|

New York, NY, USA

Experience: Intermediate

Platform: NinjaTrader 8

Broker: InteractiveBrokers, Kinetick

Trading: ES, CL

Posts: 22 since Mar 2017

Thanks Given: 8

Thanks Received: 53

|

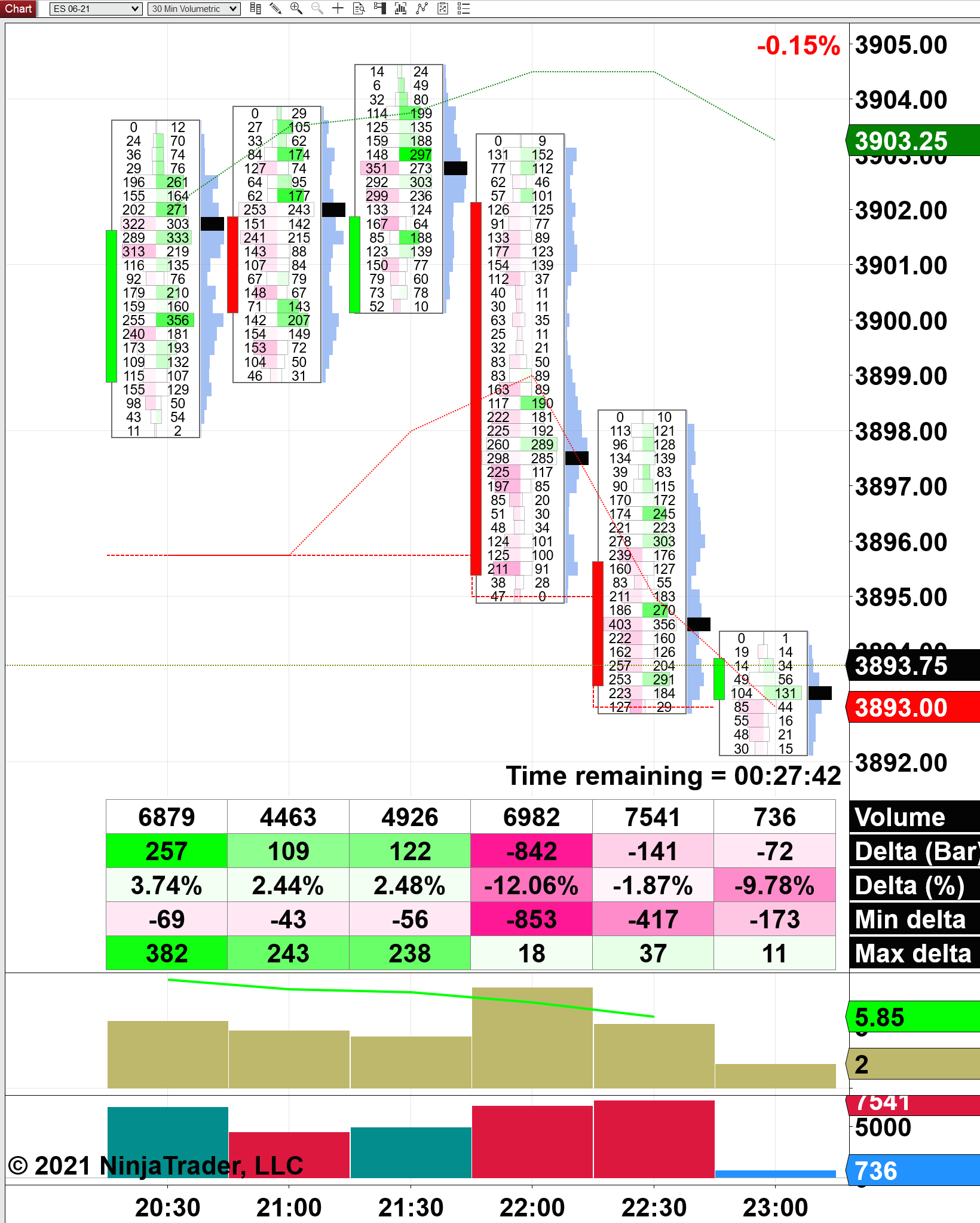

On some of the recent large ES dips on the 100 point ATR days, I observed that the sellers are able to take tremendous heat, with price moving against them > 25 points before they re-shorted heavily and created new lows. It's been years since I remember seeing selling of that magnitude and I don't believe I've ever seen such finesse.

Has anyone else noticed this? There's similar selling unfolding now, 22:24, in the overnight, starting with the 30 minute bar ending at 22:00.

Jim Dalton says know your competition. For me this is a competitor who will let the longs get way too long then again re-initiate their heavy selling. But their selling doesn't obey traditional rules, and unless you have resting short to open orders I don't see how to avoid getting chopped. The algos are probably all measuring each other to gauge liquidity then the liquidity all gets pulled at once. You need really large stops to trade this, which isn't possible for me without dropping back to the MES.

|