|

Bari,Italy

Posts: 5 since Sep 2018

Thanks Given: 5

Thanks Received: 1

|

Here's the story:

I was reading R.Schabacker s book(Technical Analysis and Stock Market Profits) and in the 1st chapter he talks about Volume of sales(i.e Volume).Now,plenty of people trade on price,volume and derivatives of them(I'm talking about indicators derived from price movemtns),so i decided to mess around a bit.

I went ahead and downloaded some gbpusd data from a FXCM demo i use to test stuff.Now,FXCM doesn't display bid/ask volume but i decided to give my own abstract definition of it.I took the daily % changes and defined:

Bid volume of the day-Volume of the day x 0.5+ the % change of daily price.

Ask volume - 1-Bid volume defined as above. Sum of these is equal to volume.

I calculated a simple delta from these and decided to sum all of them up.In this case:

Bid vol- Ask vol=V*(0.5+ΔP)- V*(0.5-ΔP)= 0.5V +VΔP - 0.5V +VΔP=2VΔP.

Accumulated Delta = Σ2VΔP.

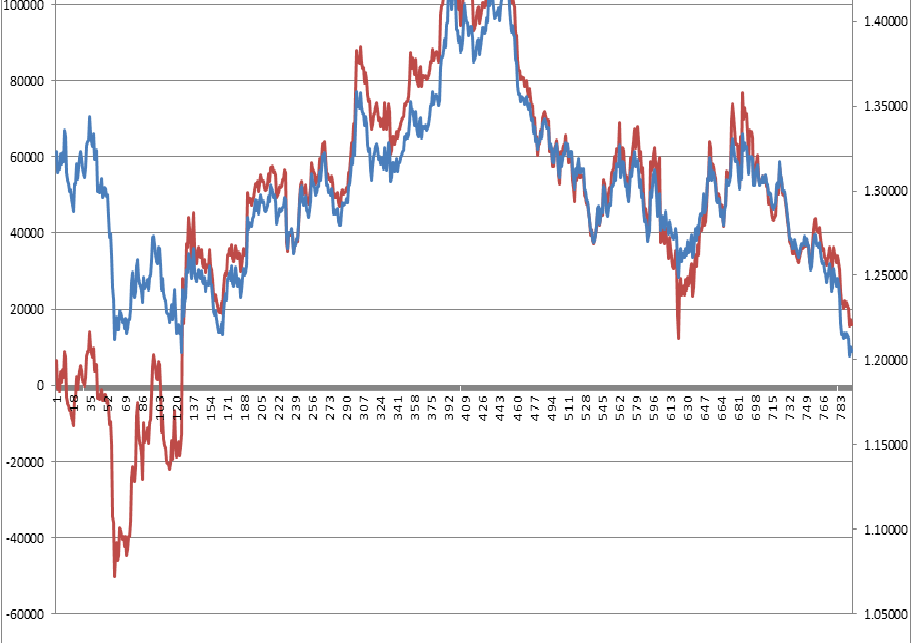

Here's where i can't wrap my head around.How come multiplying the volume by 2 times the change in daily prices give this:

Can anybody explain what am I missing?

Cheers! Disclaimer:I' not very good at math.I think i m missing something at the last calculation where the calculated accumulated delta is simplified into P.

|