|

San Jose, CA

Experience: Intermediate

Platform: Zaner360

Broker: DeCarley/Zaner/Gain

Trading: NG,6E

Posts: 18 since Aug 2018

Thanks Given: 30

Thanks Received: 14

|

Hi all,

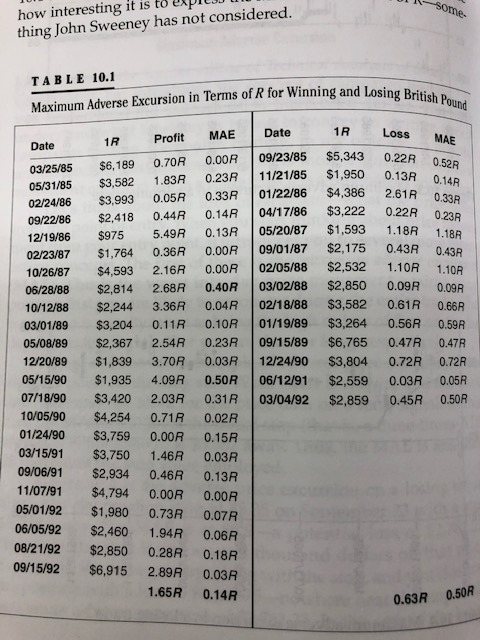

I'm reading Tharp's "Trade your way to financial freedom" and in chapter 10 (pg 296) he covers the idea of Sweeney's Maximum Adverse Excursion (MAE). I believe I understand what MAE is, but I don't understand his examples, either the chart one, or the table one. I was hoping someone could help explain what I'm missing from Tharp's explanation.

Here's what I understand from MAE, for example:

* Say you enter a corn position short at 450.00, with a stop at 460.

* Say the contract moved to 457 then you exited for a profit at 442.

* Your MAE would be 7 cents (450-457). Your initial risk is 10 cents (450-460).

* Your MAE would be 0.7R.

From what I understand, you should never have an MAE that exceeds 1R (except in cases of slippage) and your loss cannot (ever) be larger than your MAE. In general, MAE should be between 0 and 1 R.

However, in Table 10.1 (below), Tharp has multiple examples where the loss is greater than MAE and one case where MAE is >1R. How is that possible?

|