|

Loa Angeles

Experience: Intermediate

Platform: OEC

Trading: ES

Posts: 12 since Jan 2012

Thanks Given: 39

Thanks Received: 8

|

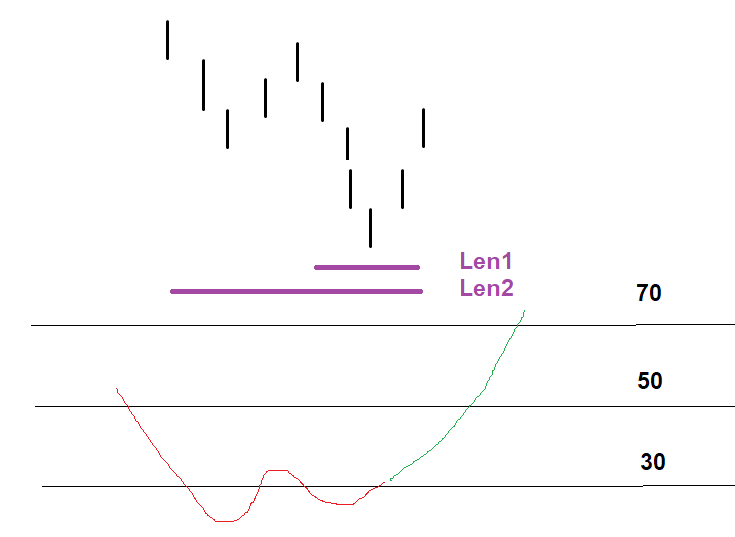

See if a simple approach approach would work.

pseudo code:

//conditions to look for:

lowest (pr, len1)=lowest len(pr, len2)

//want them to be the same (=) because otherwise the first low would be lower

lowest (uo, len1) > lowest (uo, len2) and lowest (uo, len2) <30

Otherwise you might have to use code from zigzag and or count bars back to get those locations.

|