There is a statistical definition of

volatility which is typically annualized.

To obtain the historical daily volatility you would calculate the

standard deviation on daily logarithmic returns over a lookback period of N days and then divide the standard deviation by the square root SQRT(N). The interesting observation here is that volatility is approximately proportional to the square root of time.

For intraday data the definition above is more or less useless, and volatility is typically measured via

- the average

range

- the

average true range (see Welles Wilder's "New Concepts in Technical Trading Systems")

- the standard deviation

With these indicators volatility can only be correctly measured on time based charts. If you try to measure volatility by applying a range or true range indicator to a range or renko chart, you won't get any new information. Tick charts and volume charts are somewhere between time based and range or renko charts.

Nota: The original average true range (

ATR) developed by Welles Wilder uses a Wilder

moving average for smoothing. This is an exponential moving average with a smoothing constant of 1/N, where N is the lookback period. In other software packages you will also find other formulas for the average true range. Common variations are an arithmetic average and an exponential moving average that uses the smoothing constant 2/(N+1).

The average true range measures intra-bar volatility. It is only dependent on the size of all bars and the size of any gaps within the lookback period. Otherwise it shows the same result for a trending

price action and a

range bound price action. The same applies to the average range, which is similar to the average true range, but does not take into account any gaps.

The standard deviation only measures the dispersion the data

points used for the calculation. It is not dependent on the size of the bars, but entirely relies on the deviation of the selected input series from its arithmetic mean. Think of the average range, ATR and standard deviation as follows

average range, ATR -> measure intra-bar volatility (volatility inside the price bars, ATR including the gaps)

standard deviation -> measures inter-bar volatility (for example volatility of the bar closes)

Displaying volatility:

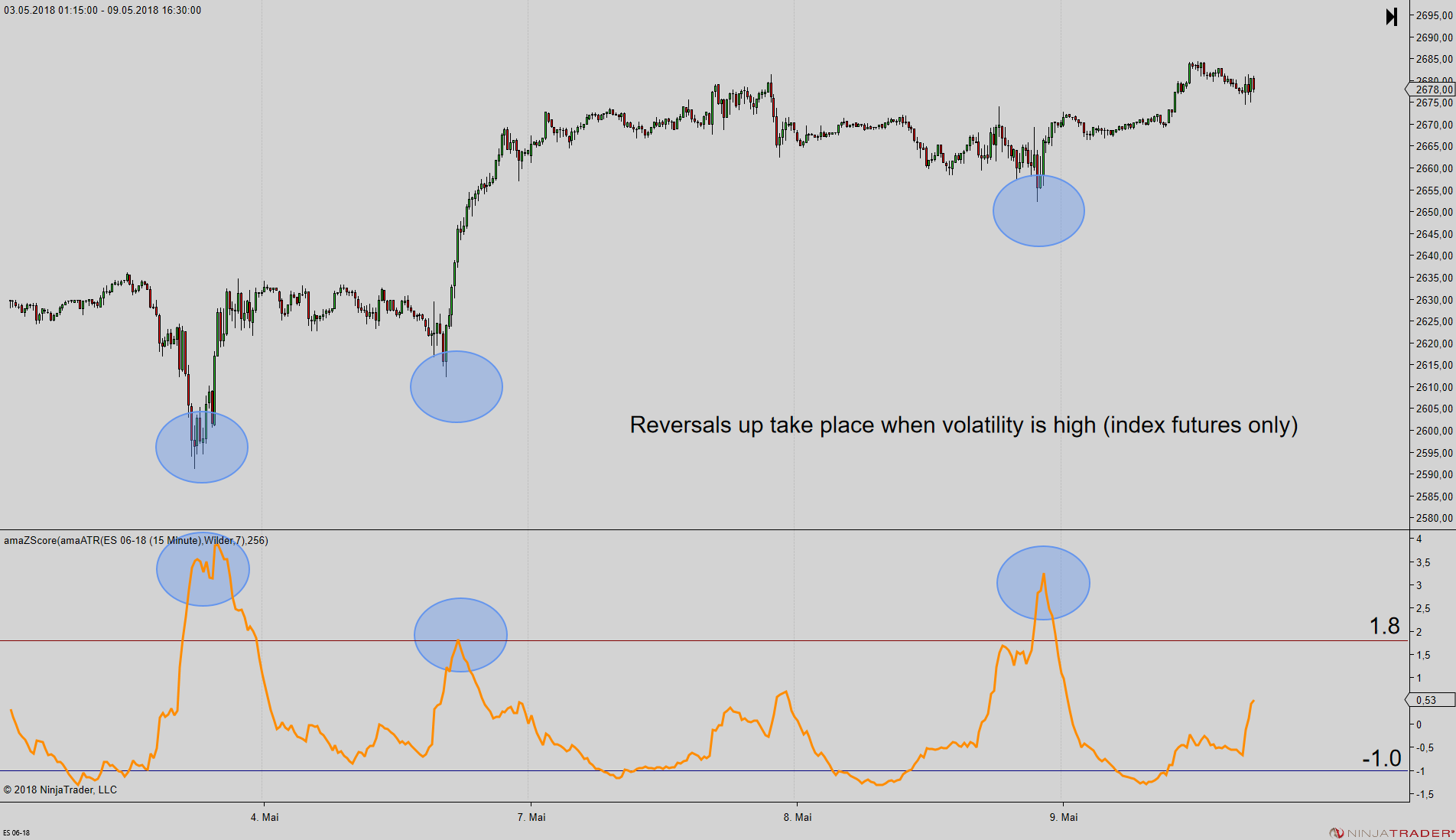

If you wish to know, whether the current volatility is high or low, you may simply use the absolute readings of the average range (apply a

SMA to the range) or the average true range (ATR). Applying a z-score to the ATR is feasible, but has some limitations. Normally, a z-score makes only sense, if the underlying data points are more or less symmetrically distrbuted around the mean. This is not the case for the ATR, as it may rise ten fold, but not decline further than zero. Accordingly, if you apply the z-score to the ATR, it will never reach the lower threshold of 2 standard deviations, but only helps to identify the volatility peaks, when passing above the second upper deviation.

For stocks and index futures peak volatility is often linked to fear and is followed by upside reversals, so you may use this indicator to detect the temporary sell-offs (chart attached).