Now let us play a little with the Excel application and compare three different trading systems that have exactly the same

expectancy per trade!

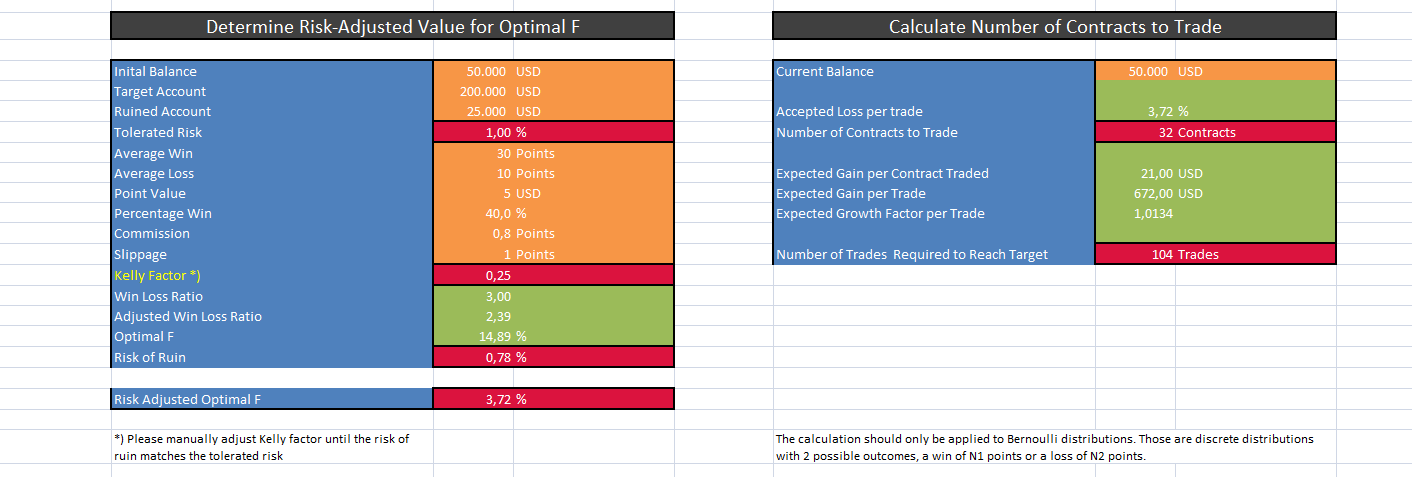

System 1:

- Average Win : 30

points

- Average Loss : 10 points

- Winning Percentage: 40%

Expectancy per

contract traded is E = 0.4 * 30 points * $ 5 - 0.6 * 10 points * $ 5 = $ 30

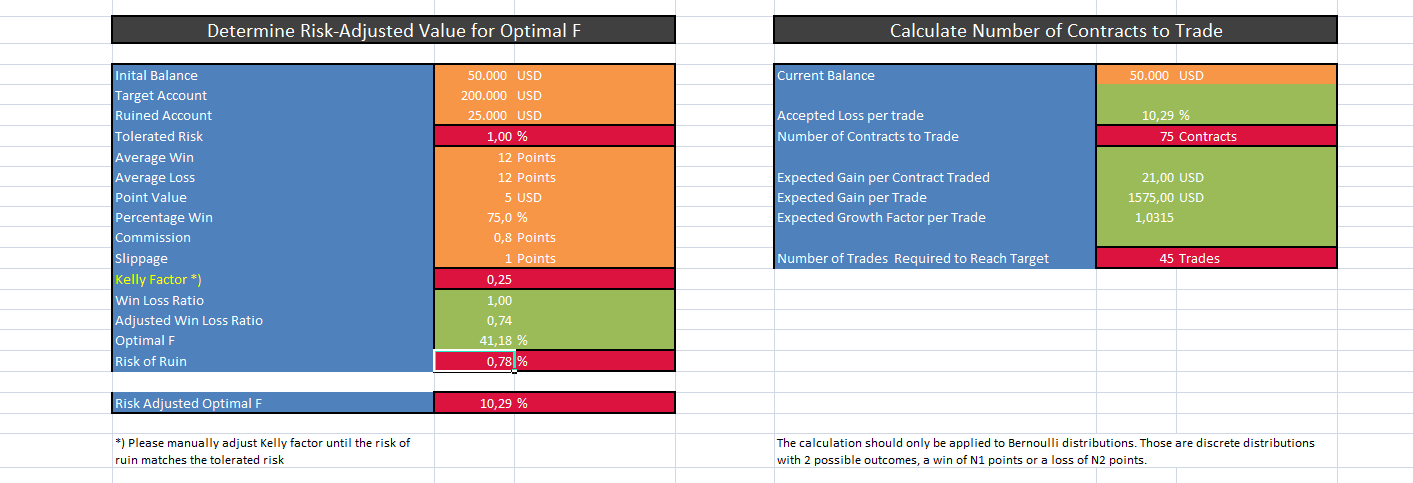

System 2:

- Average Win: 12 points

- Average Loss = 12 points

- Winning Percentage: 75 %

Expectancy per contract traded is E = 0.75 * 12 points * $ 5 - 0.25 * 12 points * $ 5 = $ 30

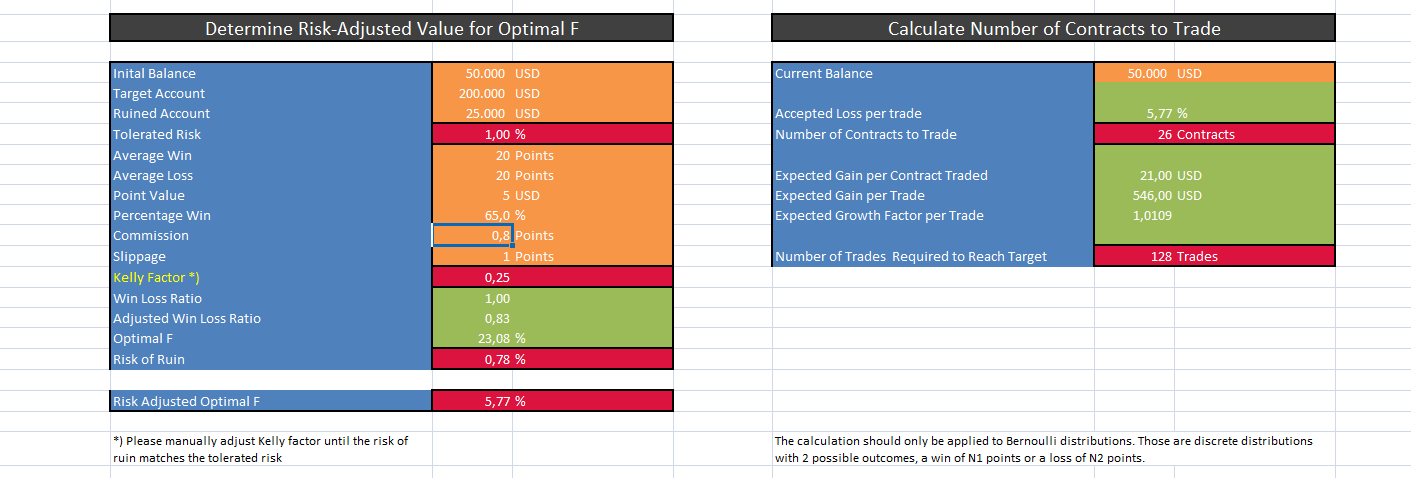

System 3:

- Average Win: 20 points

- Average Loss = 20 points

- Winning Percentage: 65 %

Expectancy per contract traded is E = 0.65 * 20 points * $ 5 - 0.35 * 20 points * $ 5 = $ 30

All expectancies are before

slippage and commission. Slippage and commission is identical for all three systems and would be $ 9 per roundturn based on 1 point slippage and 0.8 points commission. This leads to a net expectancy of $ 21 per trade. The important point here is that the net expectancy for all three systems is the same. System 1 is typical for a

breakout system or a trend follower, system 2 is not unusual for a

scalping system. System 3 could be a system that uses retracement entries.

All three systems are traded with a Kelly factor of 0.25

This fixes our risk of ruin at 078%. Note that the risk of ruin does not directly depend on the R-Multiple or the

win/loss ratio, as the Kellycrieterion already adjusts for it. The three systems now

- have the same expectancy per contract traded

- have the same risk of ruin via the 0.1 Kelly approach

The best system is that one, which allows us to trade size for the same risk appetite. Now we just need to put the figures into that Excel table, and here are the results:

System 1: The optimal position size would be 3.72% of the

initial balance, the system would start trading 32

contracts and the target would be reached after 104 trades.

System 2: The optimal position size would be 10.29% of the initial balance, the system would start trading 75 contracts and the target would be reached after 45 trades.

System 3: The optimal position size would be 5.77% of the initial balance, the system would start trading 26 contracts and the target would be reached after 128 trades.

Conclusions

Conclusions

We have compared three different trading systems with the same expectancy per contract traded, that is $ 30 before commission and slippage, and $ 21 after commission and slippage.

We have then adjusted position size to our predefined risk appetite in order to maintain a level of 0.78% for the risk of ruin. The results are interesting.

System 1 allows us to trade 32 contracts, system 2 allows us to trade 75 contracts and system 3 allows us to trade 26 contracts for the same risk. Clearly system 2 is my favourite, as it allows to trade larger position size and I may reach the target account after only 45 trades.

Have written all this to show that my assumption as per last sentence of post #69 was correct, and because @

Hotch has encouraged me to do so.