A key reversal is a one-day trading pattern that may signal the reversal of a trend. Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

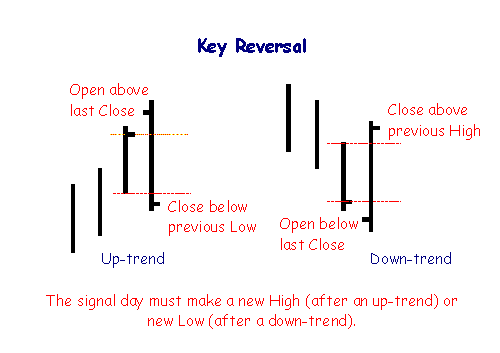

Depending on which way the stock/futures instrument is trending, a key reversal day occurs when:

In an uptrend -- prices hit a new high and then close near the previous day's lows.

In a downtrend -- prices hit a new low, but close near the previous day's highs.

The greater the price

range and volume on the day that this occurs, the more reliable the signal will be.

Source (with edits):

https://investinganswers.com/financial-dictionary/technical-analysis/key-reversal-1312

The key reversal does not occur very often but is very reliable when it does.

After an up-trend:

The Open must be above yesterday's Close,

The day must make a new High, and

The Close must be below yesterday's Low.

After a down-trend:

The Open must be below yesterday's Close,

The day must make a new Low, and

The Close must be above yesterday's High.

Remember:

The signals are most reliable if they occur after a strong trend. If the trend is weak, so is the signal.

Source:

https://www.incrediblecharts.com/technical/key_reversal.php

See also:

https://www.investorwords.com/7667/key_reversal_day.html

https://www.traderslog.com