|

New York

Posts: 23 since Jul 2014

Thanks Given: 5

Thanks Received: 9

|

\All:

I thought I would just start sharing some thoughts for those interested.

Again, I trade lots of Iron Condors with the IWM and SPY. There are many reasons why I use these ETF's, these include: liquidity, tight bid ask spreads, lots of strikes, etc.

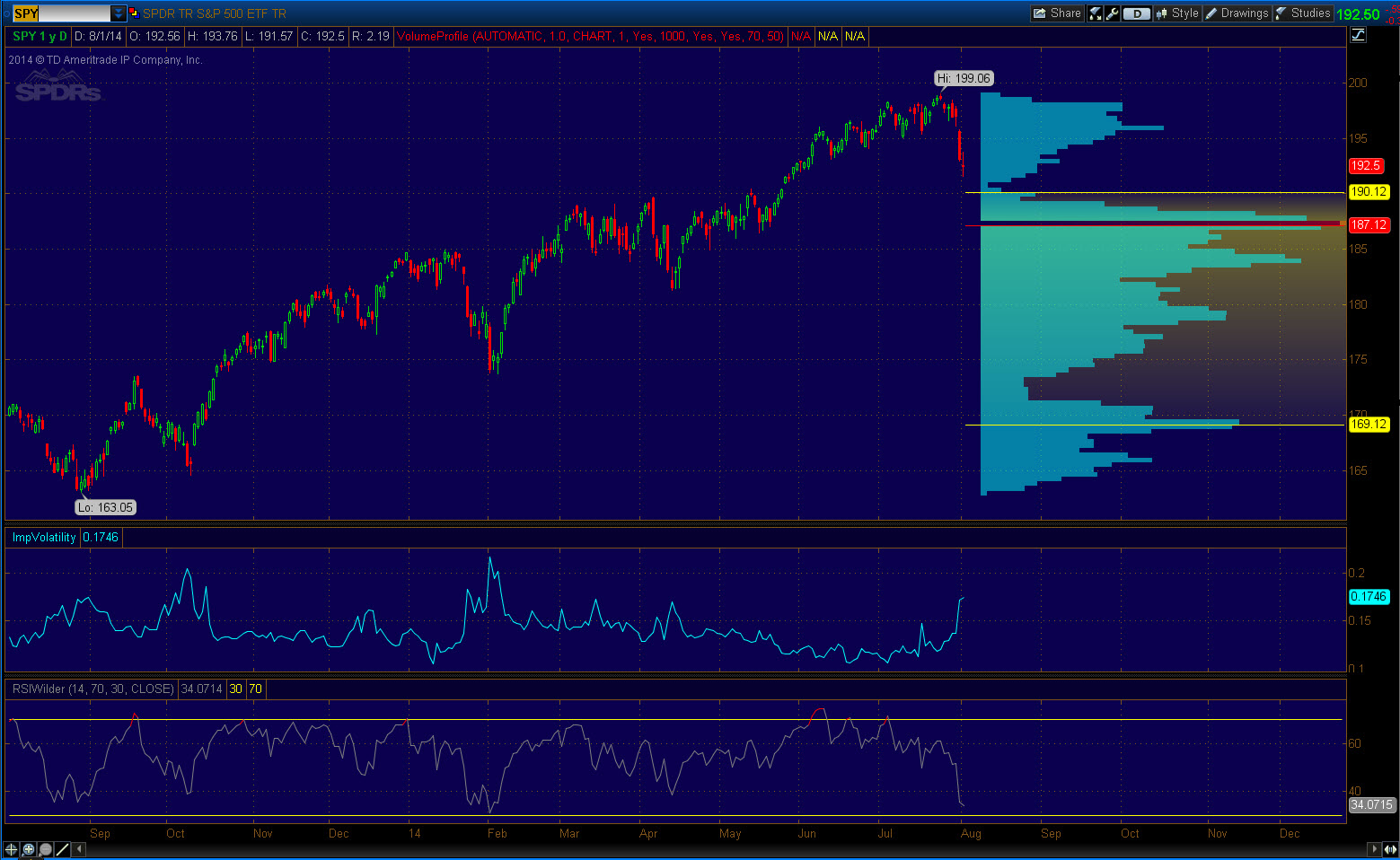

With the recent sell off, the SPY is now back in a range bound area and not hitting up against the the top end of the chart.

For the last month or two, it has been harder to trade the SPY so the IWM was more tradable from a Condor perspective.

If you notice in the chart for the SPY, prior to the last 4 days, we continued to move to higher highs in the SPY. For an Iron Condor trader like me, this is hard to trade on the upside as you really have no price level to create a baseline from or a defined resistance level. In the past, I used the greeks as my guide but I have learned the greeks might give you some "spoiled wine" and they might not always work. Several reasons for this.....

When you compare the SPY to the IWM, you can see we have been in a trading range area with the IWM that is more defined. For me this is more tradable and increases the probability. Additionally, I am more comfortable with my trading plan with these conditions. For IWM, notice the resistance at 120 and support 108. These were established trading ranges, combine that with the option greeks, created a more high probability set of trades.

Now the good news is that with the recent SPY retreat, SPY is going to open up some new trades. One issue that I am having is that most strike prices above 200 are in 5 dollar increments. However, I will work through that.

|