|

Columbus, OH

Experience: Advanced

Platform: NT8

Trading: ES, CL, GC, NQ, YM, RTY/TF/EMD, 6A/B/C/E/S

Posts: 57 since Jan 2017

Thanks Given: 0

Thanks Received: 22

|

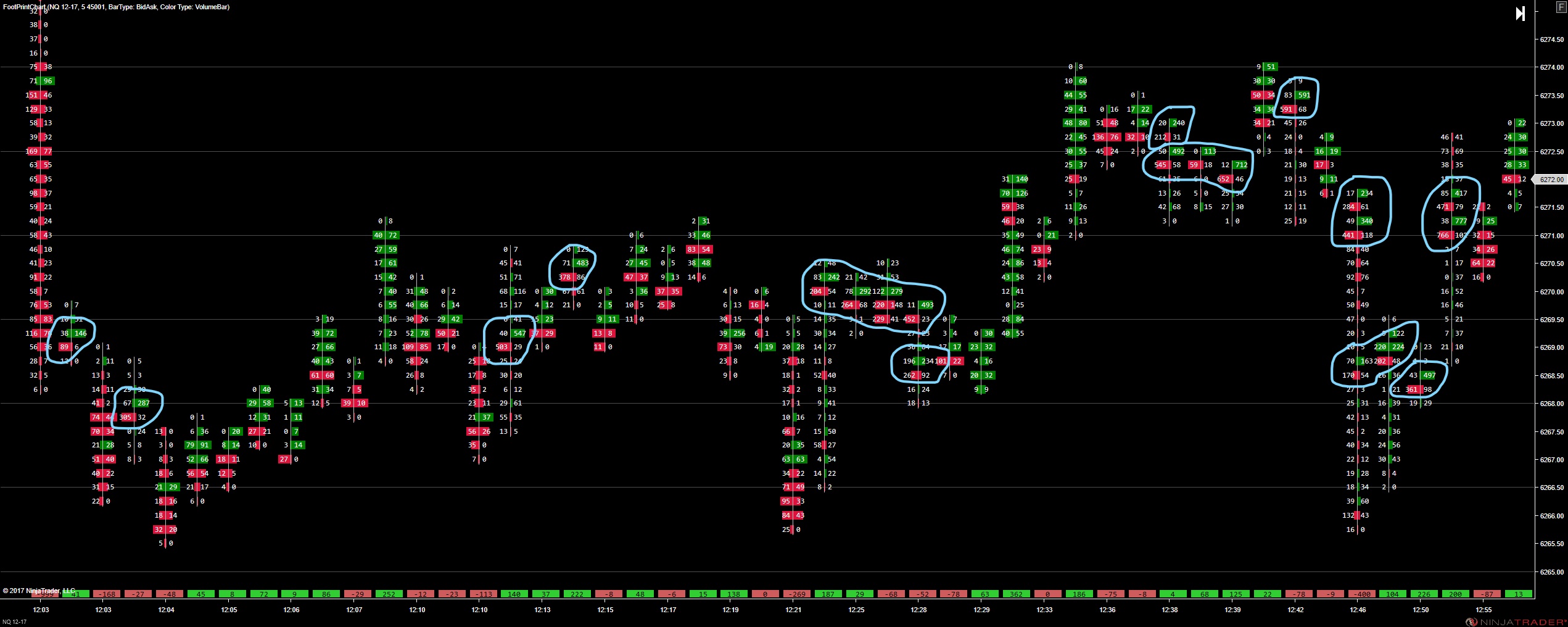

For footprint chart users, what is going on here? Apart from normal volume traded at the bid and ask, I see this pattern occasionally, especially in NQ futures; abnormally high volume at the inside bid and ask of roughly the same size. Are these spread trades being executed or what?

|