|

Bedford, UK

Experience: Beginner

Platform: SierraChart/TT Feed

Trading: NQ

Posts: 129 since Mar 2012

Thanks Given: 212

Thanks Received: 215

|

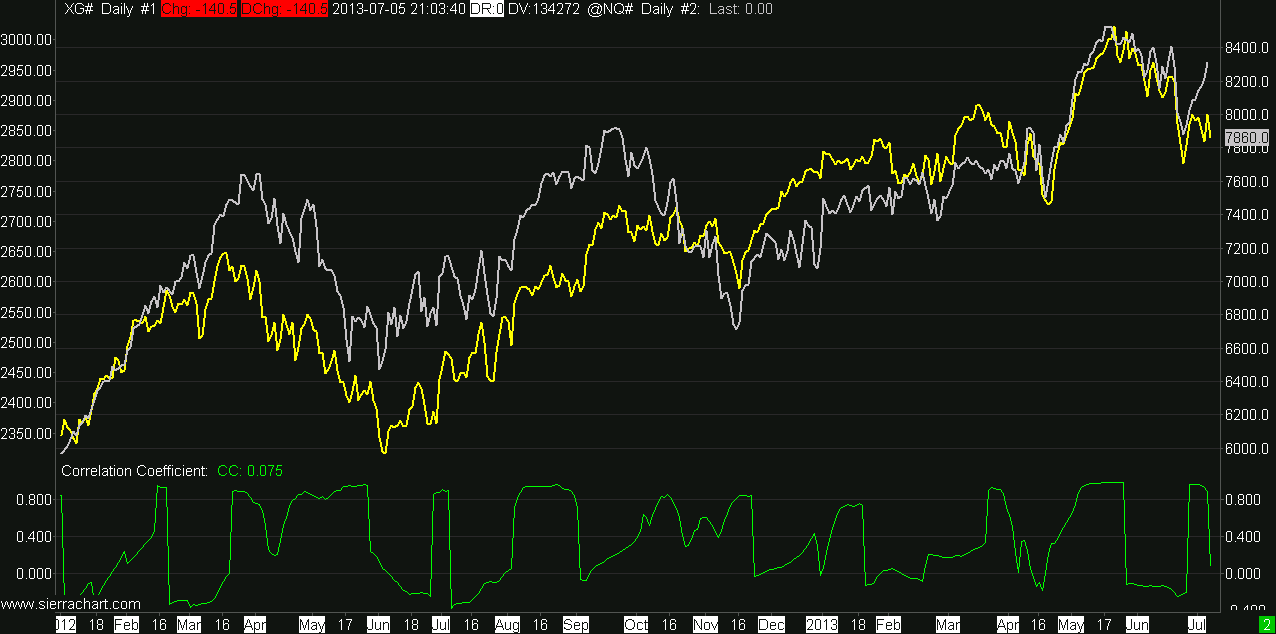

I am using Sierra Chart and attempting to evaluate an unbiased correlation between two markets. By "correlation" I am also including inversely correlated (for example EURUSD, USDCHF are pretty nicely inversely correlated most of the time).

The idea is I trade a basket of instruments on the higher TFs (60min+) that are reasonably uncorrelated. Trouble is correlations change over time as market dynamics change and underlying fundamentals drive correlations towards or away from each other.

In Sierra Chart I am using the Correlation Coefficient study to evaluate on a daily chart to get a rough idea how correlated two markets are. The question is, am I using the right study? I believe I am. What settings should I use? I am currently using a 21-day period which will show a moving correlation coefficient over the past 21 trading days on my chart. If you are interested in trying this on Sierra Chart I did a video on how to set it up:

Here's a chart of how correlated the NQ is to the DAX:

Thanks for any comments, suggestions or ideas.

|