|

Chicago, IL

Legendary Price Action Student

Experience: Beginner

Platform: Sierra Chart

Broker: Edge Clear

Trading: MES

Posts: 2,171 since Feb 2019

Thanks Given: 9,617

Thanks Received: 9,627

|

Hello,

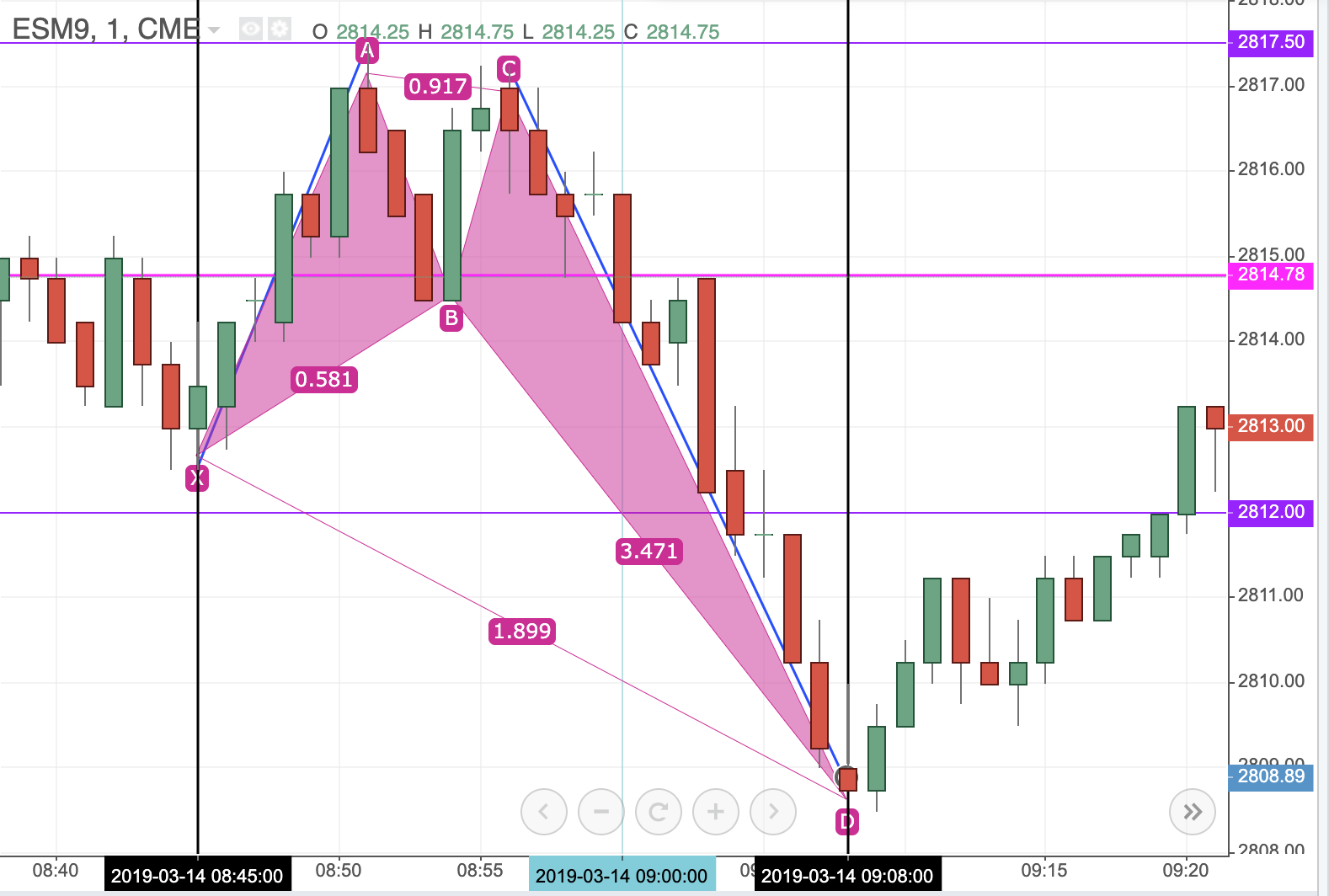

I've been investigating periods of perceived "choppy" market-behavior to try and get better at identifying trading opportunites in them. Right now choppy markets seem frantic and my hope is that by studying these conditions, I will be able to see the market "slow down" a bit for me, so I can see through the chop!

I noticed this "choppy" moment coincided with a widening of range, and seemed to fit this "xabcd" pattern, but I don't really understand the fibonacci time element. I tried to research this, but a lot of sites give vague descriptions as if they don't seem to really understand it either.

So would this be considered a true "xabcd" pattern and why/why-not? How does the fibonacci-time element fit/not-fit?

Here are fibonacci retracements involved:

100% : 2826.50 YH

76.4% : 2817.50

61.8% : 2812.00

50.0% : 2807.50

38.2% : 2802.75

23.6% : 2797.25

0% : 2788.25 YL

And the midpoint is in Pink.

(this is from just after the opening bell first-rate opening range chop-action in this morning's /ES market! 1-min. ticks are used.

Regards,

snax

|