|

Calgary Alberta/Canada

Posts: 934 since Feb 2014

|

I am not allowed to express my opinions on the falling oil prices because the owner of the The CL Crude-analysis Thread does not like me and has place me on ignore so after one response to the poll I was forbidden to offer any more comments.

But that is fair I suppose since the majority there have no interest in Canadian stocks and long term/swing trades of the same. It is primarily for futures traders as I see it so this discussion will not interfere with their discussion as it will focus on Canadian issues.

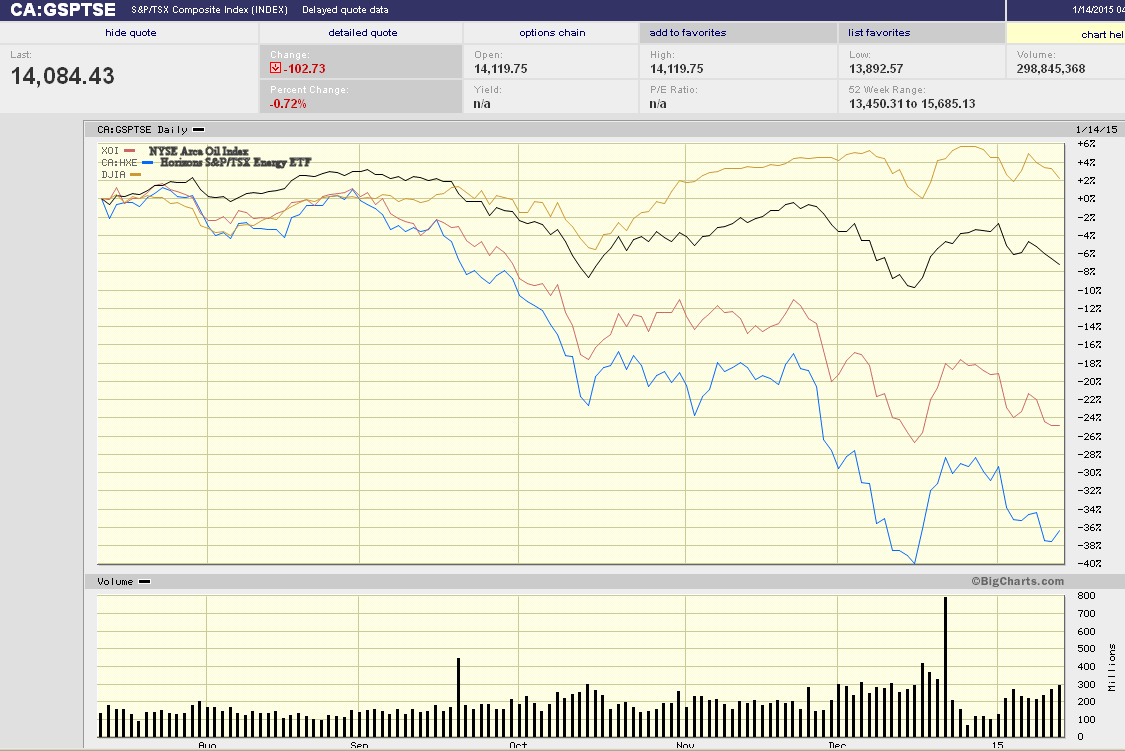

It is not easy to get a comparison on a S&P Capped Energy index so I chose a Horizon ETF [HXE:TSX] on Energy which includes natural gas as well as oil.

Here is the comparison between the NYSE Oil index, the Dow Jones average, the S&P TSX composite and the HXE Canadian ETF.

Looking at the DJA and S&P TSX Composite index by themselves does not tell the tale of the effect on Oil prices between the two countries, though as you can see the TSX has suffered far more than the DJA.

It is the NYSE Oil index and the Horizons S&P/TSX Energy ETF that really tell the story on the effect of falling oil prices on the industry. Both of these charts reflect the effect on companies specific on the energy sector... sice it is those companies that make up the indices and etf.

As you can see the effect is very harsh on Canadian energy stocks compared to their American counterparts.

It has become very serious in Alberta, Canada as billions of revenue for the province coffers have been lost to date. and this is the province that HAD (past tense) the strongest economy in the country.

Suncor cuts $1B in capital spending, plans to [AUTOLINK]chop[/AUTOLINK] 1,000 positions | Calgary Herald

you can see the effect on just one major Oil company in the Oil Sands.... others are following suit.

Please contribute your thoughts on this crisis...I say crisis as most feel we are entering a recession because of these games with the oil prices....nice to have cheaper gasoline but it is pretty lame if your job disappears.

|