|

Sydney

Experience: Beginner

Platform: E signal

Broker: AMP, Stage 5

Trading: AP -SFE; FESX; ES; 6A, 6N,6E,6B,6C,6J

Posts: 42 since Jul 2010

Thanks Given: 20

Thanks Received: 31

|

Hi traders,

I wanted to start this thread because I like to try and imagine what will happen in the short-term with the market action - it helps me plan possible trades. I do it to help overcome bullish or bearish bias. I think that a lot of traders AVOID doing this - but after playing chess, I think there's nothing wrong with it.....why do I get the Impression 'Pro trader' don't try and guess what's going to play out in the next trading session? In my mind there is nothing wrong with doing that.....in fact, it helps me be prepared for any particular situation that may play out, being a discretionary trader. Of course, I can only trade the bars appearing in front of me.....but having some possible scenarios given the previous few sessions can't hurt....or can it?

Interested in opinions.....

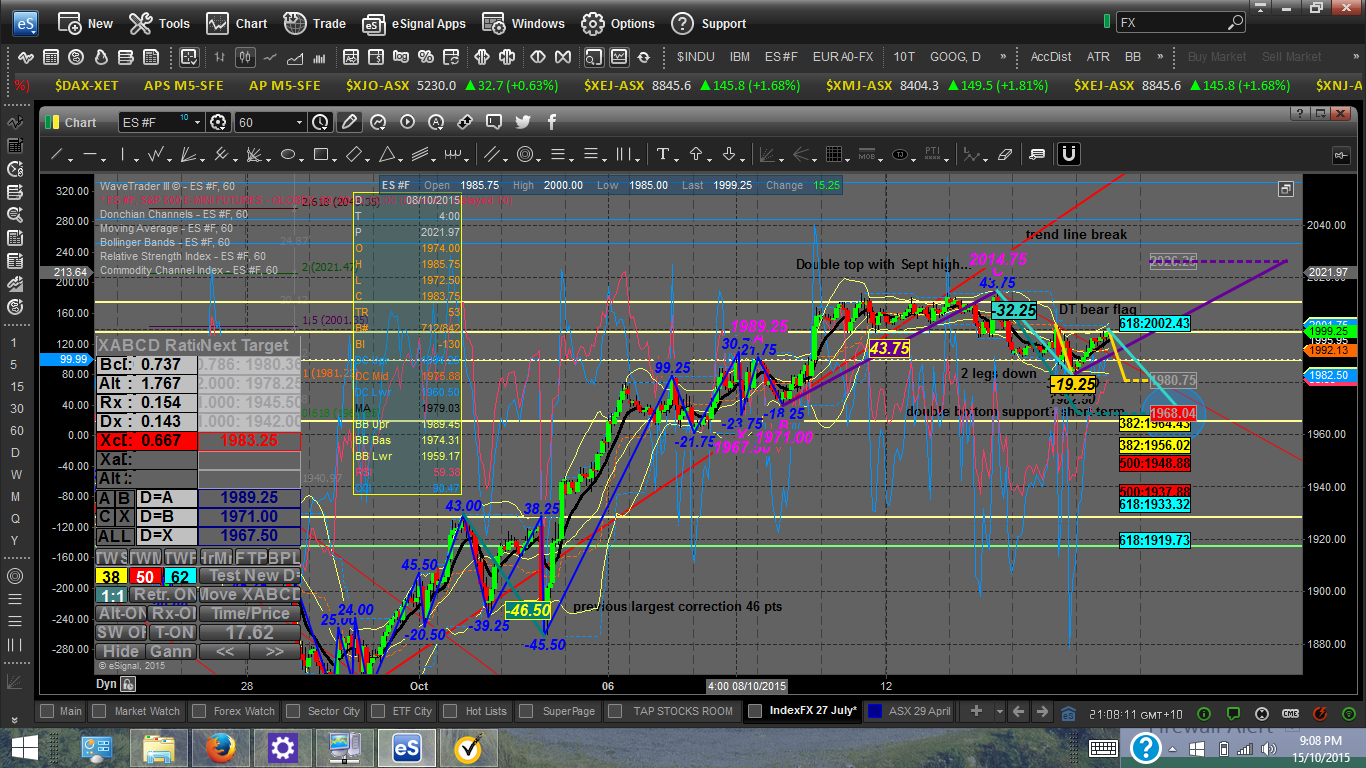

I will give an example of a chart to show what I like to do:

Bullish scenario on ES futures - there is a smaller degree 2 legs down to complete a correction; also a trend line break out of down trend line, the 43 point extension of previous rally from the low gives a target above the major double top of 2026....there is a strong bullish spike up to a double top bear flag; if this fails to correct much then it could break through via short covering through the highs....watch how it corrects in next session, possibly buy a smaller degree ( 15 min chart) correction that fails and a bullish reversal threatens bears positions and stops....

Bearish scenario - on the 60 min chart there is a clear break of the major uptrend line...there is already a 32 pt correction, but this is smaller than the 46 pt correction previously. The pike down from highs is bearish, so the bear rally take it back to a sell zone as it's a double top bear flag...it looks hard to sell here for most traders being such a strong covering rally....a marginal break to the 62 RT at 2002 is likely. Will have to wait and see if sellers come in here....it coulds spike through, however if it reverses strongly back down into the 19 point trading range, selling high and buying low can be a short-term strategy from swings traders. Bias on the sellers side. The more bearish scenario is a 32 point double drive down to the larger double bottom area around 1968. I would look to sell if possible at 62 RT with a tight stop for a larger capitulation downwards, and take profit at the bottom of the smaller range and leave some contracts to run lower......

Of course, I don't pretend to KNOW what will happen, I don't even trade the ES, I trade the AUSSIE SPI, but it's the opinion of traders I'm interest in........

60 min view

15 min view - just an example not trading advice; I'm playing with ideas only before session :

|