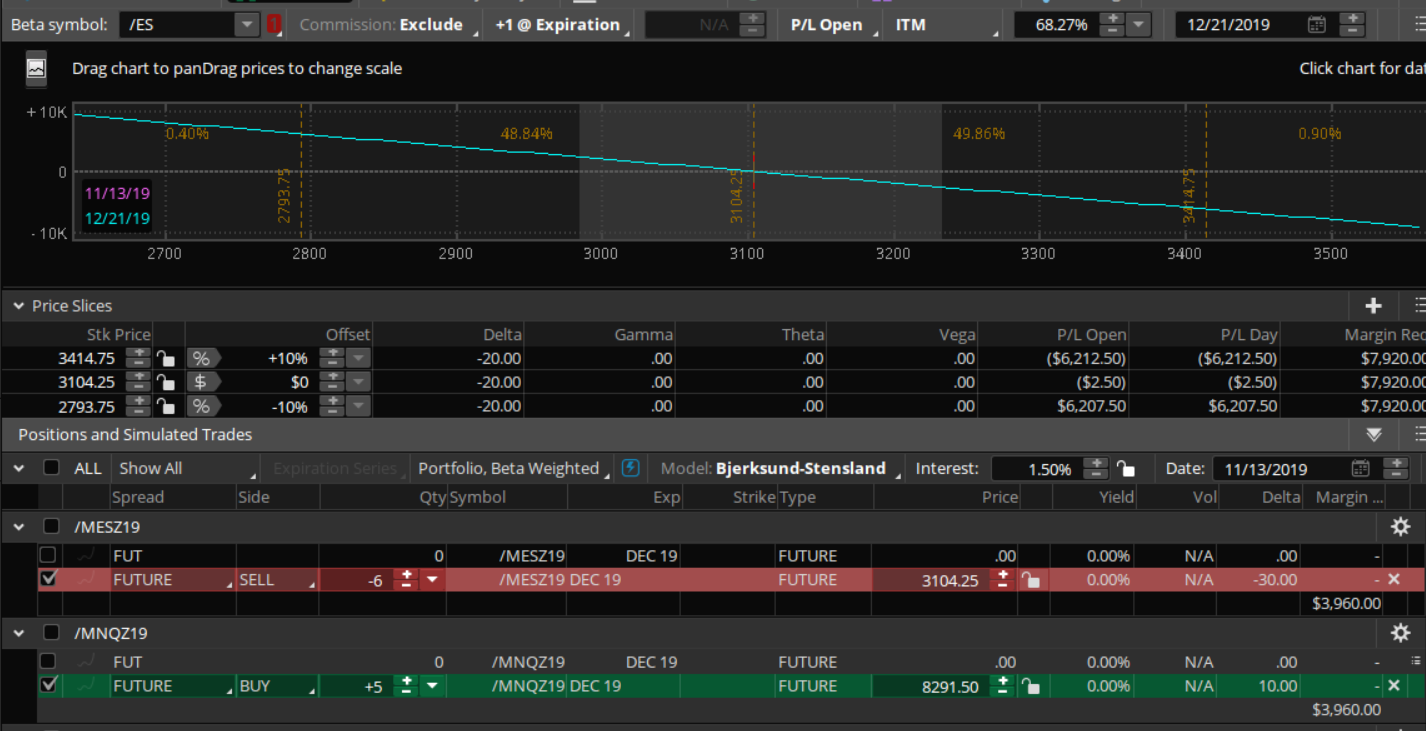

Finally, if looking at /MNQ vs /MES, I could just look at Margin Requirement instead of Fast Beta weight. 1:1 they are 660 vs 792 margin. However +5 to -6 /MNQ to /MES both show $3960, which is then the perfect exact ratio, regardless of the fact that the two instruments' volatility differ a bit? (But then betaweighting of course shows a massive skew in the model).

I've been told that /MNQ and /MES 1:1 ratios are almost the same - is 5:6 ratio an exact one?

Thank you!

|