NFA just charged FXDD with myriad accounts of alleged violations of its rules. Details are below. To the best of our knowledge several more firms are on NFA’s radar and have been heavily audited in the past year. This is a result of the audit NFA announced back in January 2010 which then lead to FXCM being hit with a big charge costing it more than $16 million in fines and customer credits. Following all this NFA finalized its rules on

Slippage and Requoting.

Interesting facts: As of March 1, 2011 (when NFA commenced its 2011 audit of FXDD), FXDD had approximately 70,000 U.S. clients. 99% of them traded on the MT4 platform.

“NFA’s 2011 audit of FXDD revealed deficiencies associated with the firm’s recordkeeping, its anti-money laundering (“AML”) program and other areas of the firm’s operations. In conjunction with the 2011 audit, NFA also conducted an investigation of FXDD’s order execution practices, which revealed that the firm treated price slippage differently (i.e., asymmetrically) when the price slippage favored FXDD as opposed to when the price slippage favored a customer.”

NFA goes as far as to claim that “during NFA’s investigation, senior employees of FXDD, including Green (FXDD’s Chief Compliance Officer – MG), engaged in a deliberate course of conduct designed to mislead NFA and others in connection with activity related to the accounts of certain FXDD customers.”

It seems that this in particular set NFA off.

Main Complaint:

“To make an IE (Instant Execution – MG) trade, a customer clicks on the

bid or offer price seen on the customer’s computer screen, and FXDD simultaneously tags the screen price as the price at which the customer placed his/her trade (i.e., “tagged price”).

For example, in an IE trade, if a customer wants to buy 100,000 EUR/USO where the bid price on the customer’s computer screen is 1.43 and the ask price is 1.45, the customer would click on the ask price of 1.45 to buy the

contract and that would be the tagged price captured on the front-end of FXDD’s system. However, before executing the trade and confirming it to the customer, FXDD would also run the customer’s order through two primary “checks” – a “margin check” and a “price check” – on the back-end of FXDD’s system. The “margin check” ensures that the customer has adequate funds to make the trade, while the “price check” ensures that when the back-office system receives the customer order that the tagged price remains within certain price parameters based on current market prices. After these “checks” are completed, FXDD either fills the customer’s trade at the tagged price of 1.45 or rejects the trade.

During a visit to FXDD in June 2011, NFA discovered that FXDD had been using asymmetrical price slippage settings since becoming an NFA Member in December 2009. These asymmetrical slippage settings were activated during the “price check” process when FXDD’s system compared the customer’s tagged price to current market prices. If, after the customer entered his/her order, the market moved in the customer’s favor (“positive slippage”) by no more than two

pips, then FXDD would fill the customer at the tagged price. On the other hand, after the customer entered his/her trade, the market moved in the customer’s favor by more than two pips, then FXDD would reject the order. However, FXDD did not follow this same practice if the market moved in FXDD’s favor. In this situation, FXDD would allow the market to move an unlimited number of pips in the direction favorable to FXDD, without re-quoting or rejecting the customer’s order. As a result, FXDD always filled the customer’s order at the tagged price, even if the tagged price was far outside the prevailing market price at the time the order was executed. Under such circumstances, the customer’s position would be unprofitable the very instant it was executed.

NFA attempted to determine the monetary harm to customers that resulted from FXDD unequal slippage settings. Toward this end, NFA requested data from FXDD for executed trades from December 2009 to June 2011. FXDD produced trading data for the requested period, which Green assured NFA was complete trade data for executed trades during the period in question. NFA went to great lengths and expended an inordinate amount of resources over several months reviewing and analyzing the data FXDD had provided to NFA and which Green had assured NFA was complete trade data. However, because of erroneous statements Green had made about the trade data, which stemmed from his lack of understanding how FXDD captured its data, NFA was unable to verify representations Green had made about FXDD’s trading system or to draw any conclusions concerning the monetary harm to customers that resulted from FXDD’s unequal slippage settings.

In order to try and understand the data, NFA returned to FXDD’s offices in April 2012 and spoke with Shawn Dilkes (“Dilkes”), the head of information technology for the firm. Through conversations with Dilkes as well as a demonstration of a test account, NFA and Dilkes determined that Green had previously provided NFA with inaccurate information about the trading data that the firm had originally provided to NFA. It was little wonder, therefore, that NFA was confused by such data.

Through the meeting with Dilkes, NFA was able, at last, to obtain a complete and accurate understanding of the trading data for the period from December 2009 to June 2011 and was able to complete its analysis, which, among other things, confirmed that FXDD had used asymmetrical slippage settings during the above period.

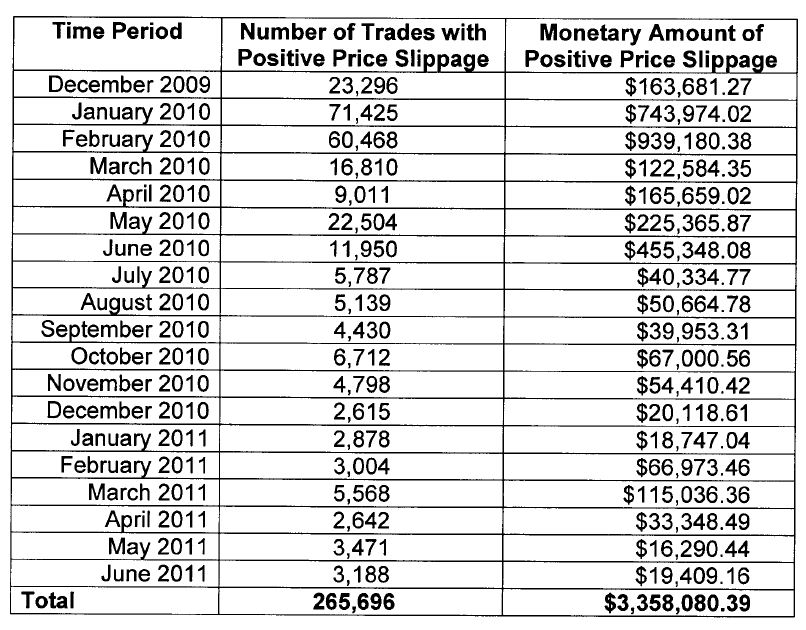

NFA was also able to compute the monetary impact of FXDD’s asymmetrical slippage practices by analyzing the

number of trades FXDD filled outside the two-

pip slippage tolerance setting – which resulted in orders being filled detriment of the customer and to the benefit of FXDD, instead of the order being rejected which is what occurred if the price moved more than two pips in favor of the customer. The table below summarizes the number of trades FXDD filled outside the two-pip tolerance setting and the extent to which FXDD benefited financially from this price slippage practice.”

(This one is going to cost FXDD at least $3.4 million – MG)

Further allegations:

“In December 2011, NFA received a complaint from a customer that FXDD had removed profits from the customer’s account. NFA investigated this customer’s complaint’s and found that since November 30, 2011, FXDD had removed profits totaling almost $280,000 from nine customer accounts. According to Green, FXDD unilaterally decided to remove the profits from these nine customer accounts because the customers had “manipulated” FXDD’s trading system by executing trades at allegedly “off-market” prices.

In early February 2012, NFA’s Compliance Department notified FXDD that, based upon the information the firm had provided NFA, to date, the firm had violated numerous NFA Forex Requirements. Specifically, NFA informed FXDD that by unilaterally removing profits from the nine customers’ accounts – based upon unsubstantiated claims that certain trades took place at “off-market” prices FXDD appeared to have converted customer funds and engaged in activities that were inconsistent with just and equitable principles of trade.”

FXDD claimed that these clients ‘injected’ prices into FXDD’s platform and manipulated trades. FXDD was then granted a temporary restraining order by Manhattan court against these clients which NFA claims was achieved under a false pretense and was a method to buy time.

Keep reading here or view the Complaint in full below: