|

Toronto Canada

Posts: 1 since Jan 2013

Thanks Given: 1

Thanks Received: 0

|

Hello everyone. I'm a new member and and a beginner investor. Thanks for providing such an expansive shared resource!

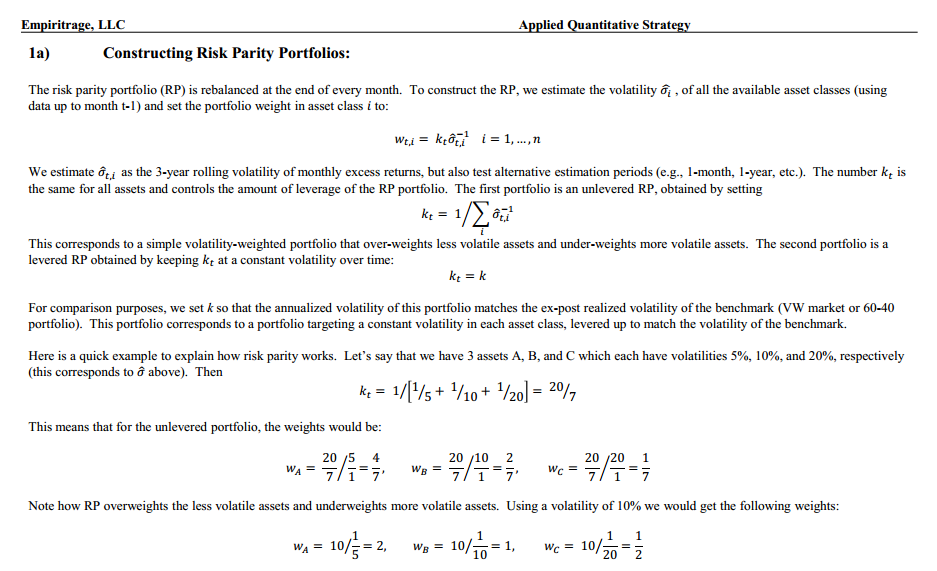

I'd like to construct a portfolio of Index Funds that are re-balanced monthly based on Risk Parity and Momentum. I realize this is not "trading", but I thought members who are strong in math might be able to help me with deciphering the following:

(I don't understand how the volatilities of the various funds are determined) (I don't understand how the volatilities of the various funds are determined)

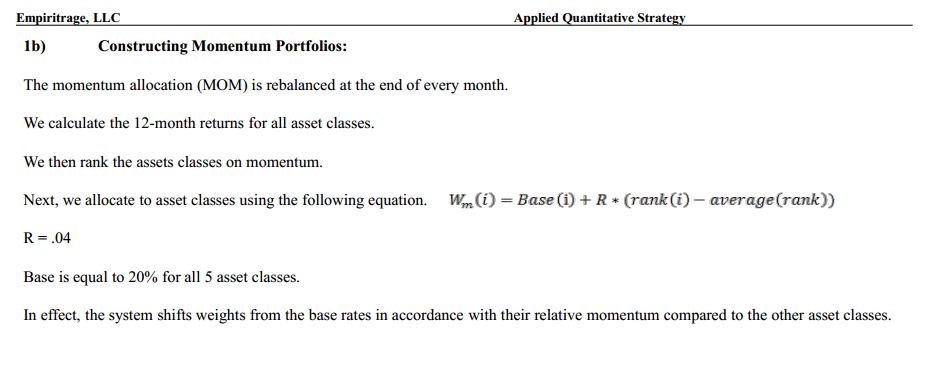

(I don't really understand the formula in this one. Additionally, I'm wondering if using the 12 month returns is the best method of quantifying momentum) (I don't really understand the formula in this one. Additionally, I'm wondering if using the 12 month returns is the best method of quantifying momentum)

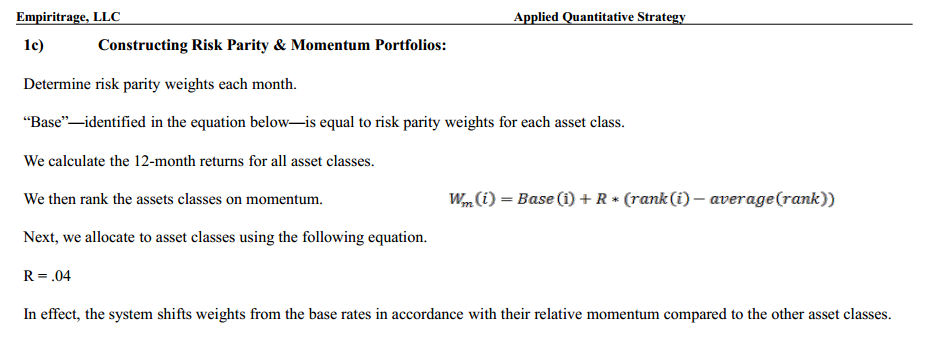

(If I fully understood the first two attachments, I think I could put them together to construct the Risk Parity/Momentum portfolio) (If I fully understood the first two attachments, I think I could put them together to construct the Risk Parity/Momentum portfolio)

As you can see, the first attachment shows the math behind the Risk Parity Portfolio. The second shows the math behind the momentum portfolio, and the third puts them together.

I'm interested in learning more about the mechanics behind these portfolios and how I can actually implement it. I would love it if someone could break it down in layman's terms...perhaps with an example.

The 5 asset classes in the portfolio are as follows:

1 - SP500TR=S&P 500 Total Return

2 - EAFE=EAFE Total Return

3 - GSCI=Goldman Sachs Commodity Index

4 - ML 7-10=Merril Lynch US Treasury 7-10y

5 - REIT= All Equity REITS Total Return Index

If this is not the right place for this post, I would really appreciate being redirected to another source. I'm very interested in learning!

The research behind this portfolio was done by Empiritage and back-testing has shown it to be less volatile than buy and hold strategies and provides better long-term returns.

Although this is a "trading" forum, is this anyone else interested in this strategy? Does anyone have any input?

Thank you very much in advance.

-Chris

|