|

Chicago, IL

Legendary Price Action Student

Experience: Beginner

Platform: Sierra Chart

Broker: Edge Clear

Trading: MES

Posts: 2,171 since Feb 2019

Thanks Given: 9,620

Thanks Received: 9,627

|

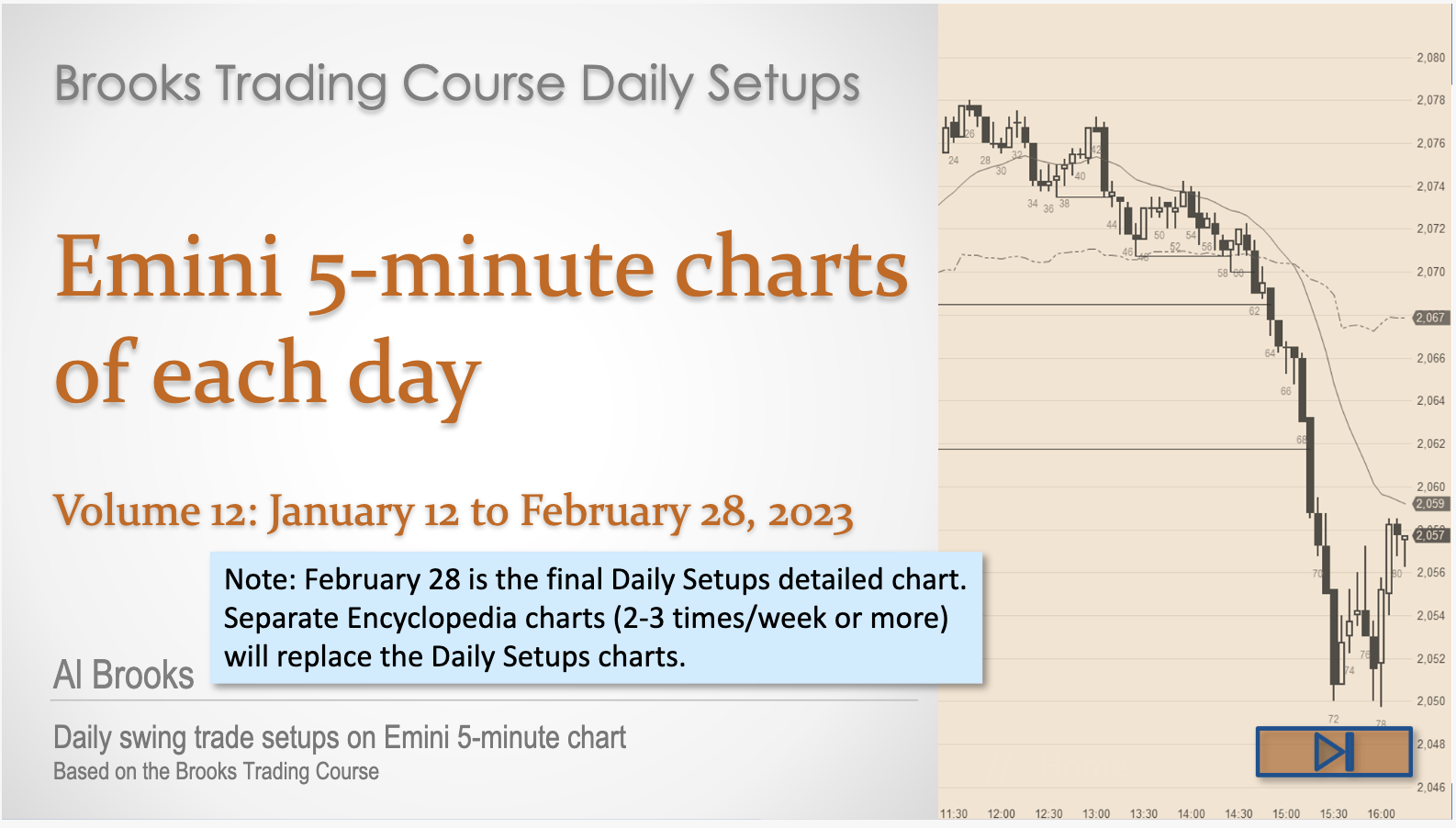

Update I noticed yesterday, the regular detailed daily setups for encyclopedia members look to be ending, instead being replaced by separate encyclopedia charts 2/3 times a week.

I learned a ton from these charts, I try to mark up my own screenshot of the chart after every day and then compare against these which are like the charts posted to the (free) blog except with lots more detail. I've learned how to see a lot of these things on my own (usually after the fact, real-time is a work in progress) but I am still learning a lot so it makes me a little sad. But there is a ton of material accumulated over the years so its enough to learn from.

I'm not sure of the underlying reason but it seems Al is slowing down a bit. Could be he is spending time away from computers and charts which would be a good thing.

|